Cryptocurrency trading has boomed in Turkey recently as investors look to protect themselves from inflation and the weakening lira.

The rapid weakening of the Turkish lira is diluting the strong performance of Banco Bilbao Vizcaya Argentaria SA's business in its third-largest market despite the Spanish banking giant having significantly hedged against the currency's depreciation in 2021.

The sharp fall in the lira, which has sunk more than 28% against the U.S. dollar this year, is hitting returns for several foreign lenders that invested in Turkish banking.

BBVA has the largest exposure to the market of any foreign lender through its 49.85% stake in Turkiye Garanti Bankasi AS. The Madrid-based lender hedged against currency depreciation in 2021 in several of the emerging markets in which it operates, with 70% of expected annual results in Turkey protected.

However, the worsening outlook for the lira means BBVA will likely have to extend its positions beyond their current settlement dates, incurring charges and limiting the benefits of the process, according to Stefan Nedialkov, director at Citigroup Global Markets.

"Whatever happens in the [foreign exchange] market, you may hedge all you want, but eventually reality catches up with you because you have to roll over those hedges," Nedialkov said.

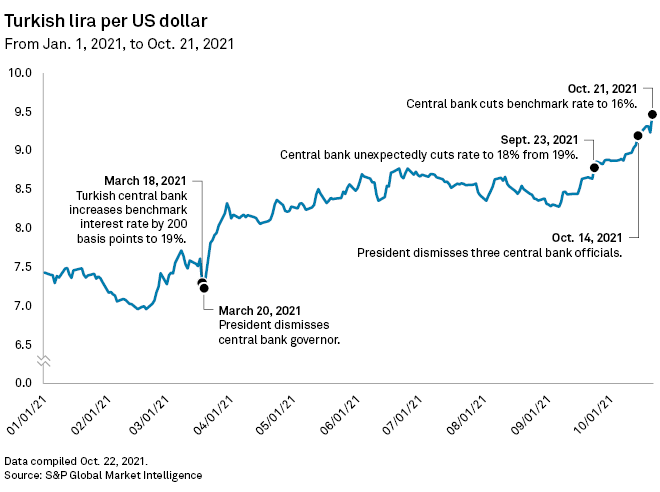

The lira tumbled to record lows Oct. 22 following a 200-basis-point cut to interest rates by Turkey's central bank, a larger cut than was expected by markets. The currency fell by more than 2% in the hours after the decision, trading at 9.51 lira to the dollar at 6.00 a.m. London time.

Monetary policy uncertainty

The central bank's decision follows President Recep Tayyip Erdoğan's dismissal of three central bank officials Oct. 12. The firings were seen as a push by the president to further cut rates, which he believes cause inflation to rise if too high, a view widely dismissed by economists. The current central bank governor is Turkey's fourth in less than two years.

The uncertainty has delivered a double hit to BBVA's investment. On top of the lira's 28% plunge against the dollar and 22% drop against the euro, Garanti's share price has fallen 13% since the start of 2021 compared with a drop of 3% for the wider Turkish BIST 100 index.

"If I were a Garanti shareholder, I wouldn't be too happy about it," according to Batuhan Ozsahin, chief strategist at Turkish asset manager Ata Yatirim Menkul Kiymetler. "As a foreign investor you're down 41% this year [in dollar terms]. The value of BBVA's investment has done poorly."

BBVA's strategic commitment to Garanti and Turkey has not changed, and it is "comfortable" with its 49.85% stake, the bank said in an emailed statement.

BBVA's deteriorating total returns from Turkey come despite Garanti being one of the country's strongest lenders, according to Ozsahin.

"[It] is a very well-run bank and it's in a great position because it has been run very diligently for some time," Ozsahin said.

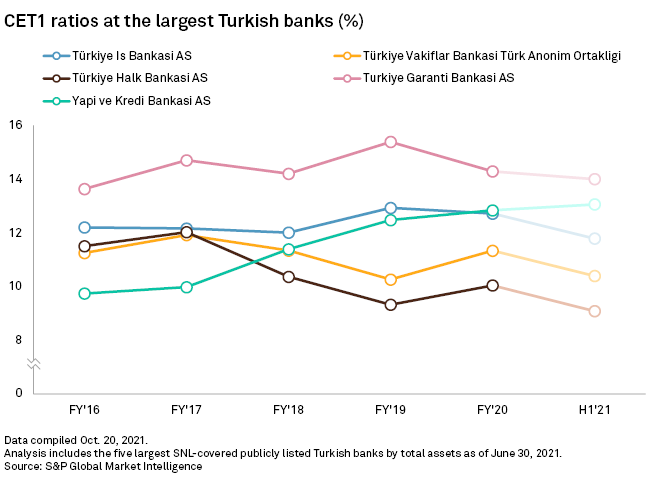

Garanti has been Turkey's best-capitalized large bank for several years, S&P Global Market Intelligence data shows. Its core Tier 1 ratio was 14.00% at June 30, 234 basis points higher than the average of the country's five largest listed lenders.

