As befitting an election year, there was no shortage of drama and intrigue in 2024 for US insurers. Property and casualty carriers faced severe weather, including five hurricanes in four months, a bridge collapse, long-awaited changes in the country's largest market and soaring rates for the private auto and homeowners lines of business. In managed care, the year began with changes in the Medicare landscape and ended with a CEO being gunned down in New York, which intensified the scrutiny of the claims practices of the insurers, while the life insurance sector saw regulatory changes and a record year for annuities. Overshadowing all of that was Donald Trump's upcoming return to the White House and what could be in store for the country's economic, regulatory and social environments. Here's a selection of our stories from an eventful year in the US insurance market.

Property/Casualty

Reinsurers, marine market to bear brunt of Baltimore bridge collapse

The Francis Scott Key Bridge collapsed in the early morning of March 26 after being struck by a Singapore-registered cargo ship leaving the Port of Baltimore en route to Sri Lanka. Chubb Ltd. was the lead insurer for the bridge, but CEO Evan Greenberg said the company's exposure was not outsized.

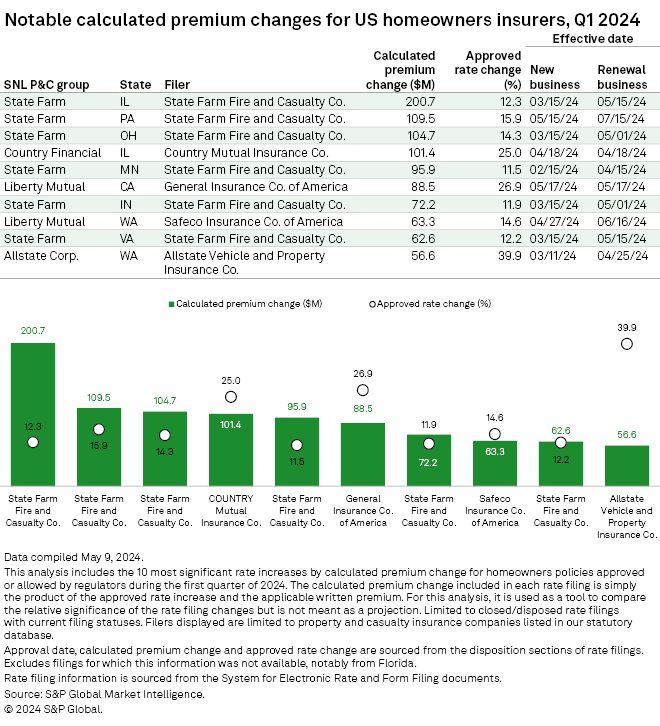

Rate Check: More pain for US homeowners as insurers play catch-up on inflation

The cost of homeowners insurance in the US is likely to remain elevated in the near term even as inflation cools and the severity and frequency of claims increase.

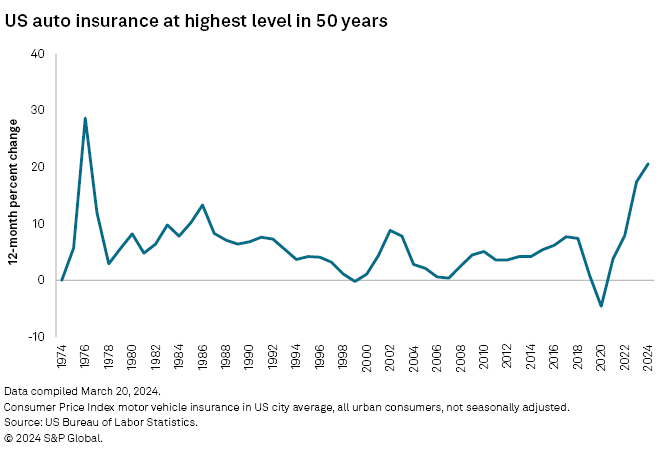

Consumer checkup: Rising US auto insurance costs creating toxic problem

The average cost of motor vehicle insurance in the US rose 20.6% in February, the steepest year-over-year increase for that metric since the mid-1970s.

American Transit's surplus wiped out by $705M net loss in Q2

The New York City-focused commercial auto insurer booked $769.6 million for loss reserves and $159.1 million for loss-adjustment expenses in the second quarter following the recommendation of an independent actuary. American Transit later filed a federal lawsuit against healthcare providers.

Allstate takes 1st step to leave health and benefits business with $2B deal

The all-cash deal to sell Allstate's employer voluntary benefits business to StanCorp Financial is expected to close in early 2025.

1st profitable quarter powers Wall Street surge for Root

The Columbus, Ohio-based insurer, which held its conference call Oct. 30, booked net income of $22.8 million, up from a loss of $7.8 million in the second quarter and a loss of $45.8 million a year ago.

