The pace of banks launching new buyback programs has picked up in the fourth quarter with some banks bringing back or reinstating the programs after stopping them earlier in the year due to the coronavirus pandemic.

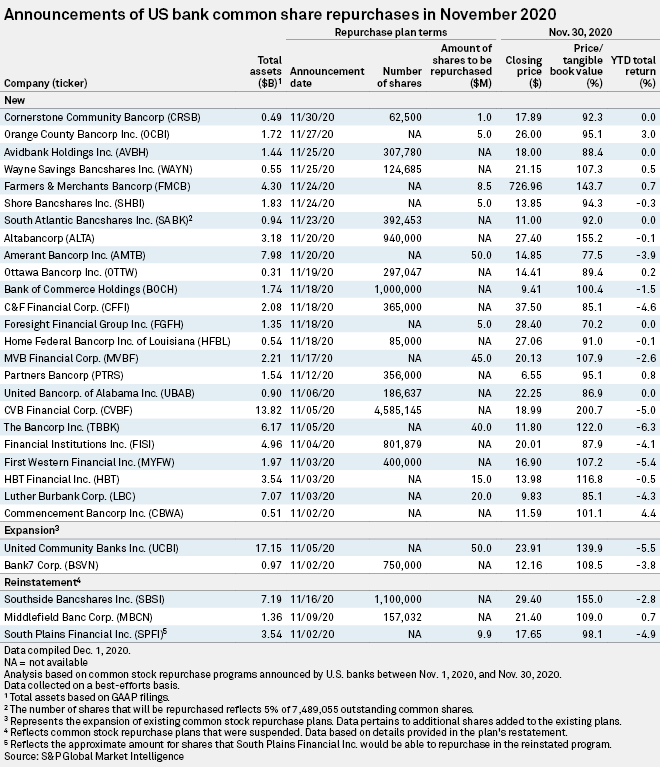

November saw 24 banks announce new buyback plans after 22 did so in October, and that two-month fourth-quarter total already surpasses the 30 announced in the entire third quarter, according to data from S&P Global Market Intelligence, which collects the information on a best-efforts basis. The data also show that 14 banks have announced reinstatements in October and November combined, up from eight in the third quarter.

Still, compared to 2019, the pace of buyback announcements in 2020 has slowed, according to a November report from Janney Montgomery Scott LLC analyst Feddie Strickland. The analyst noted that fewer large-cap banks, which are subject to more regulatory scrutiny, have announced buybacks in 2020. The repurchase announcements have been coming from mid-size and smaller banks that have plenty of excess capital, Strickland said.

"Most banks simply have to ensure that these plans fit with the overall capital planning and risk management procedures with regulators, rules that are always in effect regardless of economic conditions," he said.

Even after announcing plans, economic uncertainty could factor into how quickly banks pursue buybacks. In November, Middlefield, Ohio-based Middlefield Banc Corp. reinstated its buyback plan after suspending it in March because of the COVID-19 pandemic. Boenning & Scattergood Inc. analyst Joseph Plevelich said in Nov. 16 report that he expects the pace of Middlefield's buybacks to remain subdued in the near term because of pandemic concerns, and the fact that its stock is trading above tangible book value.

"Expect buyback activity to be more opportunistic in nature, especially if [the] stock price approaches tangible book," Plevelich said.

In November, Ontario, Calif.-based CVB Financial Corp. announced a new repurchase program to purchase up to 4,585,145 common shares in plan that is set to expire in November 2021. The number of shares under the new authorization represents the total remaining shares left under the program that the company had suspended earlier in 2020 due to the COVID-19 pandemic, but it is less than half the number of total shares in its previous plan.

Piper Sandler & Co. analyst Matthew Clark said CVB Financial's buyback program offers "downside protection" for a potential acquisition. "It helps protect its currency should the right M&A opportunity emerge," Clark said in a November report.

Oklahoma City-based Bank7 Corp. increased its buyback program by 750,000 shares to a total of 1.75 million shares.

Two other banks — Tyler, Texas-based Southside Bancshares Inc. and Lubbock, Texas-based South Plains Financial Inc. — reinstated repurchase programs in November after suspending them because of the coronavirus pandemic.