Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

4 Feb, 2022

By Erin Tanchico and Cheska Lozano

UBS Group AG expects U.S. automated wealth management provider Wealthfront Corp., which it is acquiring in an all-cash deal worth $1.4 billion, to serve as its "growth engine."

The Swiss bank plans to first run the company for growth, number of clients, AUM and direct technology before managing it for profit and loss, UBS Group CEO Ralph Hamers told analysts in a Feb. 1 earnings call. Wealthfront, which had roughly $27 billion in AUM and more than 470,000 clients in the U.S. as of Jan. 28, is focused primarily on millennial and Gen Z investors, a segment UBS deems to have high-growth potential in the global wealth market.

"The way we develop Wealthfront, please just look at this as a growth engine for the moment ... [It] needs to continue to grow and create value and deliver that value to us as well," Hamers said, adding that the company will work as a stand-alone operation for a long time because "they are successful, they are growing fast, [and] they have a unique proposition."

The U.S. has delivered strong growth for UBS in recent years, with its fee-generating assets in the Americas amounting to $900 billion at the end of December 2021, an increase from $757 billion a year before.

With the Wealthfront acquisition, UBS is rolling out a digital offering in the U.S. and is planning similar models globally, Hamers said. He previously said that the Swiss bank plans to launch a digital wealth management service for mass affluent clients in the U.S. with assets of $250,000 to $2 million, which analysts have said offers plentiful opportunities.

UBS has roughly 2 million customers in the U.S. alone in its Workplace Wealth Solutions offering, according to Hamers.

"They are kind of the upper affluent wealth clients that we need to have a more digital wealth offering for," the CEO said. "And that's why Wealthfront is an attractive proposition for them, and therefore, with us as well in order to ensure that we keep them as clients going forward."

The Wealthfront acquisition is part of the group's plan under which it is developing what it called a wealth management Americas platform, or WMAP, to help it achieve its strategic goals in the U.S., Hamers said.

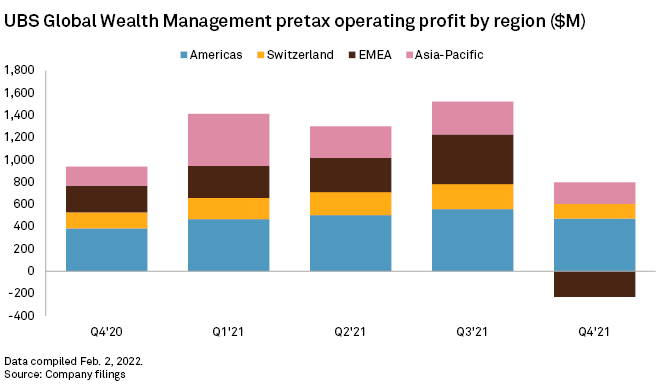

The Americas was the biggest contributor to the pretax operating profit of UBS' global wealth management division in the fourth quarter of 2021, contributing $471 million, or roughly 82% of the division's total $563 million pretax operating income.

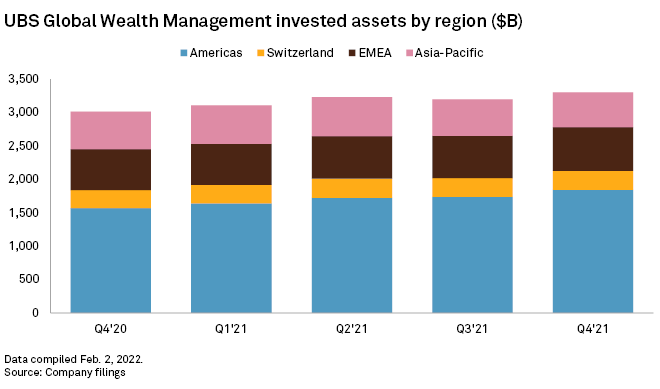

As of Dec. 31, 2021, the division had about $3.303 trillion of invested assets, of which $1.842 trillion was contributed by the Americas region. Hamers previously stressed the importance for UBS to be active in the region, noting that it is an important part of the bank's investment ecosystem.

UBS expects its common equity Tier 1 ratio to decrease by approximately 40 basis points upon completion of acquisition, which could happen in the second half. The group also expects the deal, which will be financed by its existing capital resources, to be marginally EPS accretive and to be accretive to its returns over time.

"We're actually delighted with the acquisition from a strategy perspective," UBS CFO Kirt Gardner said.