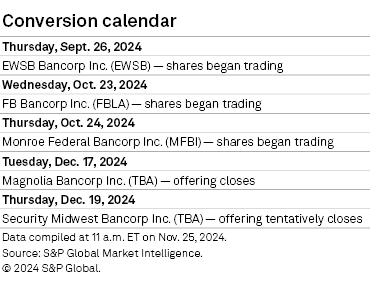

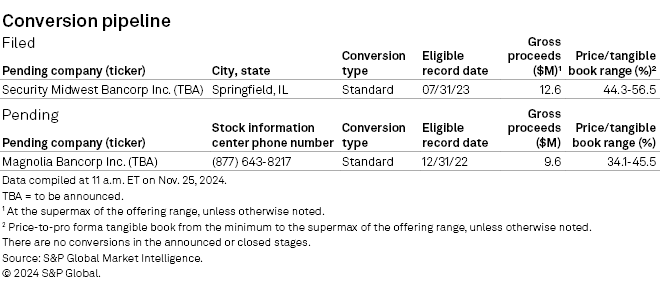

This feature has the latest news from the mutual bank conversion sector. As of Nov. 25, two conversions were in the pipeline.

Magnolia Bancorp Inc., the proposed holding company for Metairie, Louisiana-based Mutual Savings and Loan Association, has issued a prospectus for its mutual-to-stock conversion offering that expires Dec. 17.

The company's pro forma ratio of tangible common equity to tangible assets as of June 30 ranges from 45.6% at the minimum of the offering range to 49.5% at the supermax.

Mutual Savings has recorded a net loss for the last three quarters. "Because of declines in our net interest income and reduced demand for our fixed-rate loans, we currently expect to incur a net loss for the year ending December 31, 2024," the company said in the filing.

The bank, which had just one loan officer as of June 30, said in the prospectus, "We believe we will need to hire additional loan officers and grow our loan portfolio before we can return to sustained profitability, which will take time and increase our non-interest expense in the short term."

In an amended registration statement filed Oct. 9, the company disclosed that the resignation of the bank's CFO could impact its financial reporting timeliness.

On Sept. 12, Security Midwest Bancorp Inc., the proposed holding company for Springfield, Illinois-based Security Bank SB, filed a registration statement for a standard conversion. The tentative closing date for the offering is Dec. 19.

In the filing, the company said, "In 2018, we implemented a cannabis-related business (CRB) program, offering deposit and cash-management services to licensed cannabis-related businesses. We currently offer depository accounts to customers operating licensed cannabis businesses in the states of Illinois, Michigan and Ohio. In December 2022, we initiated lending to cannabis organizations and their associated real estate entities."

As of June 30, Security Bank held $54.8 million of deposits from CRB customers, representing about 27% of total deposits, as well as $20.3 million of loans to CRB customers and associated real estate entities, comprising about 19% of total loans. One individual customer accounted for just over half of the CRB deposits. Additionally, fee income related to CRB deposit accounts has made up more than 50% of total noninterest income during the 18 months ended June 30.

The company said in the filing that it intends to grow the CRB program "modestly."

Download a template showing the conversion pipeline, market performance of recent conversions, valuations of mutual holding companies and a list of conversion candidates.

Other conversion features

2023 conversion class features 2nd-largest standard deal in last 15 years

Luse Gorman dominates 2023 mutual bank conversion adviser rankings

Other news stories about mutuals, mutual holding companies, recent conversions and activist investors

Arrha CU board to vote on acquisition by Pittsfield Co-operative Bank

Affinity Bancshares stockholders approve Atlanta Postal CU purchase agreement

US banks taking advantage of higher valuations by raising capital

We encourage reader participation and feedback. Please forward any suggestions to ConversionNews@snl.com.