|

Swiss banks have become the first European institutions to resume dividend payouts after their national regulator agreed that domestic conditions suggest that they have weathered the worst of the COVID-19 storm, perhaps in contrast to other economies in Europe.

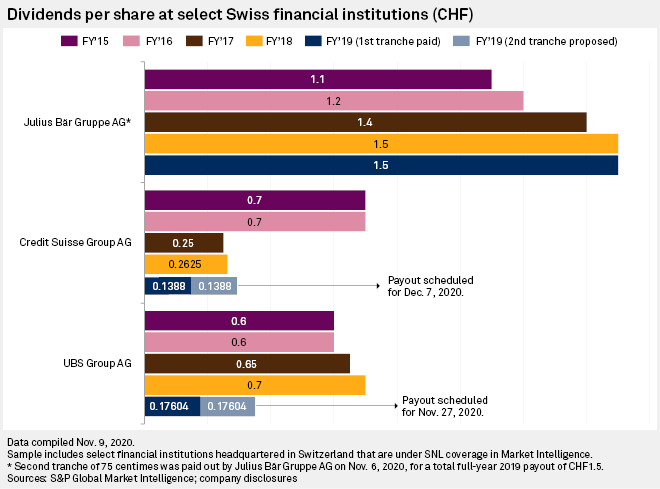

Switzerland's top three listed lenders — UBS Group AG, Credit Suisse Group AG and Julius Bär Gruppe AG — announced they will pay the second installment of their 2019 dividends by the end of 2020 after receiving approval from the national financial market supervisory authority, Finma. The banks had split their 2019 dividends in two equal parts and delayed the second payout in line with a Finma recommendation issued in March.

Switzerland's watchdog, as regulators elsewhere in Europe, has been worried at the onset of COVID-19 about banks' ability to support and continue lending to pandemic-hit economies where defaults were likely to escalate. Loan loss provisions at banks across the region surged over the first half of 2020, in turn taking a toll on profitability at a number of large European credit institutions.

In the third quarter, however, profits bounced back as loan loss provisions subsided and many banks signaled readiness to restart dividend payments.

Swiss banks a step ahead

Although financial markets remain "fragile" and medium-term uncertainty persists, Finma views the state of the Swiss financial sector as "robust," a spokesman for the regulator told S&P Global Market Intelligence earlier in November. Stress testing has showed that even in a severe downturn, Swiss banks' capital levels would be sufficient, he said.

Julius Bär already paid the second part of its 2019 dividend, of 75 centimes per registered share, on Nov. 6. UBS and Credit Suisse have scheduled payouts for Nov. 27 and Dec. 7, respectively, contingent on the approval of their extraordinary shareholders meetings. UBS' EGM will be Nov. 19 and Credit Suisse's shareholders will vote Nov. 27.

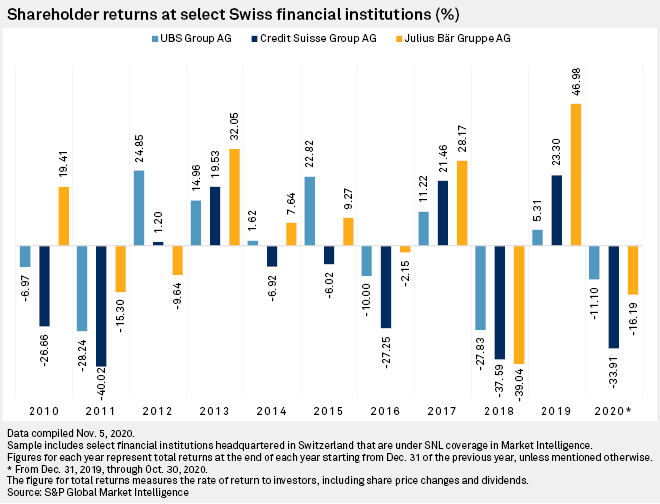

The big Swiss banks have performed better relative to many EU peers, demonstrating resilient profitability despite recent high loan loss provisions. In the third quarter, UBS reported its best pretax profit in a decade and booked a 99% year-over-year rise in net profit attributable to shareholders. Credit Suisse, despite posting a drop in attributable profit in the third quarter, still booked an 18% year-over-year profit increase for the first nine months of 2020, thanks to strong gains over the first half of the year.

Two key factors giving Swiss banks an edge over EU counterparts are Switzerland's strong economy and their business mix, according to analysts. Notably the pandemic's impact on domestic businesses appears to have been less severe than elsewhere in Europe, Maria Rivas, senior vice president with the global financial institutions team of DBRS Morningstar, said in an interview. And while Swiss corporates and small- and medium-sized enterprises did enlist government support schemes, both Credit Suisse and UBS say they have not seen demand for liquidity increase since the schemes ended in July, Rivas said.

As for the business mix, UBS and Credit Suisse have each taken a different route than European peers by having large wealth management businesses in addition to investment banking operations, Rivas said. Both wealth management and investment banking revenues have benefited from the market volatility during the pandemic. This has helped the two Swiss banks book better results than some counterparts, she said.

Moody's considers the stable wealth management businesses of Credit Suisse and UBS alongside U.S. peers with a similar business mix as "a credit positive offset to the COVID-19 disruption."

"Once the coronavirus pandemic subsides, we expect that global wealth will continue growing faster than global GDP," Michael Rohr, senior vice president at Moody's, wrote in a Sept. 10 report. This growth will support the banks' wealth management revenue base "facilitating more stable and predictable earnings streams."

EU impatience

Swiss banks are not the only ones performing well, leaving growing impatience among some well-performing lenders elsewhere in Europe with the ECB de facto ban. Speaking with Berenberg equity analysts, KBC CFO Rik Scheerlinck expressed his frustration with the regulator's "one-size-fits-all approach," the analysts said in a note Nov. 17.

The Belgian bank is hoping that the ECB considers easing its de facto ban "at least for well-capitalized banks," KBC CEO Johan Thijs said during a third-quarter earnings presentation Nov. 12.

Analysts say Nordic banks are among the best placed in Europe to resume dividends when the ban expires on Jan. 1, 2021, with bank supervisors in Denmark and Sweden recently announcing they will allow payouts if European regulators agree.

The ECB is yet to make a decision on bank dividends and share buybacks, but calls for the regulator to allow distributions will rise given the third-quarter earnings recovery at many banks, ABN AMRO credit analyst Tom Kinmonth said in a note Oct. 29. Nevertheless, the second wave of COVID-19, which heightens the likelihood of a new rise in bank loan loss provisions, could convince the ECB to extend the current ban beyond its current January 2021 end date, he said.

Scheerlinck told Berenberg analysts, there are two camps within the ECB — one wanting banks to meet minimum CET1 ratio and expected credit loss requirements before allowing them to pay dividends, and the other preferring to keep the ban on distributions until the European Banking Authority's stress tests in July 2021. "Allowing only a subset of banks to pay dividends could undermine confidence in weak banks," the analysts said.

Credit Suisse analysts consider it likely that the blanket ban will be lifted in 2021 but also note dividends could be delayed until the midyear stress tests. Banks with the highest excess of capital over regulatory minimums should be more able to pay a good dividend, the analysts said in a Nov. 10 report.

READ MORE: