The ESG Insider newsletter compiles news and insights on environmental, social and governance developments driving change in business and investment decisions. Subscribe to our ESG Insider newsletter, and listen to the latest ESG Insider podcast on SoundCloud, Spotify and iTunes.

It's annual shareholder meeting season, with support for ESG concerns put to the test at a time when many meetings are being held remotely because of the coronavirus. This week we look at how shareholders voted on ESG-related proposals at two major U.S. banks, Citigroup Inc. and Bank of America Corp.

We also dive into the European Investment Bank's plan to support €1 trillion in sustainable investments over the next decade, marking a potential step change for renewable energy financing that could spur new markets and technologies — from floating wind farms in the Mediterranean to hydrogen pipelines crisscrossing the continent.

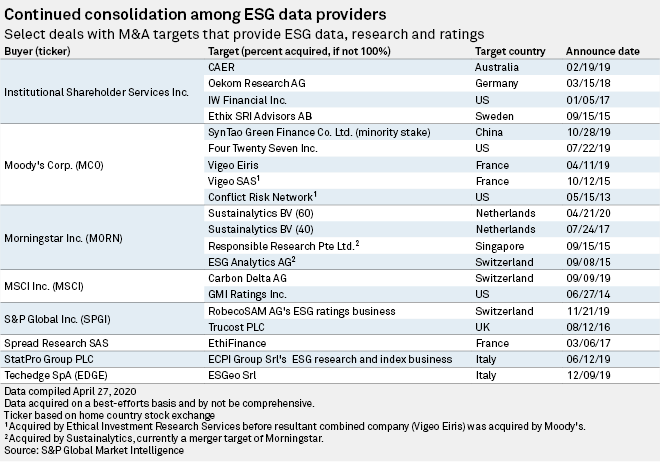

And our Chart of the Week shows the breakdown of the most active players buying up ESG ratings and research providers in recent years. Experts say the ESG data race is heating up as the COVID-19 pandemic brings sustainability into sharper focus.

Chart of the Week

Consolidation among ESG data providers continues amid COVID-19 pandemic

As sustainable investing has become increasingly mainstream in recent years, rating agencies and index providers have been some of the most acquisitive players buying up smaller firms that provide ESG ratings and research — a trend that experts say is likely to continue.

Inside the European Investment Bank's planned €1 trillion green spending spree

The EU's main lending arm plans to align all its financing with the goals of the Paris Agreement on climate change. The share of its loans dedicated to climate action and environmental sustainability is supposed to increase from 25% to 50% by 2025 and unlock €1 trillion in sustainable financing by 2030.

Morgan Stanley to stop directly funding Arctic drilling, new thermal coal

The U.S. bank presented its updated energy policy and said it would no longer directly finance oil and gas exploration in the Arctic, new coal-fired power plants, or thermal coal mines, joining a growing list of major lenders.

Green Deal lays out COVID-19 recovery, leaders vow at European climate summit

BP CEO doubles down on clean energy drive amid oil price crash

Demand for low-methane 'green' natural gas to fuel premium-price market

Social

Spotify rolls out artist fundraising feature

Stryker's board approves salary cuts of executives due to COVID-19 pandemic

Verizon pledges $2.5M to global COVID-19 relief efforts

Governance

Bank of America shareholders vote down shareholder proposals

Citigroup shareholders vote down shareholder proposals

Dubai bourse launches ESG index

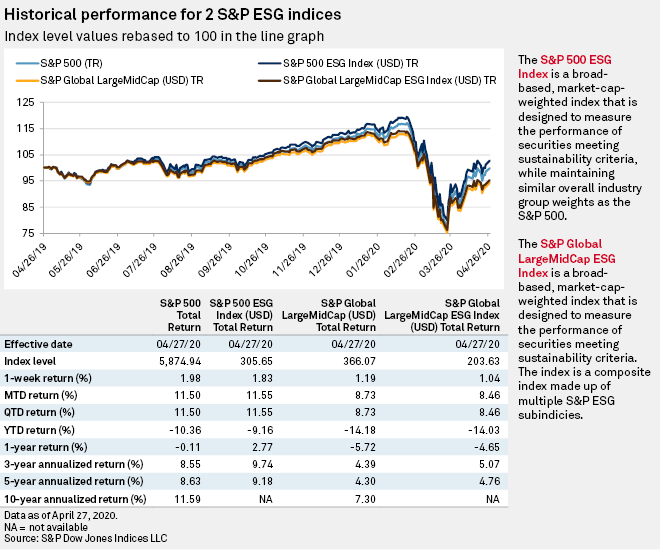

ESG Indices

Upcoming Events

Net Zero Zone Digital Conference

SDG Labs

April 29

Webinar

Aligning financial markets with sustainability goals

Trucost

May 6

Webinar

Water & Long-Term Value

Skytop Strategies

June 2

San Francisco, CA

ESG & Sustainability Forum

Infrastructure Investor

Oct. 12

Berlin, Germany

Sustainable Returns: ESG Investing

Institutional Investor

Nov. 19-20

New York, NY

Disruptive Sustainability Technologies

Skytop Strategies

Dec. 8

Palo Alto, CA

ESG and Sustainable Investments Forum

Institutional Investor

Dec. 9

Amsterdam, The Netherlands

Questions or suggestions? Contact S&P Global Market Intelligence’s ESG News team at