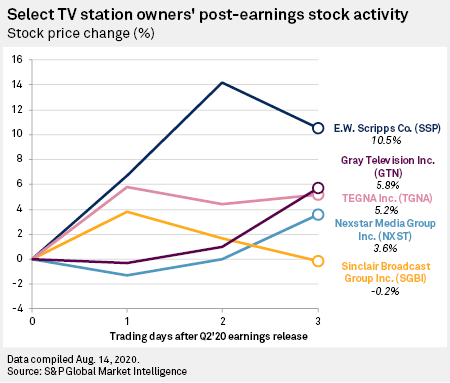

The benefits of scale through consolidation and gains from the retransmission-consent stream have helped leading TV station groups weather COVID-19 to varying degrees.

However, the pandemic stung the companies on the advertising revenue front as the virus shuttered local businesses, such as auto dealerships, restaurants and retailers, with much of the ad spending for those key local TV categories evaporating alongside the closures. The station owners, however, reported sequential improvement starting in April.

That recovery has continued into the summer months as more local businesses have reopened among relaxed sheltering mandates. Wells Fargo analyst Steven Cahall wrote in a recent note that the industry is pacing for core ad revenues to be down in the mid-teens during July and August, representing a sizable improvement from what many broadcasters reported earlier in 2020.

Gray

Total revenues at Gray Television Inc. retreated to $451 million from $508 million, with retrans revenue up 9.5% to $220 million. However, advertising revenue fell 23.7% to $219 million, which included $162 million in local revenue, $36 million from national advertisers and $21 million from the political arena, versus $287 million in the second quarter of 2019.

Gray's Executive Chairman and CEO Hilton Howell noted on an earnings call that its business "recovered faster than we hoped." Where core ad revenues were off 38% in April and had a 34% rate of decrease in May, the fall-off in June was at 17%.

"Most importantly, in many of our markets, our individual stations met or, in some cases, beat their pre-COVID budgets in June," he said.

TEGNA

TEGNA Inc.'s second-quarter revenues advanced 7.6% to $577.6 million from $536.9 million, owing to a 37% surge in subscription revenues to $323.5 million. The advertising and marketing services segment decreased 20.9% to $229.1 million from $289.6 million.

CFO Victoria Dux Harker pointed to sequential progress on the company's earnings call, with a better than 20 percentage point uptick from April until June.

President and CEO Dave Lougee noted that July was down 12%.

Scripps

E.W. Scripps Co. last year acquired 15 TV stations from Cordillera Communications LLC and eight that were divested as a condition of Nexstar Media Group Inc.'s purchase of Tribune Media Company. The company reported a 12% rise in total operating revenues to $358.9 million from $320.4 million. The numbers were boosted by a 56% jump in retransmission-revenue to $142 million. Ad revenues dropped 14.5% to $237.6 million from $276.7 million.

Brian Lawlor, president of local media, said Scripps' largest categories improved month to month amid the pandemic. Home improvement and services, its leading sector, was flat in June, he said.

The company saw further recovery in July, and it expects the automotive category, which has seen manufacturing plants reopen and new car inventory expand, to provide an assist over the rest of the year.

Nexstar

Reflecting contributions from its September 2019 Tribune deal that made it the nation's largest operator of TV stations, Nexstar saw total net revenue climb 40.9% to $914.6 million from $649.0 million.

Distribution revenue soared 70.7% to $536.5 million, while core ad revenue grew 11.4% to $298.2 million from $267.6 million.

However, Nexstar CFO Tom Carter said on the company's earnings call that on a combined company and pro forma basis, reflecting divested stations, second-quarter same-station net total revenue declined 6% due to a decrease in same-station core advertising revenue of approximately 35% in the face of the pandemic.

Sinclair

Sinclair Broadcast Group Inc., lifted by contributions from the regional sports networks and FOX College Sports (US), which it purchased from Walt Disney Company in August 2019, posted a 66% gain in total revenues to $1.28 billion from $771 million in the prior-year period. Distribution revenues, bolstered by $610 million in fees via the acquisition of the RSNs, totaled $1.01 billion, up from $367 million.

However, ad revenues dropped 30.7% to $235 million from $339 million in the prior-year period. Sinclair's stations generated $208 million with this measure, down from $315 million in the second quarter, while the RSNs only generated $3 million in the absence of live events.

Still, on the company's most recent earnings call, Sinclair CFO Lucy Rutishauser noted Sinclair registered improvement throughout the second quarter.

"June ended with our broadcast and other segments declining 26% over the same period last year, which was a significant improvement over the 43% drop in April. July has seen the improvement continuing, finishing down 20% for the month," Rutishauser said.

Political prospects

As the companies realize core ad business improvement, they are also looking to gains from the heightened political landscape and could benefit from the pandemic's restrictions on larger in-person gatherings.

Gray's Howell said without traditional campaign-trail events, funding for those gatherings will shift to TV. Gray estimates its political revenue could exceed $275 million during this election cycle.

However, Sinclair's Rutishauser cautioned that political spending often displaces other advertising categories, with Sinclair expecting core advertising to be down 15% to 22% in the third quarter.