UniCredit SpA's proposal to buy the performing assets of struggling Italian peer Banca Monte dei Paschi di Siena SpA while discarding its bad loan burden makes commercial sense, but could be derailed by pushback from unions and regional political parties, according to industry experts.

UniCredit, Italy's second-largest bank by assets, entered into exclusive talks over a deal that would see it carve out Monte dei Paschi's performing loan book. The Italian government, which holds a 64.23% stake in Monte dei Paschi following a €5.4 billion state rescue, is eager to see the lender returned to private hands.

The wealthy north

UniCredit would take on an attractive portfolio of clients concentrated mainly in the northern regions of Italy, the country's economic powerhouse, as well as in the central region.

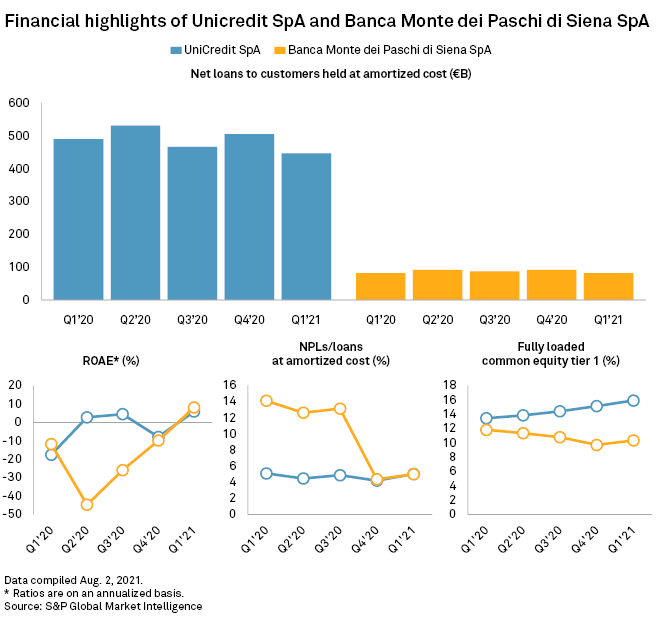

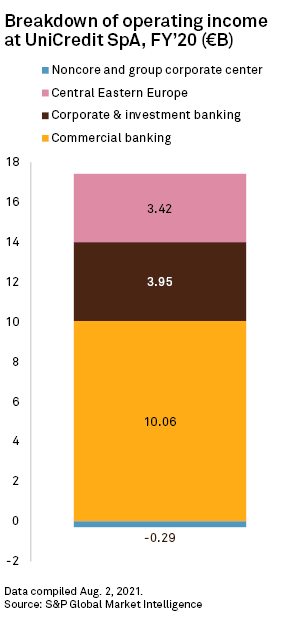

Monte dei Paschi's loans to customers totaled €82.63 billion at the end of 2020, almost all of them in Italy. UniCredit, which is also active in markets including central and Eastern Europe, Austria and Germany, had €450.55 billion in loans.

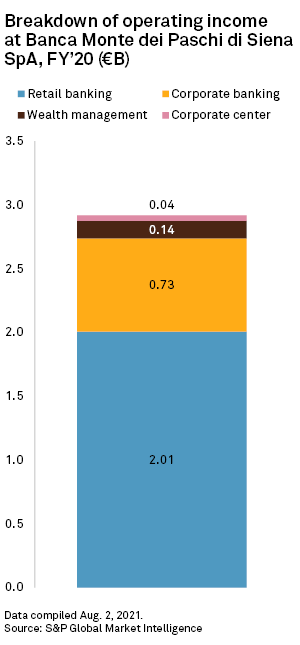

Retail banking makes up the lion's share of operating income at Monte dei Paschi, at €2.01 billion.

"[The] strategic rationale for UniCredit is the rebalancing of the commercial network towards Italy's center-north," Luigi Tramontana, financial analyst at Bank Akros, said in an email.

Approximately 77% of Monte dei Paschi's branches are concentrated in the northern and central regions of Italy, and UniCredit said the deal would allow it to grow its market share by 17% in Tuscany, 4% in Lombardy and Emilia Romagna, and 8% in Veneto. It would add about 3.9 million new clients, €80 billion in loans, €87 billion in deposits and €62 billion in AUM.

Different this time?

This is not the first time UniCredit has been mooted as a potential suitor for Monte dei Paschi. In 2020, toward the end of the tenure of previous CEO Jean Pierre Mustier, there were reports the Italian government was coaxing UniCredit into buying Monte dei Paschi in its entirety.

The deal would have been difficult for several reasons. As of November 2020, Monte dei Paschi was facing several lawsuits from investors around alleged mismanagement, running the risk of bills of up to €10 billion, although it has subsequently reached an agreement with a former major shareholder that will significantly cut its legal risk.

Monte dei Paschi also had a large overhang of nonperforming loans totaling €11.4 billion as of the third quarter of 2020, although this was reduced to €4 billion by the end of the year thanks to a deal with state bad loan manager AMCO - Asset Management Co. SpA.

Mustier repeatedly said that UniCredit was categorically opposed to M&A, and, for a time, a deal looked extremely unlikely. But now the picture is different.

Under the current proposal, UniCredit will not take on legal risks, NPLs or excess staff from Monte dei Paschi, making the deal very different from a straightforward merger, Bank Akros' Tramontana said.

Tramontana said recent leadership changes at UniCredit and in Italian politics are also changing attitudes toward the deal.

Mario Draghi, who was sworn in as Italian prime minister in February 2021, was eager to encourage mergers as a way to address weaknesses and inefficiencies in European banking during his term as president of the ECB, which ran from 2011 to 2019.

Andrea Orcel, former head of UBS Group AG's investment bank who became CEO of UniCredit in April, told analysts in May that he would consider M&A if it helped to advance the bank's strategy.

Pushback

Not everyone is happy about the proposed deal, with one Italian newspaper referring to it as a "joyless marriage."

The Italian Treasury has come under fire from banking unions and the center-left Democratic Party, who are concerned about job losses for Monte dei Paschi employees and the loss of the bank's brand and territorial roots in Tuscany.

Italy's populist 5-Star Movement has historically been against a sell-off of Monte dei Paschi and takes a particularly dim view of the idea of "selling out" to a major international bank instead of exploring solutions such as a public share issue.

"UniCredit and the Italian Treasury are now locked into negotiations, and the final outcome is still very uncertain," said Barbara Casu Lukac, director of the Centre for Banking Research at Bayes Business School.

"Mario Draghi will have a final say on the deal, and in some quarters this is read as a signal that the deal will go ahead ... Many political commentators think he was behind the change of heart at UniCredit."