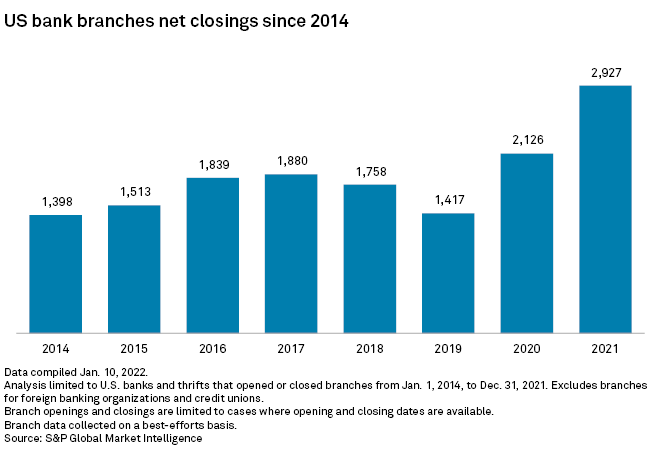

In 2020, U.S. banks set a new record for shuttering retail branches as more consumers bank digitally. In 2021, banks shattered that record — by 38%.

On net, accounting for openings and closings, U.S. banks shuttered 2,927 branches, according to S&P Global Market Intelligence data. That included more than 1,000 branch openings and nearly 4,000 branch closings. Banks have accelerated plans to consolidate their branch footprints as the COVID-19 pandemic encouraged consumer adoption of mobile and digital channels. Further, banks have faced a tough operating environment with low interest rates pressuring margins and forcing a reconsideration of expenses.

Top closers

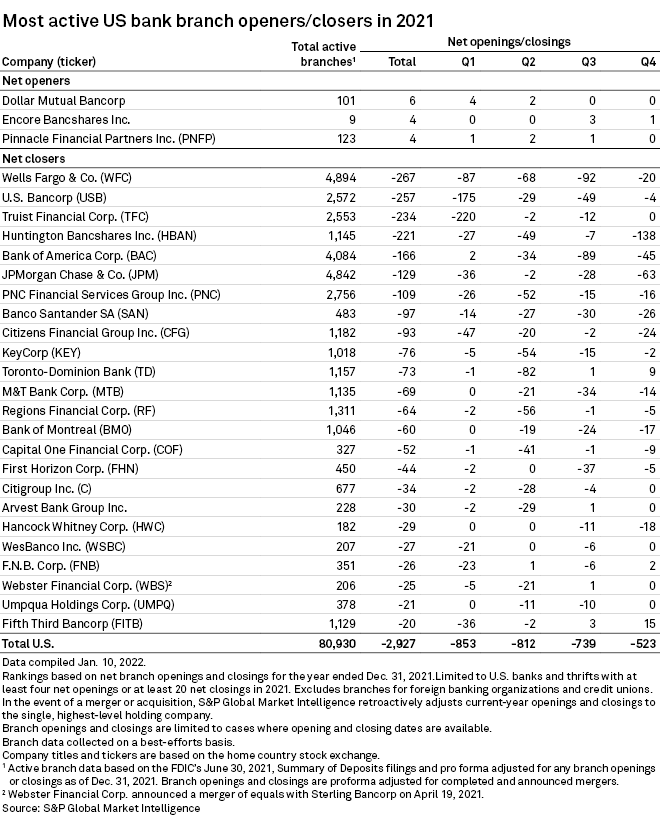

On an absolute basis, Wells Fargo & Co. reported the most net closures in 2021 at 267, followed closely by U.S. Bancorp with 257 net closures. But on a relative basis, Huntington Bancshares Inc. had the most net closures among banks with at least 1,000 branches as the Ohio-based regional closed 221 net branches, shrinking its footprint by more than 16%. Huntington has pursued an aggressive branch consolidation plan as part of integrating its merger with TCF Financial Corp. and its pursuit of $490 million in expense synergies from the deal.

Among community banks, Olympia, Wash.-based Heritage Financial Corp. reported one of the higher closure rates, shutting down nearly 18% of its footprint in 2021. During an earnings call, management said the bank saves roughly $250,000 per year, per branch after closing shop. When closing a branch, the bank typically models some deposit attrition, typically 10% to 20% if the branch is close to another location and as much as 50% if it is a distant consolidation, said CEO and President Jeffrey Deuel. However, Deuel said the bank's recent closures have not come close to fitting those models.

"The technology has made the customers a lot stickier than they used to be. And I think that's playing to our advantage," Deuel said, according to a transcript. "As we've watched how customers manage through the pandemic, it gave us a bit more confidence to take the actions we are."

Retention and regulation

Significant deposit retention following branch closures was also a theme for Red Bank, N.J.-based OceanFirst Financial Corp. The bank was one of the top branch consolidators in 2021. Management said during an investor conference the company has consolidated 56 branches since 2017 and plans to consolidate an additional 20 locations, ultimately leaving the bank with fewer than 40 branches. So far, the bank has retained 92% of deposit balances from closed branches since 2017, said George Destafney, president for the bank's central region.

Asked about regulatory pushback as the bank shrinks its physical footprint, Destafney said the bank's use of interactive teller machines, or ITMs, has helped mitigate concerns. ITMs are similar to ATMs but have videoconferencing capabilities that enable bankers in a centralized location to service consumers at the machine without the need for a full branch.

"We want to make sure that the market isn't left without access to banking, which is a big thing that I think regulators focus on," Destafney said during the investor day, according to a transcript.

Still open for business

At the same time, several banks opened branches by the dozens in 2021, as lenders continue to use retail branches as a marketing and consumer acquisition tool even while more consumers use digital and mobile services. JPMorgan Chase & Co. opened the most branches in 2021 with 169 new locations, significantly outpacing the 53 openings for the No. 2 bank, Bank of America Corp. While JPMorgan is pruning its branch footprint — ultimately closing 129 branches, on net — de novo branch locations have been a key strategy as the bank expands into new markets.

JPMorgan announced its branch expansion plans in 2018 and is about halfway through its effort, said Marianne Lake, co-head of consumer and community banking, at an investor conference. The bank has opened 220 branches under the initiative, giving it a location in all 48 contiguous states. Lake said the locations have so far beaten profitability expectations, driving deposit market share gains as well as expanding the reach of its commercial bank to local businesses as well as government entities and nonprofits.

"When we enter a new market and we start serving that community, it's not just about the consumer franchise," Lake said, adding that the branches represent "multi-decade investments" for the bank. "It's about bringing the full faith and force of JPMorgan Chase to that community."

Click here for an Excel spreadsheet detailing branch openings and closings in 2021.