S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

A consensus outlook on 2025 dealmaking emerged from the latest round of earnings calls by the four largest publicly traded private equity firms: private equity-backed transaction activity, including exits, is likely to shift higher next year.

The sentiment expressed on the calls was slightly more positive when compared with the average of companies on the S&P 500, according to an S&P Global Market Intelligence analysis of the words and complexity of language employed by executives and analysts.

Blackstone Inc. CEO Stephen Schwarzman said interest rate cuts had reduced the cost of capital and "would [catalyze] transaction activity," a prediction echoed by The Carlyle Group Inc. CEO Harvey Schwartz. KKR & Co. Inc. CFO Robert Lewin said the firm was already seeing more opportunities to monetize investments.

Look closer and that rosy outlook may be tinged with just a hint of anxiety. Investors are putting more and more pressure on private equity fund managers to shrink "bloated" portfolios, exit long-held investments and return cash to investors, Apollo Global Management Inc. Director Scott Kleinman said at a September conference.

"These sponsors need to find ways to monetize," Kleinman said.

Read more about the third-quarter performance of private equity's Big Four firms.

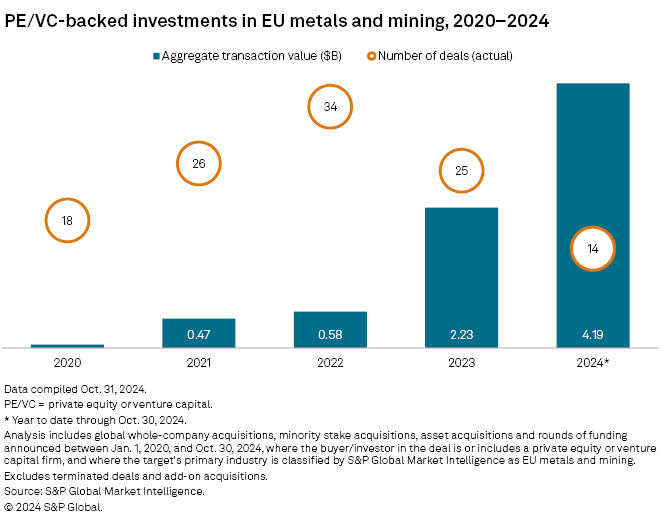

CHART OF THE WEEK: Private equity investment in EU's mining sector soars

⮞ Soaring private equity- and venture capital-backed investments in the EU's metals and mining sector came to $4.19 billion this year as of Oct. 30, far surpassing the $2.23 billion total for full year 2023, according to Market Intelligence data.

⮞ One megadeal is responsible for most of the increase: a $4.1 billion round of funding for Swedish steel producer H2GS AB, also known as Stegra.

⮞ Incentives from the EU's Critical Raw Materials Act, which aims to limit the bloc's reliance on imports from China, are also drawing more investment.

TOP DEALS AND FUNDRAISING

– Funds associated with Apollo Global Management Inc.'s impact and clean transition strategies bought a majority stake in electrical, mechanical, robotics and automation services provider The State Group Inc. from Blue Wolf Capital Partners LLC. Blue Wolf will continue to own a minority stake following the deal.

– Frazier Healthcare Partners raised $2.3 billion at the close of Frazier Healthcare Growth Buyout Fund XI LP. The vehicle focuses on acquiring controlling stakes in middle-market healthcare companies.

– Neos Partners LP secured $1.37 billion in commitments at the close of its Neos Partners II LP fund. The vehicle will invest in North America's energy transition and critical infrastructure sectors. The firm also raised $350 million for a coinvestment vehicle.

– Deutsche Beteiligungs AG secured approximately €250 million in commitments at the final close of its DBAG ECF IV fund. The vehicle seeks to make controlling investments in family-owned small and medium companies.

MIDDLE-MARKET HIGHLIGHTS

– Morgan Stanley Investment Management Inc.'s Morgan Stanley Capital Partners acquired pet and human nutritional supplements maker Foodscience Corp. The seller was Wind Point Partners.

– Charlesbank Capital Partners LLC made a strategic investment in economic impact data and analytical software company Implan Group LLC. Boathouse Capital will exit the business as part of the transaction.

– Odyssey Investment Partners LLC sold electrical and heating, ventilation and air conditioning products company NSI Industries LLC. Sentinel Capital Partners LLC was the buyer.

FOCUS ON: APPLICATION SOFTWARE

– An investor group including PSG Equity LLC and Golub Capital LLC invested $800 million of new equity and strategic financing in LogicMonitor Inc., a software-as-a-service company. Following the investment, Vista Equity Partners Management LLC will continue as the controlling shareholder in the company.

– 65 Equity Partners Holdings Pte. Ltd. agreed to buy a 13% stake in cloud platform service provider Tuya Inc. from New Enterprise Associates Inc.

– Customer service and sales platform Cresta Intelligence Inc. secured investment from Accenture Ventures Ltd.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter