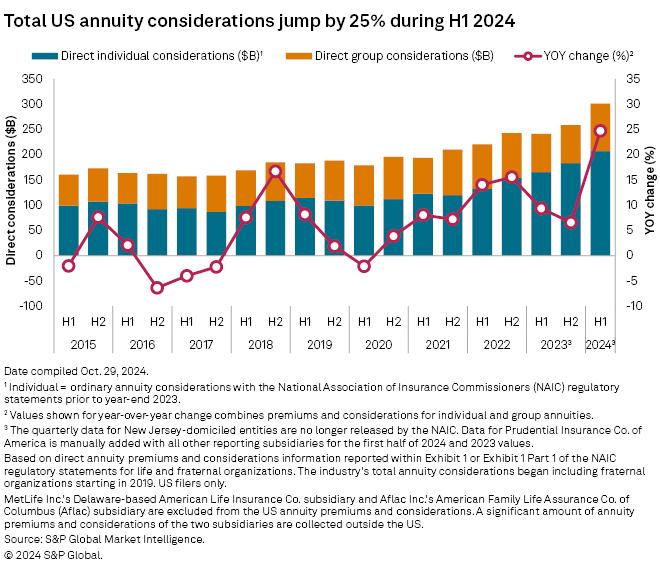

After a first half that set a record for annuity considerations and premiums, 2024 is shaping up to be yet another historic year for US annuity writers.

The industry logged $300.67 billion in individual and group annuity considerations in the first half of 2024, an increase of roughly $59.6 billion from $241.07 billion in the first half of 2023, according to an S&P Global Market Intelligence analysis. That marked the largest increase in direct premiums written for individual and group annuities in the last two decades.

Teodor Panaitisor, assistant research director for LIMRA's annuity research, said the landscape for annuities has "shifted dramatically" since 2020, causing a "flight to safety" as individuals acted on worried about economic factors.

"That's why you're seeing that boost in fixed annuities," Panaitisor said in an interview. "You'll notice a trend and then pair that with rising interest rates around 2020 that really helped additionally boost fixed annuities."

Growth drivers

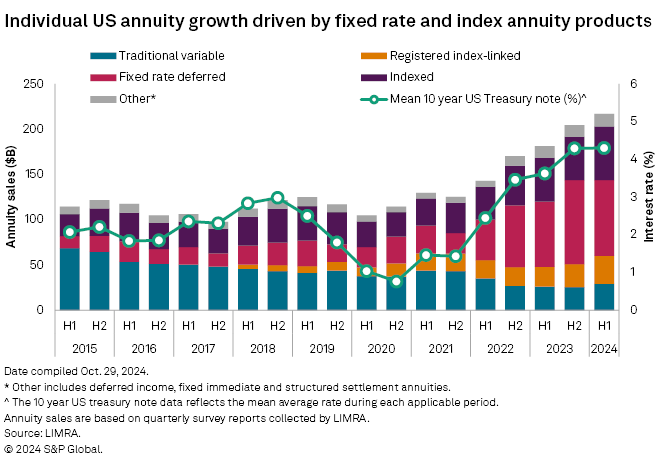

Individual annuity sales are being driven by fixed indexed and fixed-rate deferred annuities, according to sales survey data collected by LIMRA.

Fixed-rate deferred annuities increased 16.3% year over year, or $11.7 billion, in the first half. Indexed annuities were up 22.5% year over year, with an increase of $10.9 billion compared to the first six months of 2023.

–

Registered index-linked annuities grew the most on a percentage basis, soaring 41.7% in the first half compared to the first six months of 2023. The growth reflected an increase of $9.1 billion.

Panaitisor said several factors are coming together to boost annuity growth, including an aging population in the US and concerns over the state of the economy. Panaitisor said the outlook for annuities is still strong and interest rate cuts will likely have a limited impact.

"We're not going to see this exponential double-digit growth," he said. "We might see a more modest growth within the next two quarters."

LIMRA has already released preliminary results from its US Individual Annuity Sales Survey that shows total annuity sales increased 29% year over year to $114.6 billion for the third quarter.

Leading writers

Prudential Financial Inc. was the biggest writer of group annuities in the first half with $23.23 billion in direct considerations, representing a year-over-year increase of 236.6%.

Prudential had two large pension risk transfer deals during the first quarter that helped drive the massive year-over-year growth. In February, the insurer closed a pension risk transfer deal with Shell USA Inc. in which it assumed $4.9 billion in pension obligations for about 21,500 of Shell's US retirees. Alongside Reinsurance Group of America Inc., Prudential was selected in March for a pension risk transfer deal that settled roughly $5.9 billion of Verizon Communications Inc. pension liabilities, involving about 56,000 Verizon retirees.

Transamerica Corp. was the second-largest writer of group annuities in the first half of 2024 with $8.60 billion in direct considerations, reflecting year-over-year growth of 43.7%.

Meanwhile, Athene Holding Ltd. was the biggest provider of individual annuities in the US in the first half of the year. Athene booked about $18.95 billion in direct considerations, an increase of 21.4% year over year.