As Twitter Inc. and billionaire tech mogul Elon Musk lawyer up for a court battle over the company's sale agreement, analysts said Twitter's challenges are mounting, with or without the deal.

The company's stock is falling and economic headwinds are coming. Analysts said Twitter will likely need an infusion of cash — either from Musk himself or from new bargain-hunting suitors.

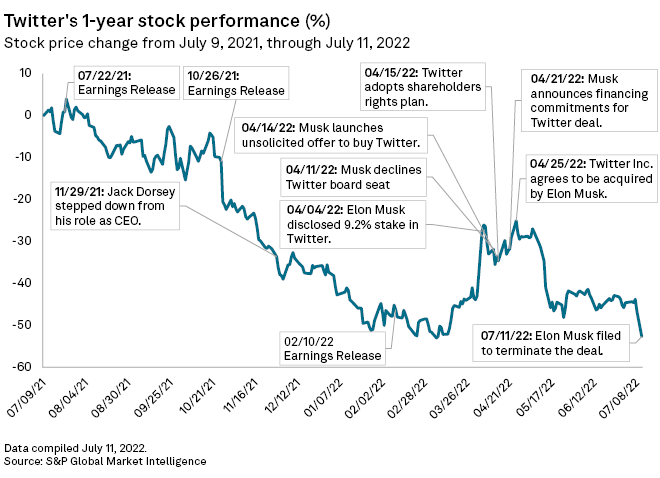

Twitter stock is down more than 50% for the past 12 months, which included a volatile trading period in 2022 as the company's rocky relationship with Tesla Inc. CEO Musk played out in regulatory filings and on Twitter's own platform.

The shares closed at $32.65 on July 11, well below the $54.20 per share in cash that Musk offered when he agreed to buy the company in April.

Were the deal to fail, it would be the fourth-largest technology and telecommunications transaction to fall through in the last two decades.

"If Twitter is serious about forcing Musk to go through the deal, they're going to have to force this to move pretty quickly," said Lawrence Hamermesh, executive director of the Institute for Law & Economics at the University of Pennsylvania Law School. "If it's only about getting a billion-dollar fee for termination of the deal, it could go on for much longer."

Central to Musk's attempt to back out of the deal is his claim that Twitter failed to cooperate with requests for information about how much of its user base is actually false accounts run by bots. Twitter has repeatedly said bots account for less than 5% of its total users.

While the company did provide Musk with data on its users, Musk's attorneys alleged that the information provided came with limitations that made it "minimally useful."

Musk filed to terminate his agreement to purchase Twitter with the SEC on July 8. Twitter, in a counter filing with the SEC on July 11, said Musk's termination was "invalid and wrongful" and the company did not breach any of its obligations.

If Musk's allegations that Twitter underreported the number of bots were proved to be accurate, that would be detrimental to the company whether or not the deal closed, 451 Research senior analyst Raul Castanon-Martinez said.

"The allegations are hitting in a sensitive area that takes away credibility from Twitter in terms of the potential revenue that it might have in the future," Castanon-Martinez said. "It could lead to some damage."

Even if Twitter were to win a court battle with Musk and force either an outright sale or the payment of termination fees, the company would still face significant challenges given inflationary headwinds and macroeconomic concerns, as well as internal instability and employee morale issues, analysts said. Since the deal announcement, Twitter has fired two top executives and instituted a hiring freeze. On July 7, the company laid off 30 percent of its talent acquisition team.

"It will be much more of an uphill battle for them in their post-Elon Musk endeavors," said CFRA Research senior equity analyst Angelo Zino, who has a "hold" rating on the stock.

Courtroom considerations

Elon Musk is trying to terminate his Twitter buyout deal. |

In terms of legal strategy, Musk could build a case if he could prove that Twitter's SEC filings contained false or misleading information, said the University of Pennsylvania's Hamermesh. But Musk is not owed due diligence retroactively, Hamermesh added.

"You can't sign an agreement and then say 'I get to walk out of that because I didn't know something that I could have found out if I'd asked beforehand,'" Hamermesh said.

Most likely, Hamermesh said, is that a court will ultimately assess the sufficiency or accuracy of the information that Twitter supplied Musk.

That will likely include looking at the accuracy of Twitter's public statements about how many of its reported users are bots.

"Musk is holding Twitter accountable for those statements," said Scott Kessler, global sector lead for technology, media and telecommunications at Third Bridge. "I think what he's suggesting is they've said that, and so they have a legal obligation to prove that statement to be true."

Possible outcomes

If Twitter is able to collect a financial windfall from Musk, that could prop up the value of its stock, said CFRA's Zino. The company may also attract interest from a private equity firm if the deal fails and Twitter's stock price continues to fall, the analyst said.

"

Despite its many challenges, Twitter can withstand the adversity it has faced and may yet find a buyer in Big Tech, said 451's Castanon-Martinez. The analyst pointed to Salesforce Inc., Microsoft Corp., Alphabet Inc. and Meta Platforms Inc. as viable potential acquirers.

"Twitter is still an attractive acquisition target," Castanon-Martinez said. "They [Twitter] still have a lot of potential in terms of trust and communications moving forward."

451 Research is part of S&P Global Market Intelligence.