The Supply Chain Daily provides a curated overview of Panjiva's research and insights covering global trade policy, the logistics sector and industrial supply chains and draws from global shipping and freight data.

Fast Retailing expects slow recovery from COVID-19

Fast Retailing Co. Ltd., owner of Uniqlo, reported a 39.4% year-over-year drop in revenues in the three months to May 31 due to store closures caused by COVID-19. While reopenings are beginning, the firm still expects a 50% slide in North American revenues in the quarter to Aug. 31.

Uniqlo is far from alone in experiencing a downturn, with U.S. seaborne imports of apparel falling 41.1% year over year in June after a 33.2% slide in the three months to May 31.

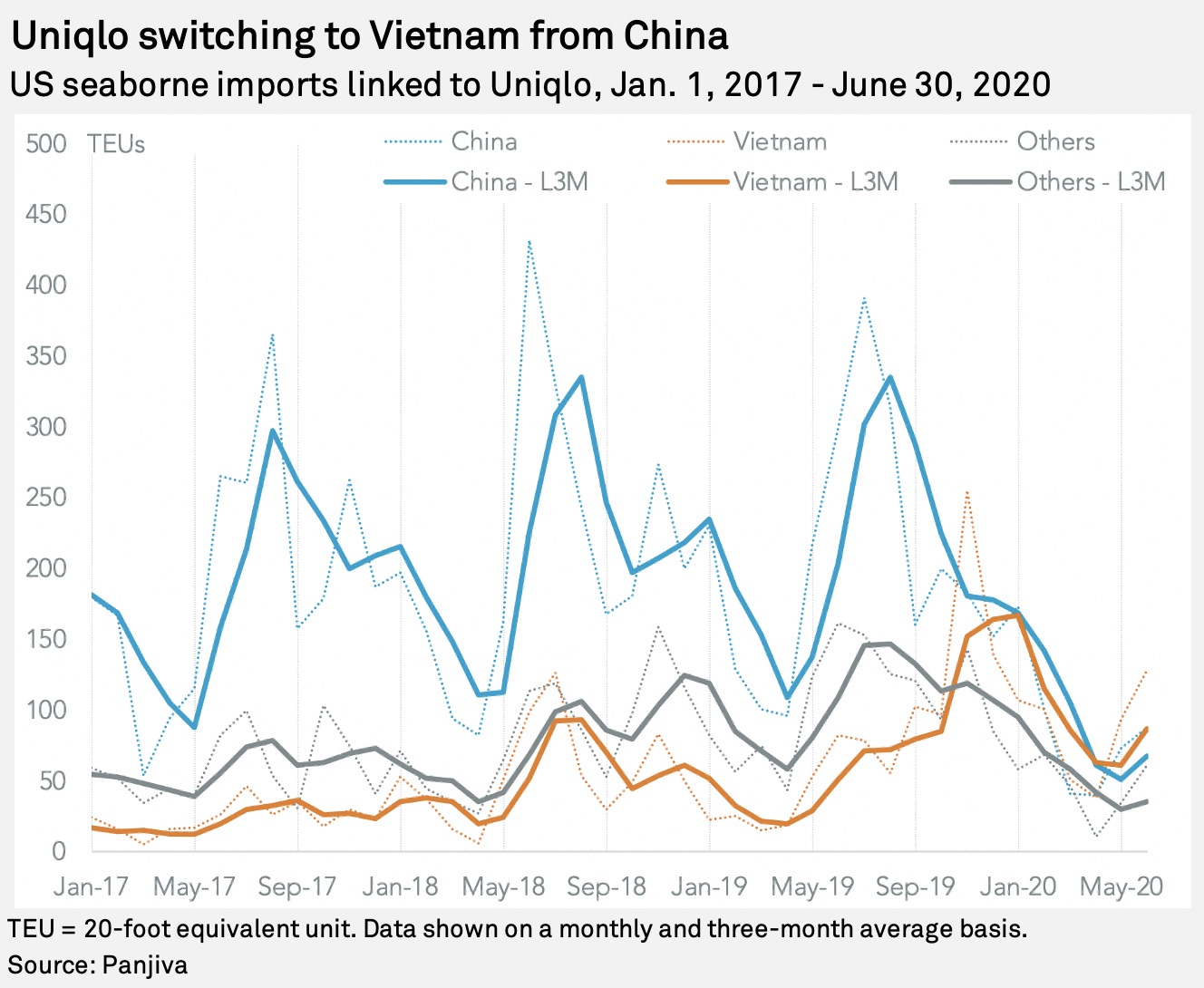

Shipments linked to Uniqlo specifically fell 49.0% year over year in June and have been reoriented toward Vietnam and away from China in response to earlier tariffs applied as part of the trade war. Shipments from China linked to Uniqlo dropped 70.6% year over year in June, while those from Vietnam continued to increase with a 54.6% surge.

