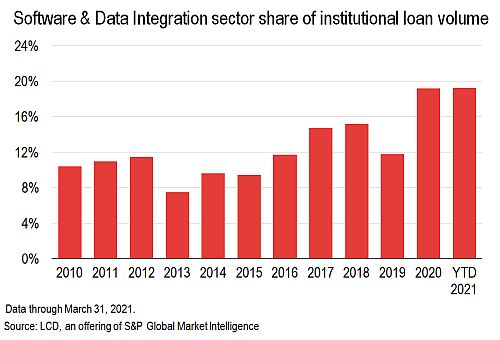

Software and data integration companies are making up a growing share of the U.S. leveraged loan market, a trend that showed no sign of slowing in the first quarter.

During the first three months of the year the share of institutional loans to software and data companies was 19% of the record-setting first-quarter new-issue volume of $181 billion, according to LCD. That level is a record high, in line with all of 2020, and has increased from 12% in 2019.

Request a demo of LCD to see more of the top leveraged finance stories

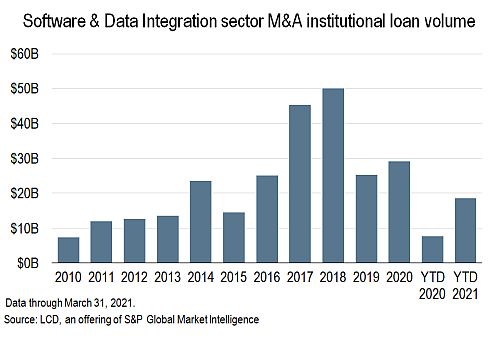

Request DemoMuch of this loan issuance is due to buyouts. The volume of software and data integration loans backing M&A transactions more than doubled in the first quarter, versus the first quarter in 2020, when the start of the COVID-19 pandemic froze credit markets.

The chase for buyout targets has continued in the second quarter. So far, April is the busiest month for LBOs since September 2018, LCD data shows. As of April 21, LBO-related institutional loan volume was at $17.8 billion, versus a $12.3 billion monthly average in the first quarter and a $10 billion average in the six months between October and March.

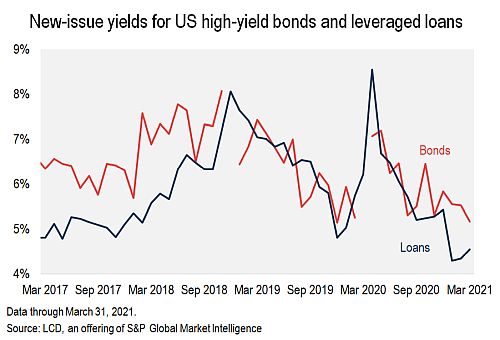

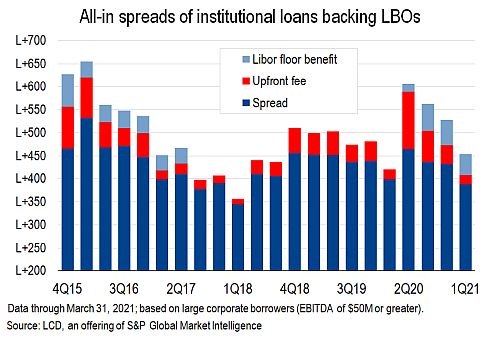

Spectacular competition for tech investments has driven purchase prices higher, and spreads on debt financing lower. Credit spreads at the end of the March were are at or near record lows for loans and high yield bonds (they've increased this month, in the loan market).

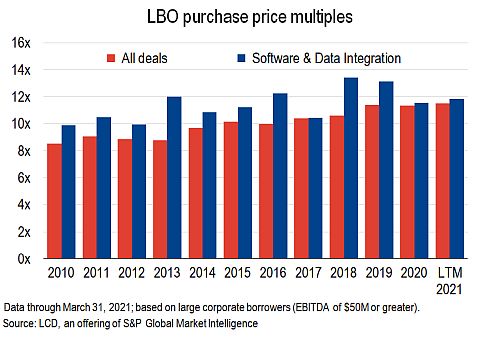

At 11.8x, purchase price multiples on software and data integration LBOs have exceeded 2020 levels on an LTM basis as of March 31, LCD data shows. This is also higher than the 11.5x average for all buyouts launched since the onset of the COVID-19 pandemic.

Purchase price multiples for LBOs in tech are a pointed example of an overall trend in the loan market. The average LBO purchase price multiple hit a high of 12.3x for buyouts launched in the six months through March 31.

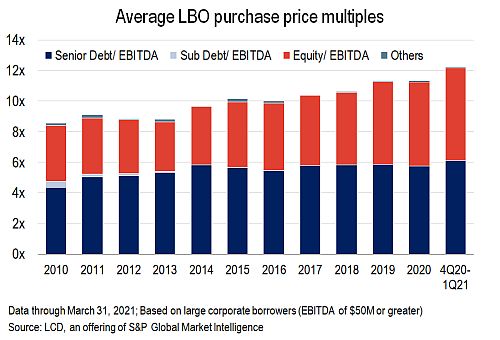

Leverage levels rose too, as private equity sponsors used more debt to finance these deals. LCD data shows software and data integration LBOs have record high leverage, at 6.5x on average, over the last 12 months, higher than LBOs generally, at 6x.

