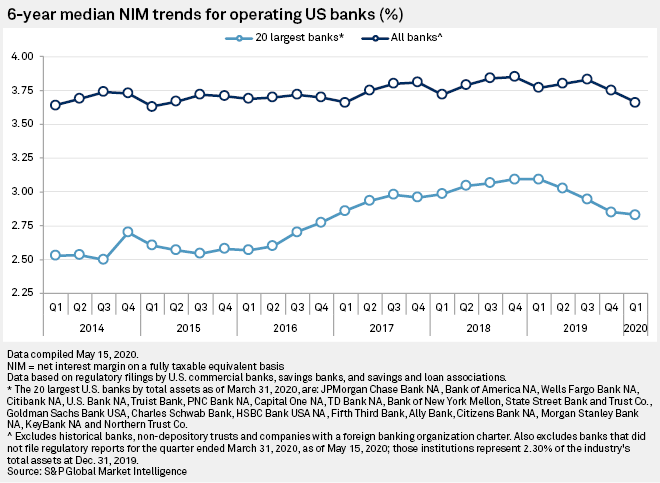

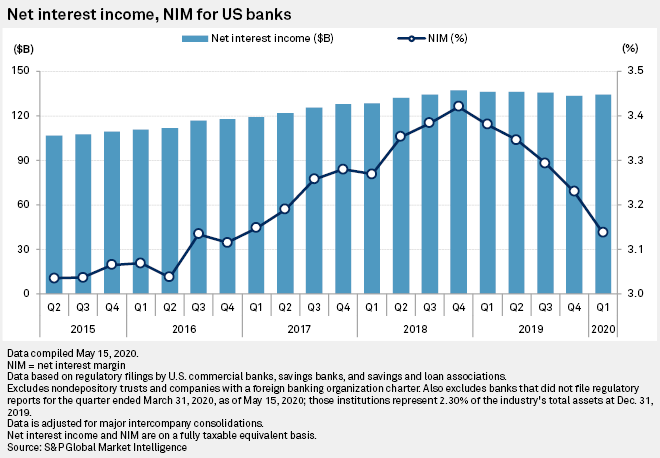

U.S. bank margins dropped for the fifth period in a row in the first quarter of 2020 and could see further pressure in the second quarter due to lower interest rates and the presence of low-yielding loans associated with the government's emergency small-business lending program.

Bank margins plunged 9 basis points in the first quarter, with the industry's taxable equivalent net interest margin falling to 3.14% from 3.23% in the prior quarter and 3.38% a year earlier, according to bank regulatory data as of May 15. Institutions were allowed to delay filing first-quarter call reports for 30 days, but banks holding nearly 98% of the industry's assets had filed as of mid-May.

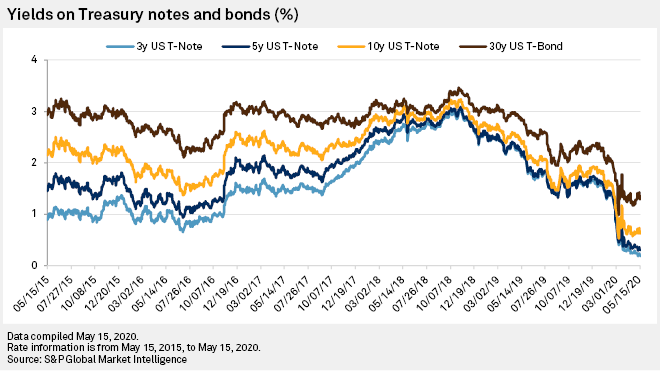

Bank margins continued to decline as interest rates plunged in the period, with long-term rates falling over fears of painful recession. The Federal Reserve has also taken many actions to soften the economic blow from COVID-19, including purchasing Treasurys and mortgage-backed securities through quantitative easing and lowering the benchmark fed funds rate to the zero bound.

The decrease in rates was much more dramatic in the first quarter but followed a trio of rate cuts by the Fed in the second half of 2019. The moves caused loan yields to drop quickly in the first quarter, while deposit costs declined but at a slower pace.

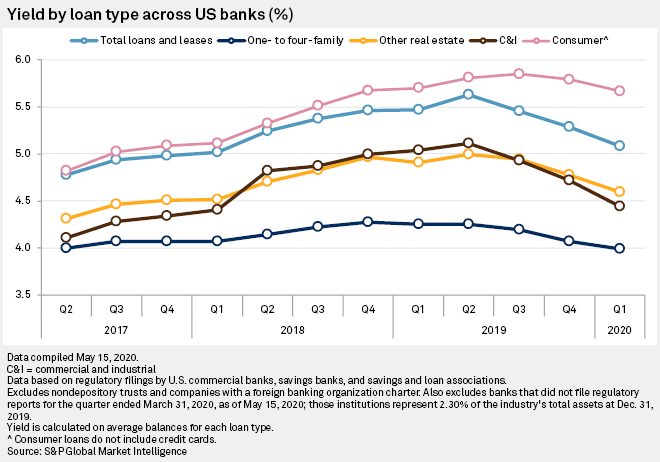

Yields on total loans and leases dropped to 5.08% in the first quarter of 2020 from 5.29% in the fourth quarter and 5.47% a year ago. Banks' cost of interest-bearing deposits fell to 0.84% during the first quarter, down nearly 18 basis points from the linked quarter and 26 basis points from a year earlier.

Between the end of the second quarter of 2019 and the first quarter of 2020, the banking industry recorded a loan beta — or percentage of changes in fed funds over the last three quarters that banks passed on to borrowers — of 47.3%. The beta on interest-bearing deposits, meanwhile, was 28.9% during the same period, meaning that banks struggled to lower deposit costs enough to mitigate the pressure on loan yields.

Yields on commercial and industrial loans plunged the most in the first quarter, falling 60 basis points from year-ago levels as short-term rates moved lower in March with the Fed rate cuts. C&I yields could come under additional pressure with one-month Libor having declined to near historical lows as various lending facilities launched by the Fed have brought stability back to the markets.

Against the decline, banks have increased spreads on commercial credits likely due to greater risk in the marketplace.

Yields on all asset classes declined from the prior quarter and year-ago levels, but the year-over-year decline in consumer loan yields was just 3 basis points.

Sharp decreases in long-term rates in the first quarter added to pressure on loan rates, particularly as higher-yielding credits rolled off banks' books. The average yield on the benchmark 10-year Treasury was 1.38% in the first quarter, down 41 basis points from the prior quarter and 127 basis points from the year-ago period. Long-term rates have traded at significantly lower levels in the second quarter, with the yield on the 10-year Treasury averaging just 66 basis points through most of May.

A massive wave of refinancing kept yields on one- to four-family mortgages from dropping notably in the first quarter, though, as lenders lacked capacity to meet customer demand.

Institutions that participated heavily in the emergency small-business lending program, dubbed the Paycheck Protection Program, or PPP, could see short-term margin pressure but eventually should receive a boost from their efforts. The program offered small businesses low-rate, forgivable financing, provided that borrowers used 75% of the funds for payroll. Loans through the program carry an interest rate of just 1%, but Keefe Bruyette & Woods analysts have estimated that the credits will bring a fee of 3% on average once loans are forgiven. KBW analysts expect most of the PPP loans to be forgiven in the third quarter and for fees to flow through net interest income.

Most banks will not be able to count on a large boost from the program and will continue to face pressure on earning-asset yields as newly originated credits come onto banks' books with far lower rates. They will need to cut deposit rates more notably in the future to stave off further margin pressure. Deposit costs should continue to decrease but might not decline quickly enough to avoid additional margin contraction in the coming quarter.