The price of nickel has soared more than 50% since the start of 2019, topping US$16,000 per tonne in early August before settling at US$15,750/t on Aug. 21 against a backdrop of rising electric vehicle demand and supply concerns.

The notoriously volatile price of the metal reached US$16,080/t on Aug. 16 as rumors of a sooner-than-expected Indonesian export ban continued to swirl, after having surged by almost US$2,000/t to US$16,690/t on Aug. 8, the largest intraday spike since 2009.

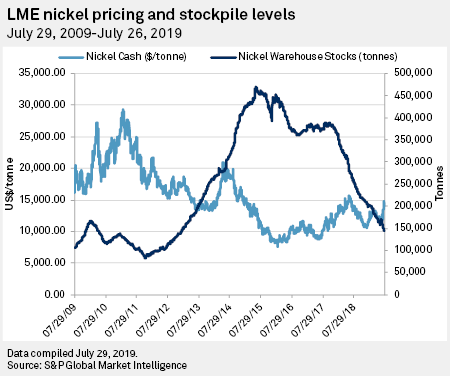

The nickel price trended downward from mid-2018 to end the year at US$10,590/t against the backdrop of escalating trade tensions between Beijing and Washington followed by a strong start to 2019 before really taking off in July.

UBS analysts highlighted mixed trade signals in a July 18 research note, saying "the recent surge does not appear to have strong fundamental backing to sustain short term." Nevertheless, they forecast a lift in 2020 to US$8 per pound, equivalent to about US$17,637/t, driven by "a step change in demand from electric vehicles." The analysts also noted that stainless steel still accounts for two-thirds of global demand, despite medium- to long-term optimism about electric vehicles.

Plug-in electric light-duty vehicles could account for as much as 11% of global light-duty car sales in 2025, rising to 23% by 2030 and 50% by 2040, according to Platts Analytics Scenario Planning Service.

"Nickel demand and therefore London Metal Exchange prices will continue to be dominated by stainless steel demand," said Matthew Piggott, the head of S&P Global Market Intelligence's Metals and Mining Research team. "While demand for nickel in electric vehicle battery applications is rising alongside the impressive percentage growth in EV vehicle sales, absolute volumes are still comparatively small."

"The key to LME pricing in the medium term [about 5 years] is therefore not electric vehicles; rather, it will be the extent to which [nickel] pig iron production will once again displace refined nickel in the stainless steel value chain and the security of the supply chain — combined with the outlook for stainless steel demand itself," Piggott added.

The recent rally has been speculatively driven by news about Indonesia's export ban, according to Piggott. "Nickel prices lie in excess of the fundamentals of demand. With pig iron production growing this year, it is hard for us to find reasons for LME nickel to sit at current price levels for any of the next three years."

"Over the longer term, incentive prices reaching the mid-US$20,000s in real terms will be required to advance higher-cost projects in Australia, Canada and elsewhere, including Russia," Roskill analyst Jack Anderson said.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.