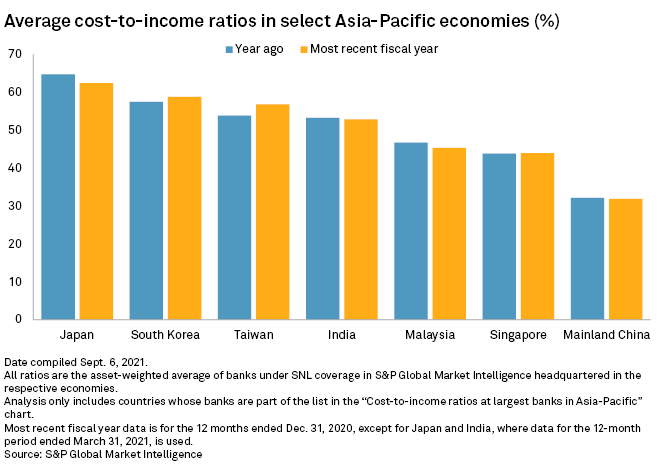

Major Japanese banks will need to consider expanding their income streams more aggressively, as years of cost cutting have yet to improve their efficiency to match their peers in the Asia-Pacific region.

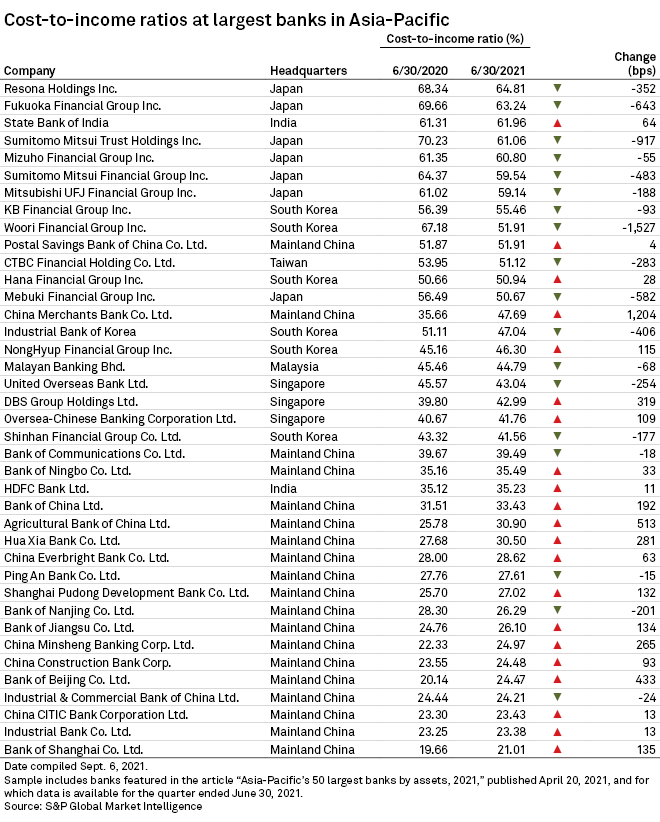

Among the 39 largest Asia-Pacific banks by assets, six of the 10 least efficient lenders were Japanese, despite significant year-over-year declines in their cost-to-income ratios for the quarter ended June 30, according to S&P Global Market Intelligence data.

The cost-to-income ratio, which measures the percentage of operating costs in relation to operating income, indicates the efficiency and productivity of banks. A lower ratio reflects higher efficiency, which could be a result of a fall in operating costs or a rise in operating income, or both, and vice versa.

The six Japanese banks posted declines in their cost-to-income ratios of between 55 basis points and 917 bps in the June quarter. Resona Holdings Inc., the least efficient Asia-Pacific bank on the list, reported a year-over-year decline in its cost-to-income ratio of 352 bps to 64.81%. Sumitomo Mitsui Trust Holdings Inc., the fourth least efficient lender in the region, scored the biggest improvement in efficiency, with its ratio dropping to 61.06% from 70.23%.

However, these improvements in efficiency still place Japanese banks behind lenders in other markets such as South Korea and Singapore. As of June 30, South Korea's KB Financial Group Inc. and Woori Financial Group Inc. had cost-to-income ratios of 55.46% and 51.91%, respectively, making them the eighth and ninth least efficient banks in Asia. Meanwhile, Singapore's DBS Group Holdings Ltd., which posted a 319 bps rise in its ratio to 42.99%, is the nineteenth least efficient bank in the region.

"Banks should fatten profits from advisory fees for M&A and from charges for loans to increase income," said Toyoki Sameshima, a senior analyst at SBI Securities Co. "In the end, they need to do both [cutting costs and increasing income]."

Cost-cutting and restructuring programs have failed to reduce the cost base of Japanese banks to levels that allow them to operate more efficiently amid weak domestic loan growth and ultra-low interest rates. Even in cost-driven mergers among smaller banks, lenders have been slow to close unprofitable branches or lay off staff, in part due to the cultural norm of lifetime employment.

"The question is whether they can speed up the pace of cutting costs. Japanese banks will not lay off their employees; they rely on attrition," said Sameshima.

Japanese banks have seen marginal growth in loan yields in recent years. For instance, Mitsubishi UFJ Financial Group Inc.'s domestic lending spread for large corporates stood at 0.45% in the quarter ended June 30, compared to 0.43% in the previous quarter and 0.41% in the prior-year period. At Mizuho Financial Group Inc., the spread between costs of deposits and returns on loans stood at 0.75% as of June 30, up from 0.74% at March 30, 2021, and 0.72% at the end of September 2020.

"I don't currently forecast expenses to decline over the long term for the Japanese major banks, although neither do I expect expenses to grow much at all," said Michael Makdad, an analyst at Morningstar.

Efficiency slips

Top Chinese lenders, on the other hand, scored some of the lowest cost-to-income ratios in the analysis, even though many of them reported higher ratios compared with the same period the prior year.

Efficiency declined the most at China Merchants Bank Co. Ltd., which has a cost-to-income ratio that increased by 1,204 bps to 47.69%. This is followed by a year-over-year rise of 513 bps at Agricultural Bank of China Ltd. and a 433 bps increase at Bank of Beijing Co. Ltd. The bank that improved the most in terms of efficiency was Bank of Nanjing Co. Ltd., which posted a 201 bps decline in its cost-to-income ratio to 26.29%.

"The increase of the cost-to-income ratio for Chinese banks is mainly driven by a slower increase of income amid the squeezed net interest margins in the past two to three years," said Mark Dong, Hong Kong-based co-founder of Minority Asset Management. "In the future, I think [the ratio] will be stabilized, though the increase of talent costs amid expansion in areas such as investment banking and wealth management may drive a slow increase of the ratio."

Five out of the six largest state-backed commercial banks in China reported year-over-year declines in net interest margins in the quarter ended June 30. Margins will remain under pressure in the coming quarters due to a softening outlook on the world's second-largest economy.

IT spending

Ongoing efforts to digitalize operations to counter the rise of financial technology platforms have increased Chinese banks' spending on technology, which analysts say also explains the expansion of the lenders' cost base.

Iris Tan, an equity analyst at Morningstar, said Chinese banks' expenses on fintech research and development have grown by more than 30% over the past few years, although the resulting cost savings could improve their efficiency in the long run.

"As traditional banks typically operate nationwide with a huge offline distribution network and intensive labor, the rapid digitalization helped improve operating efficiency via streamlining distribution networks and optimizing the cost structure of these offline branches," said Tan.

Dong said automation will likely reduce head counts for Chinese banks, which will in turn improve efficiency. "For Chinese banks, the biggest costs are still property and talent," Dong added.