Tech buyouts have help lift the overall volume of U.S. leveraged loan LBOs to a record. With tech buyouts accounting for a significant part of the loan market, leverage on all deals on an LTM 2021 basis is at a high, exceeding 2019 levels.

Paying the bills

In remarks at a conference last year, Orlando Bravo, co-founder of tech-focused private equity firm Thoma Bravo, confirmed what everyone likes these days about software investments.

"The recurring revenue stream was nearly untouched in the pandemic. Corporate customers paid their subscription software revenue, but they didn't pay rent. It was more stable than real estate," Bravo said at an event in September 2020. "When you're so embedded in your customers, software has become their business. You cannot transact, analyze information, communicate, market to your customers without these core uses of technology."

This prioritizing of tech expenses has not gone unnoticed by credit investors. Lenders have been eager to provide credit to software providers, IT management and other technology companies at terms comparable to those before the COVID-19 pandemic, market sources say.

Pricing on software contracts and managed IT services, such as those allowing employees to log into corporate networks and work remotely, regularly run for three years, and typically contain built-in annual pricing increases. Switching costs on software systems are usually onerous, resulting in a sticky customer base.

These features give lenders to these companies sought-after visibility on revenue and free cash flow for debt payments.

In love with tech

A perception that revenue streams of software companies are "safe," even during a global pandemic, has fueled a frenzied pursuit of tech investment in the past six to nine months, market sources say.

This updated thinking by investors since the pandemic has drawn new participants to the sector, a trend that has supported higher valuations. Some newcomers lack experience in tech investing.

In another trend in the COVID-19 era, "private equity firms, in an effort to provide greater certainty to sellers and meet tight timeframes, are increasingly willing to provide full equity commitments for the entire purchase price prior to arranging financing," said Gary Creem, part of Proskauer's private credit and finance groups.

This has been happening with greater frequency over the past six to nine months, taking advantage of the competitive market. In all likelihood, firms are keeping negotiations going with four to five lenders during this window, rather than having pre-arranged financing as they may have in the past.

Private equity sponsors are deploying a familiar buy-and-build strategy on these investments, bundling similar or complementary technologies together and hoping to attract a buyer of the new, larger companies.

"Many of the private equity firms know they're going to be combining businesses before they even buy them," said Benjamin Rubin of Proskauer Rose's private credit group. "We're seeing high levels of competition, both between the PE firms in the buyout market, and lenders for the debt financing. Deal structures have evolved to reflect that."

For example, covenants governing incurrence of incremental indebtedness and interest coverage tests have become more sponsor-friendly. They sometimes allow leverage levels to exceed closing-date levels with incremental debt, in some cases, according to market sources.

In some cases, the sponsor has the ability to reallocate the general debt basket to the "free and clear" component of the incremental, which would allow for increased capacity for pari senior secured debt.

While some aspects of documentation terms are loosening, other features are stricter or more specific. Language surrounding delayed draw term loans, which are commonly used to execute acquisition strategies, is more targeted for an allowed asset purchase. DDTLs put in place prior to the COVID-19 outbreak may have had more general language allowing borrowings for purposes, such as working capital, sources say. This trend has reversed a bit from the extremes of last year, when lenders were more cautious, however.

The tighter language is a way to protect lenders, who say drawing on a DDTL to build up cash for general use isn't what they were meant for.

In another difference, compared to before the pandemic, change of control provisions now regularly recognize the prevalence of SPACs as a way an IPO could occur, possibly triggering loan repayment. Tech deals account for a significant share of capital raising by SPAC transactions, which set a record year-to-date in 2021.

Private credit, too

It's not only the syndicated loan market that's interested in software deals. Private credit providers say they can offer greater flexibility in deal terms and documentation versus debt financing syndicated with a large lender group.

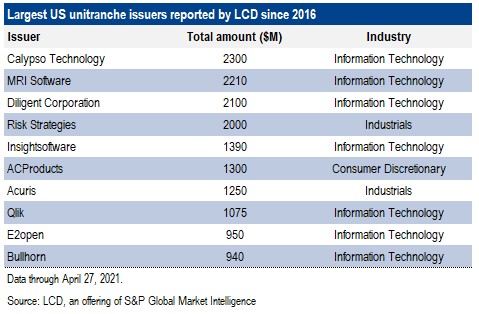

In a sign of the strength of firepower that private credit providers are willing to deploy to tech, a rough analysis shows the largest unitranche loans as tracked by LCD show a significant proportion was to tech companies.

Private credit providers have even been willing to provide loans based on recurring revenue, to borrowers that generate low or negative EBITDA. These are typically given to companies in development or growth phases. LCD doesn’t track these loans, however.