(Panjiva Research - Retailing)

|

Muji devastated by COVID-19, plastic tableware proves robust

Ryohin Keikaku Co. Ltd. has placed the U.S. operations of its Muji home goods stores into Chapter 11 bankruptcy protection due to "the devastating effects of the COVID-19 pandemic." U.S. seaborne imports linked to the firm dropped 78.9% year over year in the second quarter after a 52.5% slide in the first quarter and a 19.7% decline in the fourth quarter of 2019. At the product level, plastic tableware proved more robust than furniture and stationary but still dropped markedly.

Yet, total U.S. imports of plastic tableware only declined 2.7% year over year in the second quarter as demand for disposable products has risen during the pandemic. There has been a marked difference in behavior among different retail categories.

Discount stores have increased their shipments, with imports associated with Dollar Tree Inc. and Dollar General Corp. improving 12.1% and 7.1%, respectively. Shipments linked to big-box retailers including Target Corp. and Costco Wholesale Corp., meanwhile, declined 25.3% and 24.3%.

(Panjiva Research - Retailing)

|

LVMH may need price hikes, Italy shift as digital tariff war gets underway

The U.S. government is going ahead with retaliatory measures against digital service tax plans in France. While the 25% duties on about $1.08 billion of products will not be applied until January 2021, this should be seen as part of the widening trade spat between the U.S. and EU, which includes aerospace subsidies and may include carbon border taxation.

The product list is narrower than prior filings from the government and includes beauty products worth $786 million in the 12 months to May 31 and handbags worth $404 million. There is no sign of stockpiling so far as imports of the two product groups combined were down 49.8% year over year in May, with the likelihood of the tariffs being passed through to customers.

Exporters from France, including Longchamps and LVMH Moët Hennessy - Louis Vuitton Société Européenne, may also switch sourcing away from France to Italy, which already accounted for 24.2% of shipments of handbags in the 12 months to May 31, or to China and Vietnam, which represented 15.6% and 11.6%, respectively. It is worth noting that imports from China already fell 53.3% year over year in the 12 months to May 31 due to tariffs put in place as part of the U.S.-China trade war.

|

Bike helmets avoid tariffs, cross small COVID-19 dip

The U.S. government has issued a new round of exemptions from tariffs on Chinese imports. The products covered are part of the "list 4A" group of Section 301 duties applied since September 2019. There were just 86 approvals out of 4,557 decisions made, or a 1.9% rate, bringing the total for list 4A so far to a 4.6% rate. Those exemptions will nonetheless prove important if the trade war is rekindled and the tariff rate increased above the current 7.5%.

The latest round of positive decisions includes an eclectic group of products, including shower heads, an Ai Weiwei sculpture and bicycle safety helmets. The latter includes shipments by Vista Outdoor Inc.s Bell Cycles and Roth Distributing Co., Inc.s Trek.

U.S. seaborne imports of cycle helmets have proven relatively robust during the pandemic due to increased demand, with shipments declining by just 3.0% year over year in the second quarter. Most companies appear to have absorbed the cost of tariffs, with shipments from China still representing 59.1% of imports in the 12 months to March 31, compared to 47.5% in 2017.

(Panjiva Research - Consumer Durables)

Brazilian wood boosts Houston as US ports struggle to recover

U.S. port activity struggled to recover in June. Total activity through the ports of Long Beach and Oakland fell 11.1% and 2.3% year over year, respectively, while total U.S. seaborne imports across all ports declined 8.4%.

That was somewhat better than the 19.6% slide in May and brought the second-quarter total to a drop of 11.2%. LA and Long Beach combined saw a decline of 8.4% in imports in the second quarter, while Oakland fell by 4.3%. Not all West Coast ports did better, though, with Seattle/Tacoma down by 13.4%. Among the other major ports, Port of Houston Authority was one of the best performers with shipments down by just 3.7% in the second quarter.

Houston was helped by a lower-than-average exposure to China as well as a surge in shipments from the Americas outside Mexico, including a 25.9% rise in imports from Brazil. In turn, the latter reflects a surge in activity in forestry products, with wood product shipments linked to UFP Industries Inc. and Brambles Ltd. increasing steadily.

(Panjiva Research - Logistics)

Christopher Rogers is a senior researcher at Panjiva, a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence.

The Supply Chain Daily has an editorial deadline of 5:30 a.m. ET. Some external links may require a subscription. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.