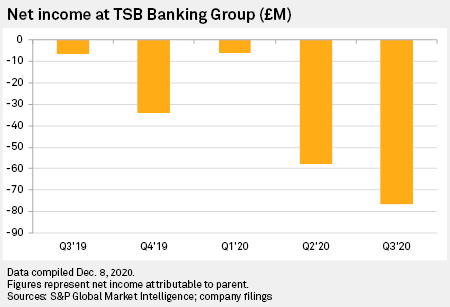

British lenders Starling Bank Ltd. and TSB Banking Group PLC have each been touted as potential takeover targets, even as the former aims for a stock market listing and the latter's losses have widened during the coronavirus pandemic.

Starling has emerged as one of the U.K.'s highest-profile digital challengers since receiving its banking license in 2016, while TSB, in contrast, is a high street bank that has struggled on the technology side.

Both Lloyds Banking Group PLC and JPMorgan Chase & Co. have been reported as potential acquirers of Starling, the all-digital bank founded by veteran banker Anne Boden: Lloyds for the bank's digital technology, said The Times, and JPM for its customer base ahead of the launch of its Chase retail bank brand in the U.K. next year. Boden has insisted that the bank is not for sale and that she still has her sights on a stock market listing.

Starling, which declined to comment, launched its first mobile current account in 2017 and the first digital business account in the U.K. in 2018. Unlike some digital rivals, its more diversified revenue stream means that under half its business comes from card transaction fees. It has made a loss every month since it launched until October this year when it reported a £800,000 operating profit.

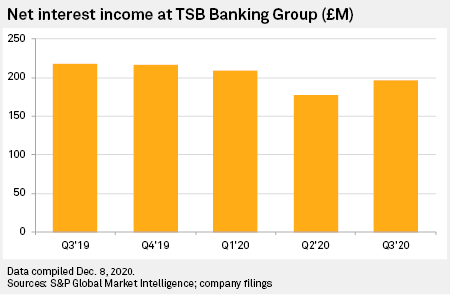

TSB is part of Banco de Sabadell SA and the Spanish group, beset by weak profits and low capital levels, is assessing options for its U.K. business. TSB is likely to attract interest from potential acquirers including Virgin Money UK PLC and OneSavings Bank PLC, while mortgage specialist Kensington Mortgage Co. Ltd. and credit card company NewDay have also been named as potential bidders in any auction process, according to Reuters.

Competition in the market

After merger talks between Sabadell and Banco Bilbao Vizcaya Argentaria SA collapsed, Sabadell said it would explore ways of creating shareholder value, "with regard to the group's international assets, including TSB." TSB declined to comment on Sabadell's strategy but said it had seen good momentum in underlying business growth and was reducing overall costs.

Deutsche Bank analyst Kazim Andac said Sabadell, which did not return requests for comment, is keen to put TSB on the block for a sale but it might find it faces considerable competition for interest while the disruption caused by the end of the Brexit transition period.

"There are many challenger banks in the U.K. looking out for suitable bidders such as Sainsbury's Bank and the Co-operative Bank," he said.

Goodbody analyst John Cronin said that Virgin Money may be tempted to make a bid for TSB to accelerate funding-cost reduction. This would boost returns on mortgages, which account for about 80% of Virgin's revenue.

Another U.K.-based analyst, who declined to be named since he was not authorized to speak publicly to the press, said Sabadell's problem in offloading TSB would be a lack of buyers because the big banks would not be allowed to buy it.

Virgin Money was the logical acquirer, the analyst said, since its aim was to be a universal bank, rather than OneSavings Bank or Kensington.

What next for Starling?

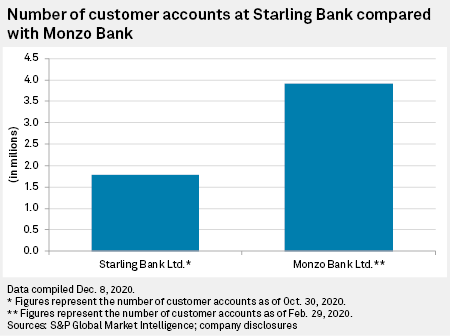

Meanwhile, