A branch of Santander in New York, part of the Spanish lender's retail banking business in the U.S.

Source: Alexi Rosenfeld/Getty Images Entertainment via Getty Images

After a tough 2020 in which it fell to its first ever annual loss, Banco Santander SA bounced back to profit in the first quarter.

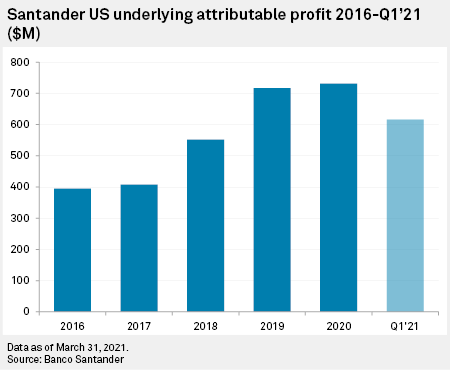

The Spanish lender's results were notable for the performance of its U.S. business, which became its largest source of net income, bringing in €660 million of profit for the group. Profits from the U.S. have steadily increased for Santander in recent years, but the market has long trailed Brazil, Spain and the U.K. as a major source of income.

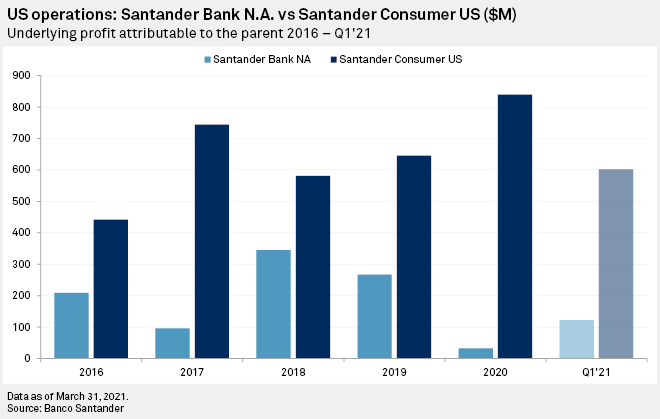

On the surface, the growth of Santander's U.S. business to become its most profitable market is a success story — CEO Jose Antonio Alvarez Alvarez called the U.S. results "excellent." But a closer look reveals a business heavily reliant on its consumer finance division and a retail banking business that, after 15 years in the market, continues to provide just a fraction of Santander's U.S. profit.

"Santander's U.S. banking operation is an underperformer," Christopher Whalen, chairman of New York-based Whalen Global Advisers and veteran banking analyst, said in an interview. "Over time, when they do a return on capital analysis for this investment, they're going to have to ask themselves a basic question that all foreign banks [in the U.S.] end up asking themselves, which is 'why are we here?'"

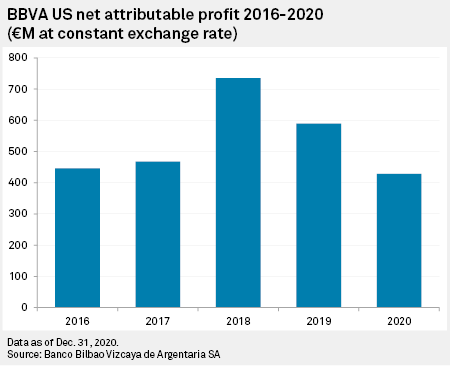

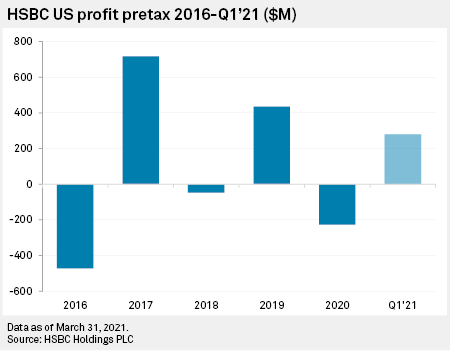

Other European banks with a similar retail presence in the US have done just that in recent months. Spain's Banco Bilbao Vizcaya Argentaria SA off-loaded its 639-branch network in November to PNC for $11.6 billion. HSBC Holdings PLC followed suit in February, when it confirmed a plan to sell its U.S. retail banking operation consisting of 150 branches spread across the U.S. eastern seaboard.