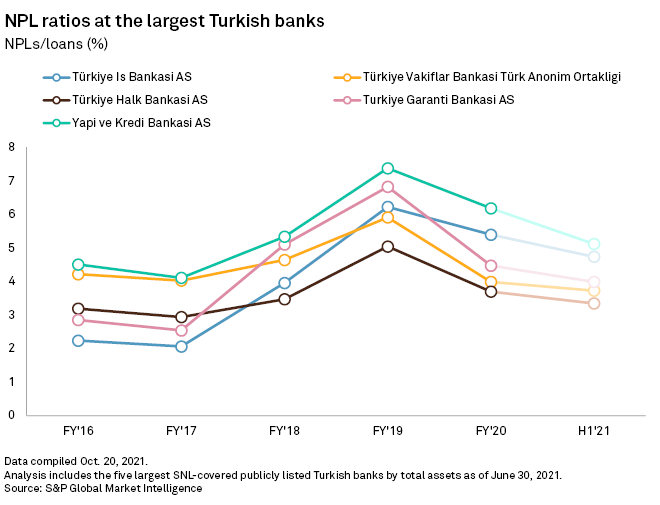

Its nonperforming loan ratio was 3.98% in the second quarter, below the average of 4.18% across the five largest banks. In the 11 years since BBVA bought a stake in Garanti, its NPL ratio peaked at 6.82% in 2019, 55 basis points above the average across the five banks for that year, following a currency crisis in the country the previous year.

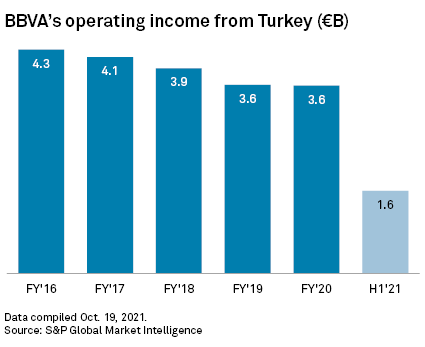

BBVA's operating income and pretax profits from Turkey have soared in lira terms since 2016, but the depreciation of the lira has meant that, in euro terms, they have fallen sharply. For 2020, operating income totaled €3.6 billion, down from €4.3 billion in 2016. For the first half of 2021, the figure was €1.6 billion.

"The underlying business is actually doing pretty well," said Nedialkov. "It's the [forex] translation that's impacting profits and book values."

Nedialkov estimates that for every 10% fall in the value of the lira against the euro, BBVA's shares "could fall theoretically by 2% to 2.5%." This impact may be affected by currency hedging and other factors.

Emerging markets

Turkey is BBVA's third-largest market by total assets after Spain and Mexico, and it contributed the second-largest share of pretax profits for the company in 2020 at more than 30%, Market Intelligence data shows.

"This is the nature of being an emerging markets bank," said Nedialkov. "Some of the emerging markets bets really work out well, others not as well."

BBVA's sale of its U.S. retail banking business for $11.6 billion in November 2020 boosted its capitalization, with its CET1 ratio rising to 14.37% in the second quarter from 12.15% at the end of 2020. The bank is using its improved position to undertake a share buyback of up to 10% of its outstanding capital, but it has entertained M&A since offloading the U.S. business, most notably when it entered talks to acquire Banco de Sabadell SA in the weeks after the sale.

BBVA should target the excess capital toward investments that could offset the volatility from its Turkish business, said Nedialkov.

"The best strategy would be to develop additional sources of profit, including domestically in Spain, to make up for the decline in Turkish profits in euro terms," Nedialkov said.

As a turnaround in the lira's fortunes grows increasingly unlikely, one positive for BBVA is that Garanti is self-funded, Ozsahin said. "Maybe the consolation ... is that at least they don't have to put in additional money. This could be a black hole."