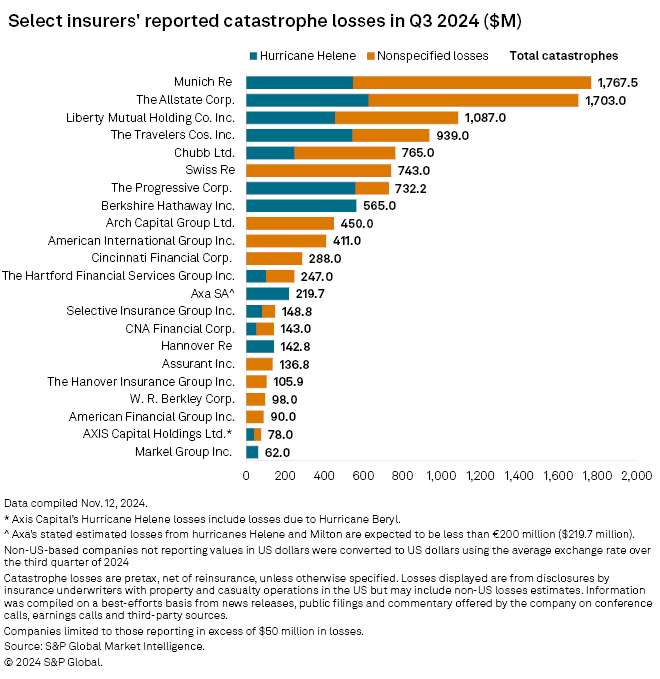

Hurricane Helene impacts insurers' Q3 catastrophe losses

Helene generated catastrophe losses for 14 out of 22 companies in an S&P Global Market Intelligence analysis. Allstate had the highest Helene losses at $630 million out of a total of $1.7 billion, while Liberty Mutual incurred losses of $458 million from the event that contributed to the company's total of $1.09 billion.

California OKs insurers' use of catastrophe models

The new regulation, which will become effective Jan. 2, 2025, allows insurers to use forward-looking catastrophe models to determine rates for lines of business that include wildfires, earthquakes and floods.

Managed care

US health insurers reel following killing of UnitedHealthcare CEO

The entire managed care sector in the US felt the impact of the targeted killing of a leading industry figure.

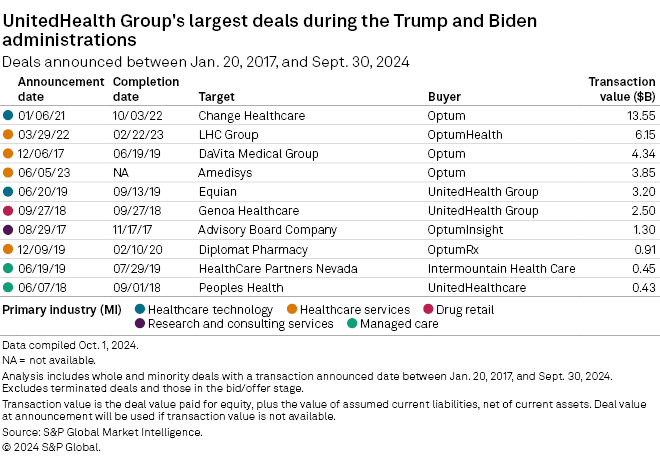

US election puts spotlight on UnitedHealth's outsized role in health insurance

November's election is set to be an inflection point in determining the future competitive landscape of the US health insurance market.

Cigna Medicare sale clears path for future acquisitions

The planned divestiture comes as health insurers grapple with rising costs amid increased usage for Medicare Advantage plans. With the sale, Cigna may decide to take another shot at merging with Humana, according to one sell-side analyst.

Truist's insurance exit a potential bellwether as capital requirements tighten

The $7.6 billion deal value makes it by far the largest deal of its kind announced since at least 2017, beating only Truist's own partial 2023 sale of 20% of Truist Insurance Holdings to the same investor group in a deal valued at $1.95 billion.

Insurance sector's race to adopt AI spurs private equity investment

Cigna Medicare sale clears path for future acquisitions The value of private equity-backed deals in the insurance sector is on the rise as buyout funds seek to create value through technology and consolidation.

Life & health

US Labor Department's fiduciary rule in trouble after Trump win

A rule targeting so-called "junk fees" in certain retirement products has been contentious since it was first proposed, garnering pushback from both the insurance industry and some state regulators.

NAIC looking to fix 85/25 issue for long-term care policyholders

The National Association of Insurance Commissioners is seeking public comment on a proposal to provide relief to older long-term care policyholders facing high rate increases.

US annuities on track to have another record-breaking year in 2024

Annuity premiums and considerations totaled $300.67 billion in the first half of 2024, an increase of roughly $59.6 billion from $241.07 billion in the first half of 2023.

Regulatory affairs

NC insurance chief calls on Congress to abolish Federal Insurance Office

North Carolina Insurance Commissioner Mike Causey told S&P Global Market Intelligence there may be widespread support for abolishing the FIO within the National Association of Insurance Commissioners and among state insurance regulators.

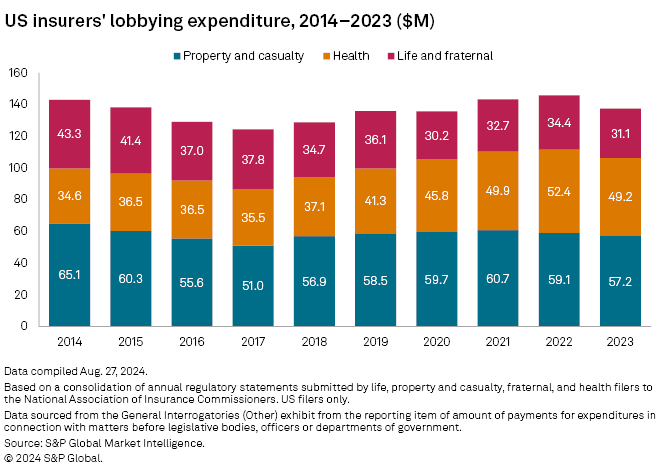

Amid growing issues with affordability, P&C insurers outspend peers on lobbying

In 2023, the last year for which data is currently available, property and casualty insurers spent about $57.2 million on lobbying, while health insurers spent about $49.2 million and life insurers spent approximately $31.1 million.