Medical and rubber glove manufacturer Top Glove Corporation Bhd. reported revenue for the fiscal second quarter ended Feb. 29 that increased 6% year over year, with sales of nitrile medical gloves 14% higher. The latter likely reflects buying from China connected to the coronavirus outbreak. The company said the wave of sales orders early in the crisis came from China, Singapore and South Korea, but has since spread to include Europe and the U.S., which has "seen the group's sales order book double."

A central challenge for the company will be meeting demand. It has said "with current utilization levels above 90%, Top Glove is able to further ramp up production close to 100%, to meet the surge in demand." It has outlined plans to add 11.2% to its capacity in 2020 and a further 12.9% in 2021.

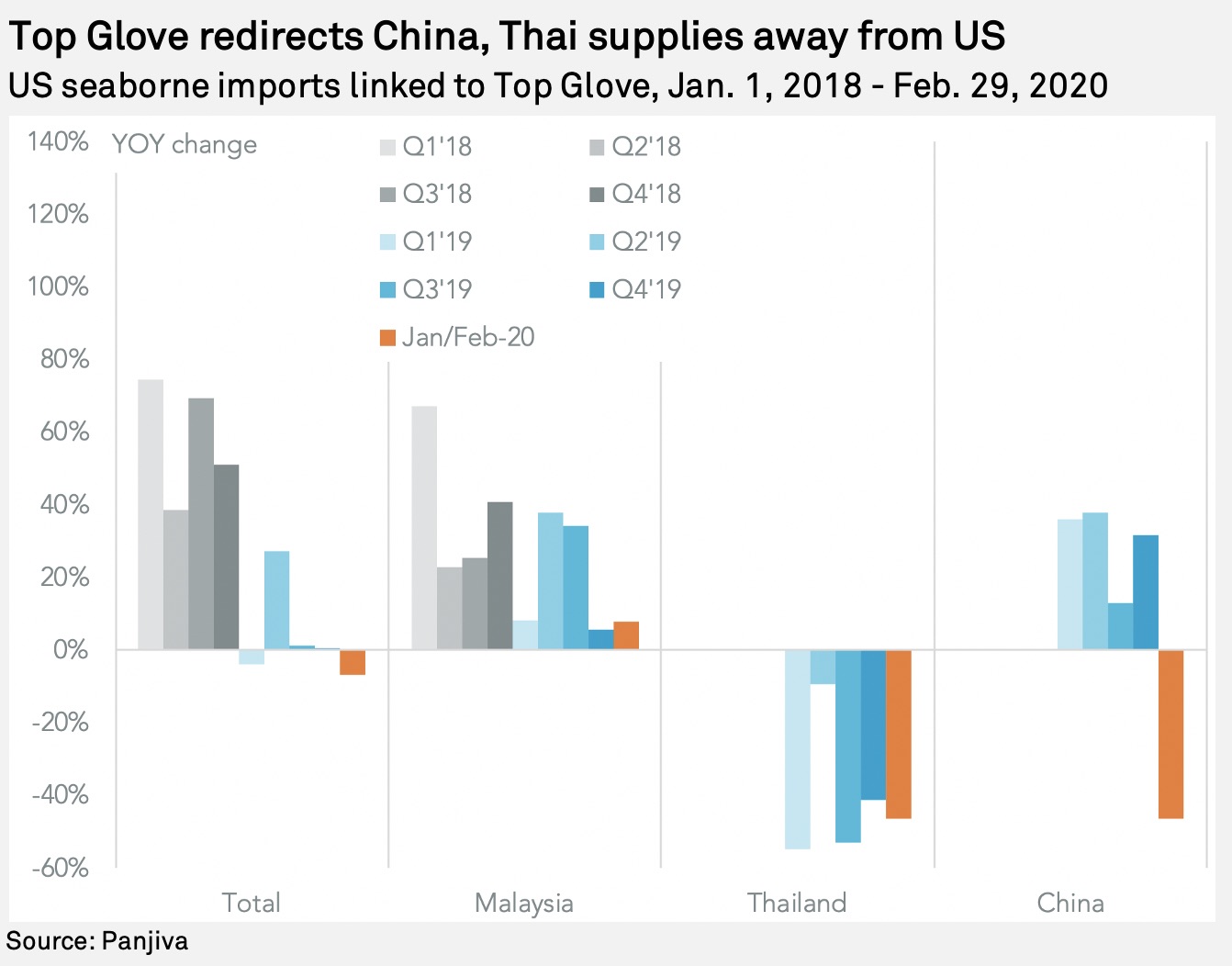

Top Glove's sales in the U.S. have likely stagnated ahead of the coronavirus crisis. Panjiva data shows that U.S. seaborne imports linked to Top Glove dropped 6.7% year over year in the first two months of the year — likely as production was shifted to supply Asian markets. Imports from Malaysia, the largest source for shipments linked to Top Glove with 72.8% of the total in the past 12 months, rose by 7.9%, while those from Thailand and China fell by 46.3% and 46.5%, respectively.

|

Malaysia represented 50.3% of U.S. imports of rubber and nitrile gloves in 2019. So far the Malaysian government has already banned the export of medical masks, The Malay Mail reports. That follows bans on exports of medical supplies from several other countries as outlined in Panjiva's research of March 16. While a ban on glove exports cannot be ruled out, at $4.11 billion the segment represented 1.8% of all Malaysian exports in 2018 and so may be too important economically to block.

Total U.S. seaborne imports of rubber gloves already fell by 5.6% year over year in the first two months of 2020. Aside from Top Glove, there was also a 36.9% slide in shipments linked to Kossan Rubber Industries Bhd. That has led major importers including Owens & Minor Inc. to redirect orders to other suppliers including Hartalega Holdings Bhd. The former increased its U.S. imports 242.7% year over year in January and February combined.

|

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.