Both banks have struggled to make their U.S. retail business pay off sufficiently. After seeing U.S. profits grow to €735 million in 2018, BBVA's mainly retail-focused U.S. operation went backwards in the two years thereafter, with profits shrinking to €429 million in 2020, when it decided to sell up.

HSBC's more expansive U.S. operation has been hamstrung by its retail business, which has dragged down U.S. profits for several years. The U.S. division in which HSBC's retail banking business operates has made a loss in four out of five years from 2016 to 2020.

Santander's U.S. retail operation, Santander Bank NA, has mostly limped into profit in that time, but the business has struggled to consistently offer value for shareholders. Santander NA's return on average equity hit 5.27% in the first quarter of 2021, its best performance since 2018, according to S&P Global Market Intelligence data. From 2016 to 2020, ROAE peaked at 3.43% in the second quarter of 2018 and troughed at negative 54.72% in Q2 2020 as the impact of the COVID-19 pandemic fully hit, the data showed.

Costs eat into profits

Costs have squeezed profitability. Santander NA recorded operating expenses of $490 million against a gross income of $631 million in the first quarter. Its overhead expenses have been "elevated for years" and are 2x larger than its U.S. peers, said Whalen, citing comparative data on U.S. banks.

"It sounds like they don't make money, but they do," said Whalen. "But the overhead expense is so high, it just consumes all of it."

BBVA's U.S. retail operation suffered from a similar problem. The bank's U.S. CEO told the Financial Times that the stringent requirements around compliance, legal structures and systems when operating a bank in the U.S. were expensive and made cost management the most challenging aspect of the business.

Given current market conditions in the U.S. retail banking market, tackling costs will be crucial to strengthening Santander NA's position, said Pablo Manzano, vice president at DBRS Morningstar. "There are very strong players in the U.S. retail market," Manzano said. "Competition is quite fierce and margins are low, so the way to make money is to keep costs down."

Credit loss has also been an issue. Santander NA's provisions are "pretty sizable" compared to U.S. peers, Whalen said. Net loan loss provisions at the bank ate into 84.9% of its net operating income in 2020.

"Again, this goes back for years," Whalen added. "The combination of high overhead expenses and high credit expenses are what drives the performance of their U.S. banking business."

With near-term interest rates unlikely to significantly rise in the coming quarters as the U.S. Federal Open Market Committee looks to fuel the economy's recovery from the COVID-19 pandemic, the outlook for U.S. retail banking is weak.

The biggest challenge

"The low interest rate environment is forcing banks to work harder and harder," said Whalen. "That's the biggest challenge facing these guys. As long as we have quantitative easing and the Fed is taking all of that duration out of the market, it's hard for banks to make money because they make money on spread."

The spreads that have made Santander's U.S. business money in recent years have come from its higher risk consumer finance division, which includes the seventh-largest auto lender in the country. Santander Consumer USA represented more than 80% of the U.S. profits in the first quarter of 2021 and recorded a return on average equity of 50.09%, S&P Global Market Intelligence data showed.

"In consumer finance, you're talking about annual percentage rates in the high teens and low 20s, depending on the risk profile of the client," said Whalen. "That's why [Santander U.S.] make[s] money."

Santander told S&P Global Market Intelligence that its U.S. retail bank continues to be "an integral part of our strategy" as its deposit base provides funding to the more profitable consumer and corporate and investment banking divisions in the U.S., while "nearly half of the risk-weighted assets of [Santander Bank NA] support all Santander U.S. businesses." Santander Bank NA has around $10 billion of auto loans on its balance sheet and originated nearly 20% of Santander Consumer's full-year 2020 auto originations, it said.

Still, if Santander wants the U.S. to continue as one of its major sources of profit, finding a way to off-load its retail division while protecting the performance of its more profitable U.S. businesses might be a wise move, Whalen added. "If Santander can get anywhere near book value for it, then they should be happy and run for the door."