Tribeca Global Natural Resources Ltd. says President Donald Trump's refusal to impose U.S. uranium production quotas has awoken institutional investors to uranium, thus removing the "handbrake" holding back investment in the sector for the past year.

Defying a U.S. Commerce Department Section 232 investigation finding that uranium imports threaten national security, Trump refused the recommendation to reserve 25% of its market for domestic producers.

Canaccord Genuity noted July 15 that the U.S. imports 93% of its commercial uranium, with Kazakhstan accounting for 40% of global production due its low-cost in situ leach recovery methods.

Guy Keller, Commodities Analyst at Tribeca Investment Partners Pty Ltd. which listed Tribeca Global Natural Resources on the ASX in October 2018, said his firm had come to know the Commerce Department's investigation as "the Section 232 handbrake" on uranium investment and contracting.

He said that since Trump's decision, Tribeca has received interest from new institutional investors outside of the Australia, Asia and North America-based high net worth investors which currently dominate its register.

"In both the physical market and in the equity space there are a bunch of other financial institutions who are not as specialized as we are in uranium that are looking to allocate some funds into the sector," he told S&P Global Market Intelligence.

Investment opportunities

Tribeca's fund has about 12 holdings listed across Australia, London, Canada and the U.S. with projects in various jurisdictions at different stages of development, including Yellow Cake PLC, which listed in July 2018.

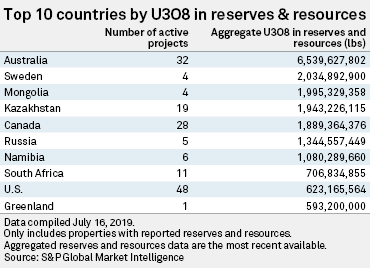

Keller said Trump's "very sensible" decision would give clarity to companies developing uranium projects globally, particularly in Australia, which S&P Global Market Intelligence data charted below shows has over three times more aggregated reserves and resources than any other country.

Trump's decision is a "massive positive" for one of Tribeca's substantial investments, Boss Resources Ltd., whose Honeymoon deposit in South Australia is well positioned to become the first Australian-based uranium project to come to market in years, Keller said.

Hailing Trump's decision in a July 15 statement, the Minerals Council of Australia acknowledged the Australian government's "strong advocacy" in Washington for the interests of the country's exporters.

Canaccord said a lifting of restrictions in the world’s largest market, the U.S., would be best captured by near-term developers like Hylea Metals Ltd. which is taking 85% in the fully permitted Kayelekera Malawi mine; Paladin Energy Ltd. which is working towards restarting the Namibian Langer Heinrich mine; and Vimy Resources Ltd.

Vimy, which is targeting the U.S. for its West Australian Mulga Rock project, has a full-time person in North America talking to the country's utilities.

CEO Mike Young said those utilities have devoted hundreds of man-hours from their relatively small fuel contracting departments to the government's probe into uranium imports, so Trump's decision not only frees up investment but also allows them to diversify supply from ex-USSR countries.

Young said U.S. utilities had told Vimy they were effectively "frozen" by Section 232, which "paralyzed the uranium market on the buyer side."

While the U.S. is commonly known to account for about 30% of global uranium consumption, Young said it's likely to be closer to 80% of the open market — and therefore most impacts the spot price — given the Chinese buy from Kazakhstan and French utility Electricité de France SA buys mainly from Orano SA.

"Now that the utilities know the lay of the land, we'd expect the utilities come back, not only into the spot market but the contract market. We've already seen a rally in the spot market since the decision," Young said.

The Tribeca fund's introductory shareholder letter upon listing noted that energy and nuclear power demand is growing, with reactor restarts being seen in Japan as well as new builds in China. This is reflected in 2017 International Atomic Energy Agency data, charted above, showing not only China's massive plans for nuclear generation, but how important the U.S. is at present and France as the second-largest consumer.

Keller said the working group Trump established will also benefit global uranium producers and utilities if it offers "sensible solutions about how to shore up the strength of the whole U.S. nuclear industry," which would be "long-term positive for everyone."