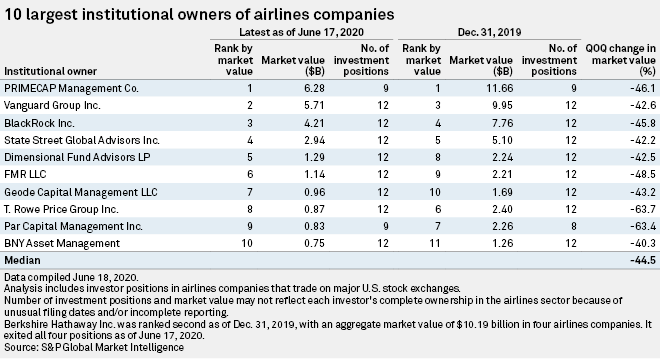

Some of the biggest institutional investors in the U.S. airline sector slashed their holdings as the travel industry's share prices and outlook crashed amid the coronavirus pandemic, according to an analysis by S&P Global Market Intelligence.

The most notable investor activity was by Berkshire Hathaway Inc., which exited its positions in the four largest airlines: American Airlines Group Inc., Delta Air Lines Inc., Southwest Airlines Co. and United Airlines Holdings Inc. Berkshire was the second-biggest holder of public companies in the airline sector at the end of 2019, with $10.19 billion in holdings.

"We took money out of the business, basically even at a substantial loss. And we will not fund a company ... where we think that it's going to chew up money in the future," Berkshire Chairman, President and CEO Warren Buffett said during the company's annual shareholder meeting in May, citing doubts on airline traffic over the next two to three years.

The International Air Transport Association said June 9 that the global airline industry is headed for a collective net loss of $84.3 billion in 2020, its worst year ever as the coronavirus pandemic wipes out passenger demand. The industry group warned that airlines also face a "financially fragile" 2021 and that their recovery would be "long and challenging" amid elevated debt levels, changing travel patterns and a global recession. The Dow Jones U.S. Airlines Index has lost nearly half its value since the end of 2019.

PRIMECAP Management Co., the leading institutional owner of airline companies at the end of 2019 in terms of market value, reduced its combined public holdings in 12 airlines to roughly 223.2 million shares as of June 17 from about 236 million shares as of Dec. 31, 2019, according to regulatory filings. It divested nearly 4 million shares each of American and Southwest, to 15.25% and 11.52%, respectively, of common shares outstanding, and 2.8 million shares of United, to 11.83% of common shares outstanding.

BlackRock Inc. cut its combined holdings in 12 airlines to 151.2 million shares from 155.9 million shares at the end of 2019, having sold off 2 million shares of Delta to 5.06% of common shares outstanding and 1 million shares of Southwest to 4.2% of common shares outstanding.

State Street Global Advisors Inc.'s combined equity holdings in 12 airlines fell to 95.8 million shares as of June 17 from 96.8 million shares at the end of 2019. It sold off 624,410 shares of Delta and 577,981 shares of American to keep a 3% stake in each company.

T. Rowe Price Group Inc.'s combined public holdings in 12 airlines dropped to about 24.5 million shares from roughly 35.5 million shares. It unloaded about 5.7 million shares of United to 2.35% of outstanding common shares and 2.4 million shares of Southwest to 0.77% of outstanding common shares. It also reduced its stake in Delta and American to about 0.2% each, dumping 2.1 million shares and 557,839 shares, respectively.

Par Capital Management Inc. slashed its combined holdings in eight airlines to 25 million shares from 35.8 million shares at end-2019. It divested about 6.2 million shares of United to 2.71% of outstanding common shares and 2.4 million shares of American to 0.27% of outstanding common shares. Conversely, it acquired 31,000 shares of Southwest to increase its investment positions to nine airline companies.

FMR LLC's combined holdings in 12 airlines declined to 48.5 million shares from 54.6 million shares, shedding about 11.7 million shares of American to 0.09% of outstanding common shares and 982,833 shares of United to 0.51% of outstanding common shares. However, FMR acquired about 2.6 million shares of Delta and 1.2 million shares of Southwest, raising its stakes in the companies to 1.27% and 1.03%, respectively.

Other notable activities include the exits of Harris Associates LP and Lansdowne Partners Ltd. in American, divesting 16.9 million shares and 6.5 million shares, respectively. Goldman Sachs Group Inc. also unloaded about 6.9 million shares of American, cutting its stake to 0.53%.

Artisan Partners LP and Arthur J. Gallagher & Co. made the largest purchases, acquiring about 10.8 million shares of Southwest and 8 million shares of Delta, respectively. Parnassus Investments also bought 5.3 million shares of Southwest.