Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Feb, 2021

By RJ Dumaual and Jason Woleben

Oscar Health has drawn strong funding support from private investors and will now look to garner similar support in public markets in an upcoming IPO.

The tech-minded health insurer secured $140 million in new funding in December 2020 and has raised about $1.6 billion from private sources, "making it one of the health insurance unicorns that raised the most from private sector," IPOX Schuster LLC analyst Kat Liu said in an email to S&P Global Market Intelligence.

"It's an ambitious offering for a healthcare company of its profile, but not for an up and coming technology company," Avalere Health LLC founder Dan Mendelson said in an email. He expects Americans to become increasingly willing to use telehealth and believes the Biden administration's bid to "expand the affordability and availability of insurance" will help Oscar Health.

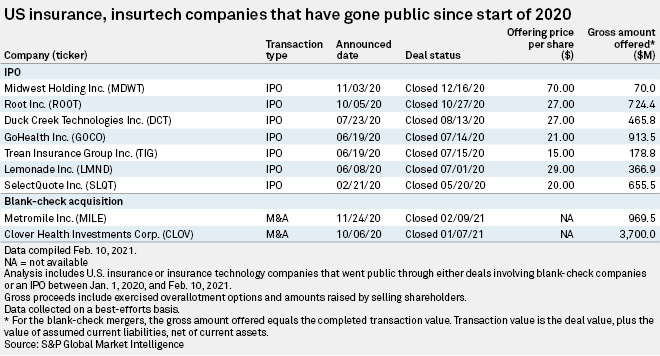

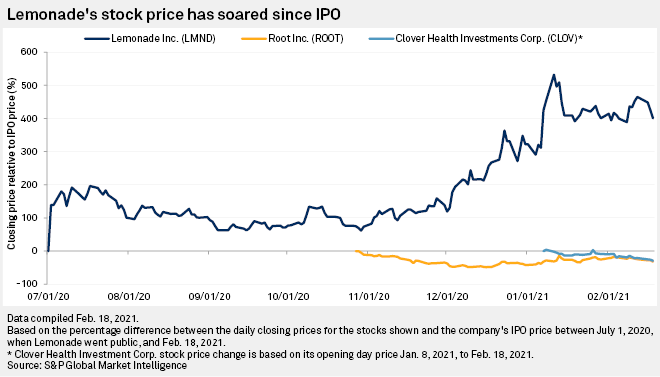

Liu, who described the initial IPO price range as "quite reasonable," said Oscar Health picked a good time for its IPO plans given the "high valuation, market sentiment etc." She noted that Lemonade Inc. is up over 400% since its IPO on July 1, 2020.

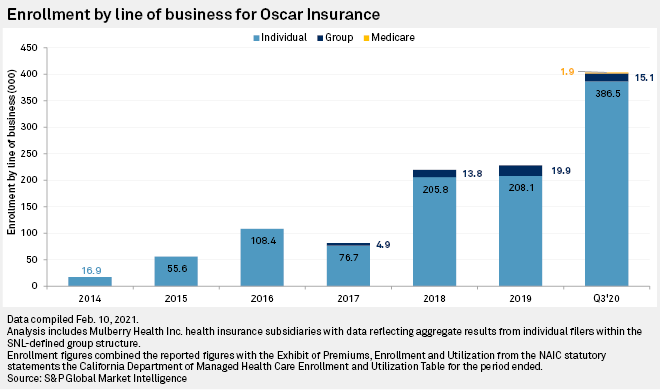

The company was founded in 2012 with a focus on the individual market, before adding small group plans in 2017 and expanding to Medicare Advantage in 2020. It had 529,000 members in 18 states as of Jan. 31, compared to 82,000 as of Jan. 31, 2017, which represents a compound annual growth rate of 59%.

But Oscar Health has never been profitable, with net losses widening year over year to $406.8 million in 2020 from $261.2 million. It warned that it "may not achieve or maintain profitability, and we may continue to incur significant losses in the future."

Mendelson said to achieve profitability, Oscar Health will need to focus on the "operational nuts and bolts" of marketing, underwriting, networks, benefit design and compliance, and will also need to ensure that they are in the right geographies.

Total revenue dipped to $462.8 million from $488.2 million while total operating expenses grew to $865.1 million from $747.6 million in 2019.

And Oscar Health plans to continue spending, saying in its S-1 filing that it expects to make "significant investments" to further market, develop and expand its business. IPOX Schuster's Liu does not expect spending to grow membership to stop nor slow any time soon.

But the company could face an uphill battle in growing membership in a space that new entrants struggle to penetrate. A study of 28 Medicare Advantage organizations by Milliman found that about 20% drew at least 2,000 enrollees in the first year, half of them reached the threshold by the second year and 75% reached in excess of 2,000 enrollees by the fifth year.

Additionally by the fifth year, about half of Medicare Advantage organizations had at least 4,000 enrollees and 25% had at least 10,000 enrollees.

The Kaiser Family Foundation estimated that total Medicare Advantage enrollment reached 24.1 million people in 2020, with UnitedHealthcare and Humana Inc. accounting for 44% of enrollees nationwide, and Blue Cross Blue Shield affiliates, including Anthem Inc. plans, accounting for another 15% of enrollment.

Mendelson said the segment is growing rapidly and likely to remain profitable when operated well, adding that while there are very competitive markets, the market dynamic nationally is "undeniably positive."