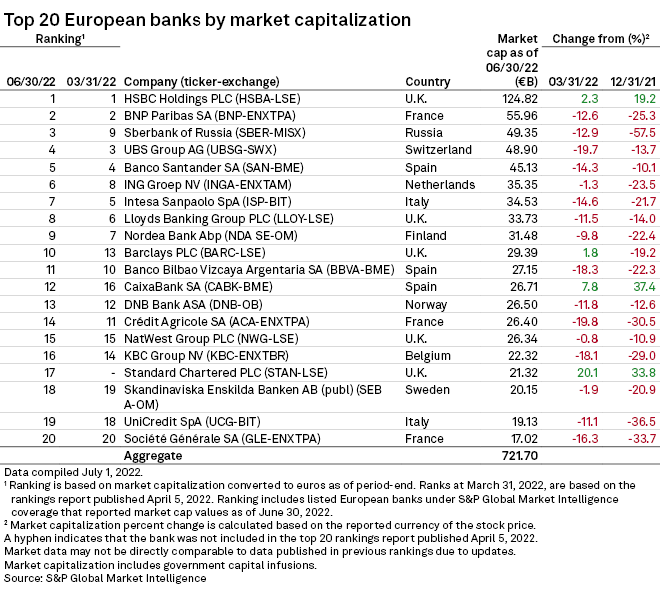

The market value of Spain's CaixaBank SA increased more than any other large European bank in the first half, a rare bright spot in a period marked by mounting recession fears amid Russia's invasion of Ukraine.

|

CaixaBank's market capitalization rose by 37.4% to €26.71 billion at the end of June from the end of December 2021, making it the 12th-most-valuable bank in Europe, according to S&P Global Market Intelligence data. It stands to generate more revenues amid rising interest rates due to its loan book composition, and it recently set out new ambitious profitability targets.

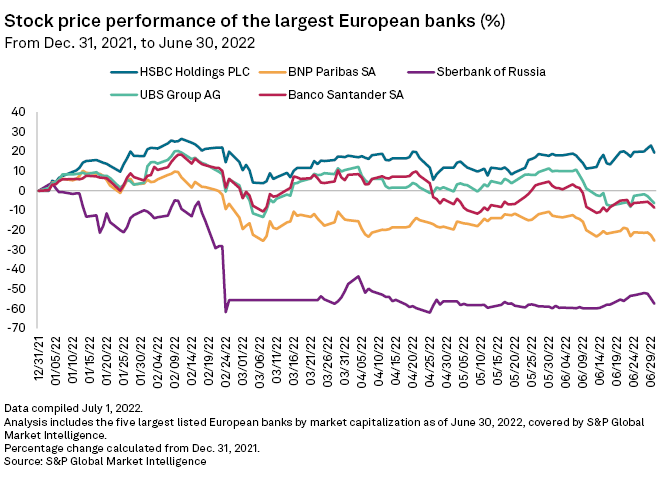

Standard Chartered PLC registered the second-biggest increase in market cap, followed by fellow U.K.-based bank HSBC Holdings PLC, which has the largest overall market cap. Both have a big presence in Asia and are somewhat insulated from the direct fallout of the Russia-Ukraine war. HSBC CFO Ewen Stevenson told Bloomberg TV in February that the bank's "very small business" in Russia presents a "very, very modest" overall exposure, while StanChart has no operations in either country, a spokesperson told Market Intelligence in April.

Against a backdrop of economic uncertainty, the two banks have set out share buyback and capital distribution plans for 2022. StanChart's planned $750 million repurchase plan was on the back of strong first-quarter results and a positive income growth outlook, while HSBC's $1 billion program came alongside lower quarterly profits affected by credit loss provisions relating to China and Russia.

In the red

All other banks in the sample suffered market cap declines in the first six months of the year. Sberbank of Russia, whose operations have collapsed under the weight of crushing sanctions, saw its market cap fall by more than half.

* Access financial highlights for CaixaBank on the CapIQPro platform.

* Access indexes including regional bank indexes on the CapIQPro platform.

Banks with significant exposure to Russia were also affected. Italy's UniCredit SpA, which is reportedly struggling to sell its Russian unit, and France's Société Générale SA and Crédit Agricole SA all suffered a drop of more than 30%. SocGen sold its Russian unit at a loss of roughly €3.1 billion, while Crédit Agricole set aside €584 million in provisions against Russia and Ukraine in the first quarter.