In the bitter fight over the disputed acquisition of Twitter Inc., a whistleblower report has Wall Street reevaluating the odds of a legal settlement.

The report granted Twitter's reluctant buyer, Elon Musk, with an insider account alleging inaccurate information about fake accounts on the social media company's core platform. In his quest to terminate the deal, Musk has repeatedly sought vast amounts of data and documentation to verify the company's estimates of fake accounts. While early court rulings limited the scope of what Musk could obtain, the whistleblower complaint filed by famed hacker and former Twitter security lead Peiter "Mudge" Zatko claimed that Twitter lied to Musk about the size of its fake account problem.

The allegations do not guarantee Musk a legal victory as he tries to get out of his deal to buy Twitter for $44 billion, but the report damages Twitter's case, analysts said.

"Twitter looked to have a easy potential win in the eyes of [Wall Street] heading into the Delaware court battle in [October]," Daniel Ives, senior equity analyst and managing director at Wedbush Securities, tweeted Aug. 24. "The Zatko story clearly adds complexity and another wild card to this battle between Musk vs. Twitter."

In an Aug. 23 memo to employees, Twitter CEO Parag Agrawal said Zatko was fired for "ineffective leadership and poor performance" and the whistleblower's claims were "riddled with inconsistencies and inaccuracies." Twitter did not respond to a request for comment by S&P Global Market Intelligence.

Any potential impact on the outcome of the litigation hinges on the credibility of Zatko and any new information he might provide, said Jill Fisch, a professor of business law at the University of Pennsylvania Law School.

"Whistleblower complaints are relatively common," Fisch said. "They range pretty dramatically from the disgruntled employee to someone who really has new light shed on the situation."

In this case, Zatko's reputation as a successful hacker and programmer makes him a formidable witness, said Patrick Hall, principal scientist at artificial intelligence-focused law firm bnh.ai and professor of data ethics at The George Washington University.

Before joining Twitter, Zatko made a name for himself as part of the seven-member group of hackers called L0pht who told Congress in 1998 that they could shut down the internet in as few as 30 minutes. Zatko later went on to work for the U.S. Defense Department's Defense Advanced Research Projects Agency and then Alphabet Inc.'s Google LLC.

"Zatko is a legend in the computer security world," Hall said. "He also has some experience in these types of high-profile situations."

Court considerations

The whistleblower's testimony may broaden the scope of pre-trial discovery, though for now, legal experts believe that Twitter still has a stronger case.

"The fact that an insider is making the claims adds some power to Musk's case," University of Chicago law professor Anthony Casey wrote in an email. "But it would have to be an allegation that something core to the business was an intentional fraud to change the game."

CFRA Research senior equity analyst Angelo Zino said Twitter still has a better chance of prevailing in court, but the whistleblower complaint could push the company to agree to a less favorable settlement than expected previously.

"Maybe this situation makes Twitter more inclined or allows them to potentially be a little bit more more generous in terms of reaching a concession or a settlement, whereas, potentially we're looking at closer to 15% to 20% of a discount relative to 5% to 10% [previously]," Zino said.

Zino maintained a "hold" rating on Twitter's stock in a research note.

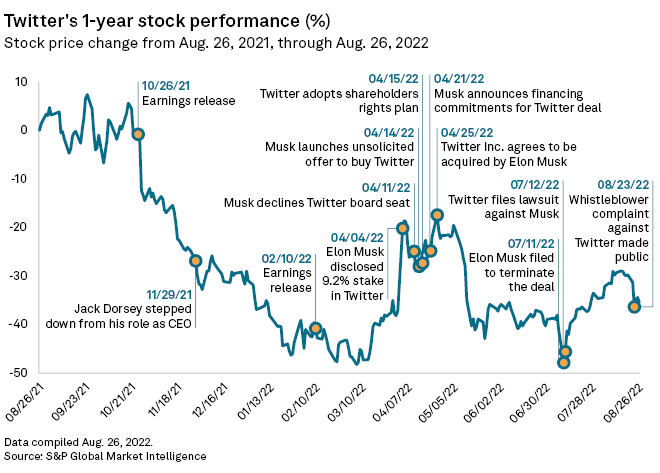

Twitter shares fell 9.4% on Aug. 23 after The Washington Post and CNN (US) broke the news of Zatko's report.

Broader challenges

Twitter's operational challenges reflect some of the growing pains associated with a company attempting to transition from a "move fast and break things" culture to one more focused on risk management, Hall said.

Even motivated individual change agents cannot facilitate meaningful reforms at a company such as Twitter without the support of directors and senior management, Hall said, adding that better regulatory oversight regarding data privacy and artificial intelligence is also needed.

"Without good regulation that balances risk management and innovation ... We are going to see more problems like we are seeing at Twitter today," Hall said.

Zatko has been subpoenaed to appear in front of lawmakers in a Senate Judiciary Committee hearing at 10 a.m. ET on Sept. 13, the same day Twitter shareholders are expected to vote on the merger at 1 p.m. ET.