Underwriting IPOs for small and medium-sized enterprises in China is set to become more competitive as Beijing pushes small companies to go public while increasing restrictions on listings for tech behemoths.

Top investment banks and brokerages in China, which have been focusing on big-ticket IPOs due to lucrative fees and strong business relationships, are set to expand into the SME space more aggressively as the Beijing Stock Exchange — a new trading venue only for small businesses — will soon come online, analysts say.

The nation's tightening scrutiny of the technology and real estate sectors, which have been the biggest sources of IPO issuers in recent years, is also forcing underwriters to diversify into other market segments more quickly, analysts add.

"[The Beijing Stock Exchange] brings a more flexible listing mechanism for small and medium-sized enterprises. [These companies] will focus on the capital market to find financing opportunities, and this will become the mainstream," said Cody Leung, executive director of China Industrial Securities International's wealth management unit.

China's onshore IPO market has been growing rapidly in recent years, largely driven by mega offerings. Thanks to large IPOs such as China Three Gorges Renewables (Group) Co. Ltd. and China Telecom Corp. Ltd., the Shanghai Stock Exchange was the third-largest listing destination in the world for the first three quarters of 2021, after the NYSE and the Nasdaq.

SME needs

China had more than 4 million SMEs with fewer than 500 employees in 2020, which accounted for more than 60% of the country's economic output, according to an April report by U.S. research firm IDC. Widening access to the capital market for SMEs is China's latest effort to support small businesses, which have been hard hit by the coronavirus pandemic and ongoing trade tensions with the U.S.

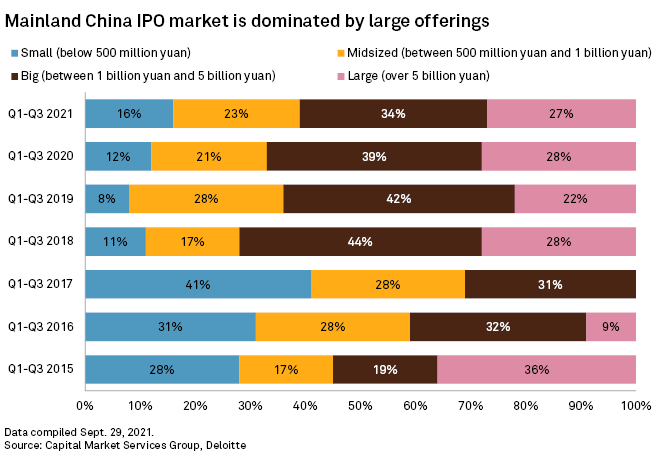

During the first nine months this year, 39% of funds raised on the Shanghai and Shenzhen stock exchanges came from IPOs that were smaller than 1 billion yuan, compared to 33% for the same period in 2020, according to a September report by advisory Deloitte. During the 2021 period, both bourses hosted 373 IPOs that raised a combined 370.4 billion yuan, compared to 294 offerings that raised 355.7 billion yuan a year ago, the report said.

He said even the major brokers, which used to mainly pursue mega IPOs, will become more aggressive in securing underwriting deals for smaller companies.

"It is echoing policy directions and the rising need to transform investment banking business to cater for new economy sectors that require [financing]," Chen added.

Shanghai-based Guotai Junan Securities Co. Ltd., one of the largest brokers in China, for example, said it will continue advising more small enterprises in the future, especially with the establishment of the Beijing Stock Exchange.

"We will catch the opportunity of the reform. The Beijing Stock Exchange will give new opportunities to security brokers' investment banking, trading and other businesses," Guotai Junan said in its response to S&P Global Market Intelligence.

Comparative advantages

Apart from the policy push, Chen said focusing more on SMEs is also "strategic" for brokers, especially for the smaller players.

"China's large-cap space is probably too competitive. The country has more than 135 brokers, and it's tough for them to go after the same targets. The pipeline for brokers outside of the top 30 on the list is already not strong enough, and it makes sense for them to go after SMEs," Chen added.

In 2020, the top five brokers in China bagged about 45.2% of underwriting fees in the IPO market, compared to 29.1% in 2015, according to Chen, who added that it is even more crucial for smaller brokers to look into opportunities in the SME field.

China's Ministry of Industry and Information Technology has identified 2,930 innovative SMEs since 2019, so-called "little giant companies," most of which are in technology and manufacturing. As of early August, more than 300 of these companies were listed in China's A-shares.

Bruce Pang, Hong Kong-based head of macro and strategy research at China Renaissance, sees that as an opportunity for brokers and said smaller brokers have an edge in advising these companies.

"[Smaller brokers'] business operations are with more flexibilities, specialties and determination for the blue ocean market," Pang said. Hence, he added that compared to top-tier brokers who have been focusing more on mega IPOs, smaller brokers have been spending more time advising SMEs.

"This gives them an advantage in finding the targets, providing continuous advisory services and building up pipelines," he said.

Tightening grip

Apart from regulators' push to support SMEs, China's tightening regulations on mega IPOs are also driving brokers to consider smaller listings.

The IPO of Alibaba Group Holding Ltd.'s financial technology arm Ant Group Co. Ltd. in Shanghai and Hong Kong, for example, was suspended less than two days before the slated debut. New data security rules also came out in August, days after ride-hailing company DiDi Global Inc.'s app was taken down from the app store following its listing in the U.S.

According to the new data security rules, Chinese companies owning a large amount of data will need to go through a security review before going public overseas.

Earlier in April, China banned companies whose main business is financial activities or property investment from listing on the Nasdaq-style Star Market. The secondary board of Shanghai Stock Exchange was a key destination of tech IPOs.

"The pipeline for mega IPOs is running short. So, the next phase [for brokers] is to identify companies with strong research and development capacity, key technologies and specialties in niche markets, many of which are SMEs," said Pang.

As of Sept. 29, US$1 was equivalent to 6.47 Chinese yuan.