Unless financial institutions do more to foster a pipeline of senior female leaders, the U.K. is unlikely to see female leaders being appointed to CEO or other "C-suite" roles at a major bank any time soon, a new report warns.

As it stands today, Alison Rose of NatWest Group PLC is the only female CEO of a large incumbent bank in the U.K., while there is not a single female board chair, according to a new report from The Pipeline, a diversity and inclusion specialist. Women make up 11% of executive committee members on main banking public limited banks as of April 17, according to the Women Count 2020 report. Though a 5% increase on the previous year, banking continues to lag other parts of the sector analyzed using this metric.

Insurance is doing better in terms of female representation on executive committees, with women making up 30% of the total, an increase of 10% on the previous year. Among FTSE 350-listed insurance companies, Direct Line Insurance Group PLC's Penny James was the only female when the report was compiled, although Aviva PLC subsequently appointed Amanda Blanc in July.

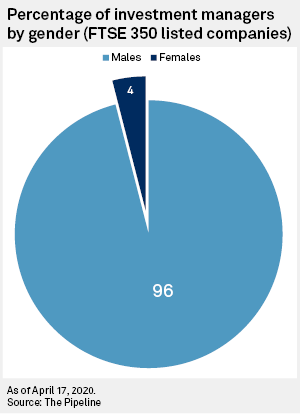

Women are particularly poorly represented at investment management companies, accounting for just 4% of the total.

Route to the C-suite

While Rose's appointment is promising, it looks unlikely that the banking industry will see another female CEO appointment in the near future, Lorna Fitzsimons, co-founder of The Pipeline, said in an interview.

A large part of the challenge is that few women are in the type of positions that usually lead to C-level appointments — senior roles with profit and loss responsibility, Fitzsimons said. This year women held only 10% of P&L roles on banking executive committees, leaving a dearth of future female candidates for C-suite vacancies coming from this traditional path, according to the report.

Among other risks, this male-female imbalance increases the likelihood that banks are out of touch with a critical portion of the end customer base, Fitzsimons added.

For Fiona Hathorn, CEO of the U.K. arm of Women on Boards, a networking and knowledge-sharing organization, and former head of global equities at Old Mutual Asset Management, the results of The Pipeline survey are jarring because there is a wealth of empirical evidence that organizations with diverse leadership perform better that those that do not.

Hathorn cites a recent "Diversity Wins" report from consultants at McKinsey & Co., which found that companies in the top quartile for gender diversity are 25% more likely to achieve above-average profitability, while those in the bottom quartile of both gender and ethnic diversity are 27% more likely to underperform on profitability.

"Stark stuff but do the heads of fund management, investment banks and insurance companies across the world care? No," Hathorn said in an email.

'A boys' club'

For Ebru Smith, an associate at Kuros Associates, an asset management company, the findings of The Pipeline report chime with her observations of fund management companies, where there is often not the same level of career support for women as there is for men.

"Mostly these asset managers have fund managers in place and their succession plans often mean their number twos are already lined up, and are mostly made up of men; a younger version of themselves," she said in an email.

"Sexism is prevalent and it is still difficult to enter the boys' club," she said.

The gender imbalance in investment management starts early on, according to Sarah Maynard, global head of external inclusion and diversity strategies and programs at CFA Institute, a trade body for investment professionals.

"Many young women were deterred from entering investment after the [global financial crisis] when money managers got such a bad image, equated with investment bankers. So it was not attractive for those with strong values and service ideals — the very people the industry needs," she said in an email.

|

Shifting the balance

Poor gender diversity in the investment management industry is "an endemic and structural issue," which needs to be addressed strategically, said Bev Shah, CEO of City Hive, an industry body focused on diversity, and a former fund manager and analyst with Aviva. That could mean having systems in place that require companies to allocate resources to improving gender diversity and to "create consequences for failure to act with an effective accountability structure," she said in an email.

Hiring from other industries might also help fill the pipeline, Maynard said.

"Some firms are looking outside the asset management industry for sources of female talent: private equity, accountancy, corporate law, are all sources of women with business experience, financial acumen and client expertise which can offer firms transferable skills."

Whatever the approach, The Pipeline report concludes, the urgency for companies to change old practices will continue to increase as the twin challenges of the coronavirus and recession bear down on corporate U.K.