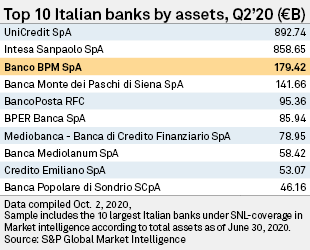

Amid expectations that Intesa Sanpaolo SpA's recent merger with Unione di Banche Italiane SpA could be a catalyst for long-awaited consolidation in Italian banking, speculation is growing that Banco BPM SpA, the country's third-largest lender, may soon become a takeover target. But while Italy's crowded market would likely benefit from consolidation, the current climate may make deal-making tricky.

Media reports have suggested that Crédit Agricole SA is considering a deal to buy BPM, possibly in an attempt to shore up its Italian operations. The French bank is also thought to have considered Credito Valtellinese SpA as a target, but is favoring BPM because of its footprint in the wealthy Lombardy region in northern Italy. UniCredit SpA has also been a rumored suitor for BPM.

|

Calls from EU regulators for consolidation in the banking market, not just in Italy but across the bloc, have intensified since the pandemic. Andrea Enria, chair of the European Central Bank's Single Supervisory Mechanism said earlier in October that the crisis caught the sector at a moment of "structural weakness," and banks that are struggling to remain profitable or stay afloat should consider mergers.

"European authorities and regulators view consolidation as one way to mitigate the expected negative impact of COVID-19 on banks' profitability, as bank mergers can help achieve economies of scale and cost synergies," Arnaud Journois, vice president of global financial institutions at DBRS Morningstar, said in an email.

In Journois' view, the Intesa-UBI deal, along with a potential merger of CaixaBank SA and Bankia SA in Spain, should "open the door" to more domestic M&A. However, the economic instability and uncertainty caused by the pandemic makes further consolidation "challenging," as does the absence of a full banking union in Europe, he added.

The Italian government predicts that the country's GDP will contract by 9% in 2020, with growth of 6% in 2021 and then 3.8% in 2022 as the economy begins to recover.

Victor Galliano, a financials and fintech analyst at Galliano's Latin Notes Ltd. and contributor to SmartKarma, an independent investment research platform, said he can see the appeal of Banco BPM for Crédit Agricole.

|

"Crédit Agricole Italia SpA [the bank's Italian subsidiary] had total assets of €73 billion at [the second quarter], making it comparable in total asset terms to BPER; Banco BPM had total assets of €179 billion at [the second quarter], so is approximately 2.5x the size of Crédit Agricole," he said in an email.

"Clearly, its large asset, and loan, base would be attractive to Crédit Agricole especially, as it could extract potential cost savings and in the long run scale economies from such a potential merger."

BPM's large branch network could also be useful conduit for fee-generating products such as the investment funds of Crédit Agricole operating subsidiary Amundi SA, Galliano said.

|

"It is unlikely that other non-Italian banks would be interested in Banco BPM, in our view, as this would imply limited scope for cost savings," he added.

One challenge that could hinder a merger is that BPM needs to accelerate its deleveraging, he said.

At the end of the first half, BPM's nonperforming exposures had a gross book value of €9.8 billion.

Crédit Agricole, which often refers to Italy as its "second home market," is no stranger to mergers in the country, having bought three medium-sized Italian savings banks, BANCA CARIM - Cassa di Risparmio di Rimini SpA, Cassa di Risparmio di Cesena SpA and Cassa di Risparmio di San Miniato SpA, in 2017.

The French bank did not respond to a request for comment at the time of this article's publication.

At UniCredit, CEO Jean Pierre Mustier is adamant that M&A is out of the question. Speaking at an S&P Global event earlier in October, Mustier reiterated that the bank was sticking to a policy of "absolutely no M&A."

When asked about a hypothetical offer for BPM, a spokesperson for UniCredit subsequently told S&P Global Market Intelligence that the bank does not comment on market speculation, and pointed out Mustier's earlier comments regarding M&A.

|