Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Mar, 2021

By Garrett Hering and Justin Horwath

|

U.S. and Texas flags in front of high-voltage transmission lines in Houston, Texas, days after a powerful winter storm knocked out power for millions of residents. |

The intensifying debate over whether to reprice certain sky-high power transactions during the arctic blast that left millions of Texans without power for days and nearly took down its entire electric grid erupted March 11 into a fierce showdown in the state Capitol.

During a heated hearing in the state Senate, Republican Lt. Gov. Dan Patrick grilled Public Utility Commission of Texas Chair Arthur D'Andrea over why the commission's sole remaining member has yet to order the state's embattled wholesale grid operator to fix a "$16 billion error" in real-time pricing that occurred during the storm. Patrick had called for the move days earlier, citing a market monitor report.

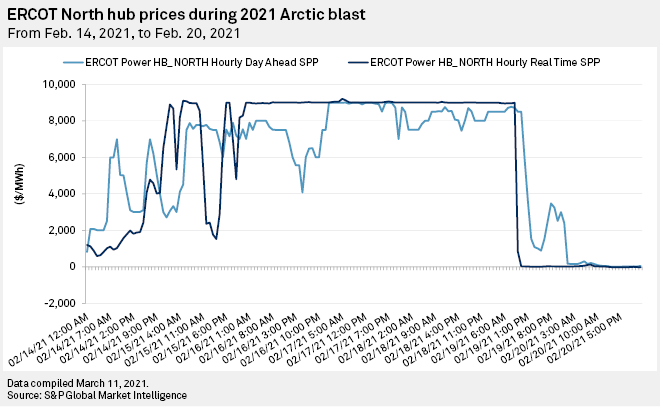

"So why didn't you let the market be the market instead of pushing [prices to $9,000/MWh]?" asked Patrick, pressing D'Andrea to order repricing of the allegedly excessive transactions beginning late on Feb. 17, three days after the arctic blast swept across the state.

"Because the market was killing people," D'Andrea replied, saying he lost faith in its design. More than 50 people died because of the blackouts, according to lawmakers.

Some market participants fear a prolonged period of chaos, litigation and the collapse of Texas' vaunted competitive electricity market could ensue unless Texas energy officials, regulators and politicians soon find common ground on a suite of solutions. That includes finding an effective answer to the question of repricing, overhauling wholesale grid operator Electric Reliability Council Of Texas Inc., providing ratepayer relief and enacting other sweeping reforms that Gov. Greg Abbott promised through emergency legislation.

"The longer we wait, the more complicated it gets," Carrie Bivens, a vice president at Potomac Economics Ltd., ERCOT's independent market monitor, said in testimony urging lawmakers to act on flawed storm pricing the monitor flagged days earlier. Bivens also warned of the possibility of "cascading bankruptcies."

In a March 11 letter to D'Andrea, Bivens and Potomac President David Patton reiterated the monitor's finding that the grid operator failed to follow a Feb. 15 PUCT directive by holding prices at the escalated level of $9,000/MWh for 32 hours after ERCOT ceased ordering load shedding. That caused $16 billion in "over-priced energy" in the real-time market, the Potomac executives said.

But correcting the mistake would result in a "settlement effect" of only about $3.2 billion, they clarified. "Correcting this error will not reduce costs to consumers by $16 billion because a substantial share of the demand is served by owned generation or forward contracts," they said.

Including its proposed repricing of ancillary services transactions, the monitor's recommendations would alter ERCOT settlements by $5.1 billion, they added. Repricing would help public power entities to the tune of $1 billion, according to Bivens.

Fears of 'irreparable harm'

Meanwhile, market participants are substantially divided over repricing the real-time market, based largely on their own financial performance during the storm.

Hard-hit competitive retail electric providers and cooperatives have issued urgent pleas for immediate implementation of Potomac's proposals. The action is necessary to prevent "irreparable harm to the competitive retail market," a coalition of retail electric companies said in a March 4 filing to the PUCT. Shortly thereafter, on March 9, the largest independent retailer in the state, Just Energy Group Inc., filed for bankruptcy protection in Canada and the United States and secured debtor-in-possession financing allowing it to pay $250 million in ERCOT invoices to avoid being removed from its markets.

Several others have been removed for failure to make payments, including Entrust Energy Inc. and Griddy Energy LLC. ERCOT initiated a "mass transition" of their customers to larger suppliers. The state of Texas is also suing Griddy for false advertising and failure to fully disclose the risks associated with its business model, under which it passes through wholesale prices directly to customers, whose bills skyrocketed during the crisis.

Brazos Electric Power Cooperative Inc., which filed for Chapter 11 bankruptcy protection March 1, owing ERCOT over $1.8 billion, and Rayburn Country Electric Cooperative Inc., which is $570 million short on invoice payments, argued in separate March 11 filings to the PUCT that ERCOT's failure to end its pricing intervention when load shed stopped was an "artificial financial penalty" for acting quickly to restore power.

Electric retailers and cooperatives had amassed cumulative outstanding payments to ERCOT of roughly $3.1 billion, the grid operator said in a March 11 notice.

Vistra Corp., the state's largest owner of power generation, as well as parent of retail supplier TXU Energy Retail Co. LLC, agreed that ERCOT made a mistake and that repricing should occur across day-ahead, real-time and ancillary services markets. While Vistra prefers a comprehensive stakeholder process to consider repricing "holistically," it also sees a need for generators to be compensated for fuel purchases, it said in a March 5 regulatory filing.

NRG Energy Inc., another major owner of gas and retail businesses in Texas, in a March 10 filing said it supports solutions to address financial burdens on some market players. But the company expressed deep concerns that repricing would cause "long-term harm" and set "a bad precedent that encourages participants to challenge future market outcomes when they do not like the resulting prices."

The City of Austin, which operates municipal utility Austin Energy, and generation owner Calpine Corp. were among those outright opposed to repricing of real-time transactions, arguing that ERCOT acted in accordance with the PUCT order. Calpine and NRG raised the specter of lawsuits if repricing were to occur.

'You can act; I'm a bureaucrat'

As the all-day hearings in the Texas Senate and House made clear, there is significant confusion over the resettlement process, including who even has the authority to order the repricing of market transactions.

Lawmakers expressed concerns about a market rule that allows the resettlement of prices only within a 30-day window of the transaction if the grid operator determines a mistake was made, while D'Andrea said it would be illegal for him to order repricing because, he maintained, commissioners made no mistake in sending prices to the cap.

Patrick disagreed with the regulator, saying D'Andrea told him on the phone on Feb. 16 that sending prices to the cap was a "mistake" — a claim D'Andrea denied.

"You can act; I'm a bureaucrat," D'Andrea said. "You get all sorts of things done that I can't do."

According to D'Andrea, outgoing ERCOT President and CEO Bill Magness convinced him to keep prices at the cap because he was worried industrial users would reconnect to the grid if prices came down, potentially causing more blackouts.

In an earlier testimony to the Senate, Magness said he was more worried about protecting human health and safety than the potential financial fallout.

"As we transitioned out of [load shedding], we did not want to get back into the danger zone" by lowering prices, he said.