Shares of Chinese rare earth companies have surged after the country signaled it may use its dominance in rare earths — a strategic mineral used in goods from phones to guided missiles — as leverage in the ongoing trade war with the U.S., with analysts predicting that tensions are expected to continue to prop up both the price of such stocks as well as the underlying commodity.

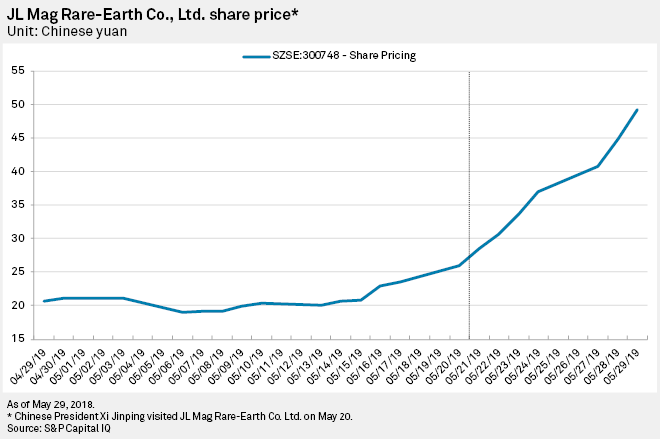

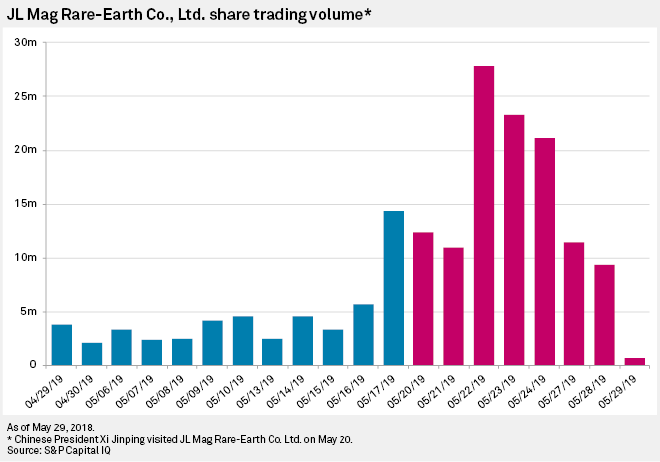

Magnetic materials producer JL Mag Rare-Earth Co. Ltd. saw its shares touch its trading ceiling eight times over 10 trading days after President Xi Jinping on May 20 visited one of its plants during a trip to the Chinese rare-earth producing Jiangxi province. Shares of JL Mag closed at 49.34 Chinese yuan apiece on May 29, a growth of 90% from 25.96 yuan of the day Xi visited the company.

On the same day, Xi at a rally called for the country to embark on a "new Long March", a reference to China's civil war in the 1930s. That was seen as a response to the latest round of U.S. tariffs on Chinese imports and a reiterating of its dominance in supplying rare earth minerals. China's state planning agency on May 28 said in a statement that it could restrict its exports of rare earth over the trade conflict and said "there is no winner in a trade war."

A gauge of 30 Chinese rare earth companies compiled by financial data provider East Money Information saw the total market cap of the index increase by 99.8 billion yuan over 14 trading days as of May 29. Shares of rare earth major China Minmetals Rare Earth Co. Ltd. increased by 20.2% to 17.38 yuan on May 29 from 14.46 yuan of May 20.

China accounted for 80% of the U.S. imports of rare-earth compounds and metals from 2014 to 2017, according to U.S. Geological Survey data. In 2018, China mined about 120,000 tonnes of rare earth elements, or about 71% of global output.

Helen Lau, a metals and mining analyst at Argonaut Securities, expects further upside potential for stocks in this sector on ongoing trade tensions. Lau added investor sentiment in the rare earths sector will continue if they believe trade tensions cannot be resolved in the near term. "China's repeated reiteration on its dominance in supplying rare earth is not without reason," Lau said.

Wu Xioafeng, a rare earths analyst with data provider Shanghai Metals Market, expects the upward trend of rare earth prices to remain but the growth will be slower as market speculation gradually tapers off.

"After China's consolidation of its rare earth sector, prices of the minerals have risen about 1.6 times of that in 2010 amid increased costs. The country-wide clampdowns on illegal rare earth mining activities have also pushed the price to such a high level that there's no space for a further significant increase," she added.

Wu said rare earth prices had already experienced an earlier surge after China banned rare earth imports from Myanmar and Xi's visit has further bolstered prices.

However, a Shanghai-based commodity analyst with a brokerage firm, who asked not to be named, cautioned that a bubble may be forming over rare earth stocks.

"Apart from speculation, I don't see any reason leading to the surge in share prices. The earnings of the rare earth majors are not strong enough to support their large market caps and their output tend to be suffering from poor conditions in their mining operations," the analyst said.

He also does not expect U.S. trade to be hurt significantly if China follows through on its threat on rare earths, as the former country is well prepared for a long-term standoff.

He noted that the U.S. imported a total of 1,000 tonnes of rare-earth metals, comprising mainly of scandium and yttrium, in 2018. This was a significant increase of more than 100% compared to the average level of the five years before that.

Lynas Corp. Ltd., the biggest rare earths producer outside of China, earlier signed a memorandum of understanding with U.S.-based Blue Line Corp. to form a joint venture to develop a rare earths separation facility in Hondo, Texas. Analysts see it as a move that the U.S. is trying to fill the absence of any rare earths separation capacity in North America. However, it is not expected to be able to feed the U.S. demand overnight and the country's smelting technology is less sophisticated than China's.

The Shanghai-based analyst noted it should not be a big issue for the U.S. to mine and smelt rare earths in the country, provided it loosens its environmental regulations. "China has advanced smelting technology, but that does not mean there's no other alternative for the U.S. The production of countries like Myanmar could help it meet demand."

As of May 30, US$1 was equivalent to 6.90 Chinese yuan.