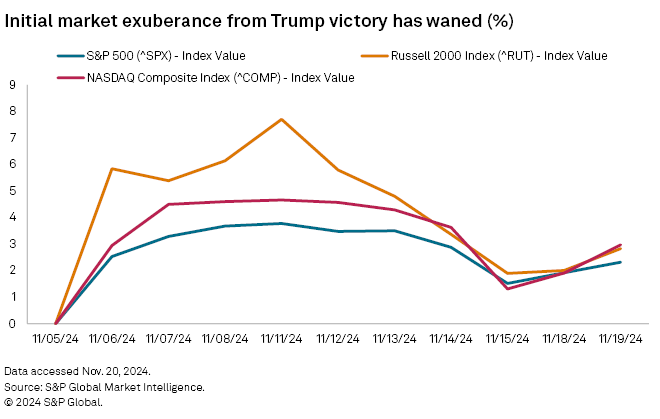

The stock market rally following Donald Trump's presidential victory earlier this month pushed the S&P 500 to a record milestone but has since slowed, leaving investors debating whether equities have reached a short-term peak or still have room to grow.

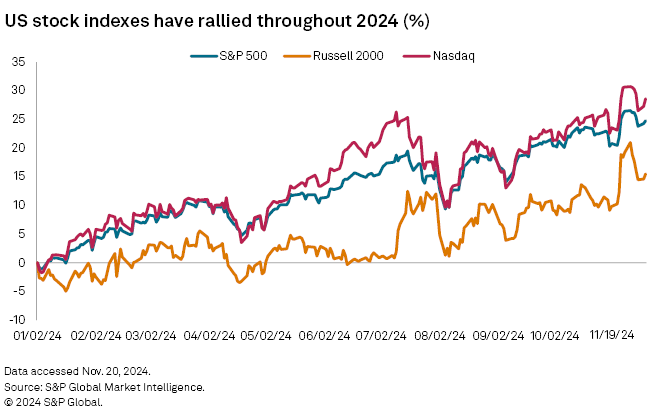

The S&P 500 surged 3.8% in the four trading days after Election Day on Nov. 5, closing above 6,000 for the first time Nov. 11. The index has climbed roughly 25% this year; the Nasdaq composite has gained about 29%, and the Russell 2000 is up more than 15%. But the postelection rally has lost some momentum, with the S&P 500 advancing just 2.3% from Nov. 5 through Nov. 19.

Strong consumer spending, plans by the Federal Reserve to ease financial conditions through rate cuts and signs the US economy has avoided recession suggest the bullish market trend could continue. But several factors, including rising real interest rates, expectations for rising unemployment, the increase in retail investor inflows and headwinds from a rising US dollar, could signal potential risks for equities.

"The S&P 500 is effectively in a critical holding pattern now below the postelection record highs yet above support from the preelection record highs from October," said Tyler Richey, co-editor of Sevens Report Research. "Whichever direction we see the index break is likely to be the next 5%-10% move in stocks, but a break either way will importantly need to see healthy or rising volumes to have any meaningful degree of conviction."

Reality has set in as the initial market euphoria over the so-called Trump trade, fueled by hopes for tax cuts and deregulation, has been tempered by expectations of unpredictability and instability, according to Michael O'Rourke, chief market strategist at JonesTrading.

The rally faltered amid concerns over some of Trump's unexpected and controversial Cabinet picks and the realization that the administration's policy decisions could differ significantly from initial expectations, O'Rourke said.

Despite the uncertainty, the market could ultimately resume its upward trajectory.

"There is still a great deal of speculative fervor in the tape, so it is possible that a new incremental high is registered," said O'Rourke. "Generally speaking, this rally is likely to mark an intermediate-term peak for the market."

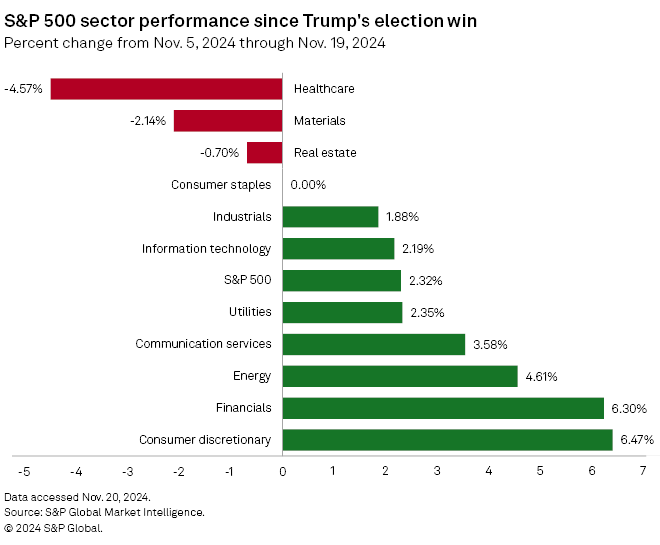

Since Election Day, healthcare stocks have struggled, with vaccine makers and other companies in the sector declining after Trump selected vaccine skeptic and pharmaceutical industry critic Robert F. Kennedy Jr. to lead the US Department of Health and Human Services.

Consumer discretionary and financial stocks have seen the largest gains since Trump's election, potentially driven by expectations of looser banking regulations and easing financial conditions.

"The rally in bank stocks suggests that even the prospect is already exciting markets," said Joseph Wang, a former senior trader on the Fed's Open Markets Desk and operator of Fedguy.com, a financial markets research blog. "Financial conditions are in part psychological."

The election has introduced "another degree of uncertainty" to the stock market, according to Tyler Richey of Sevens Report Research. The S&P 500 is unlikely to remain in a narrow range, with an equal likelihood of reaching new record highs or falling to levels last seen a month ago, Richey said.

"The broader stock market has traded into a critical tipping point here," Richey added.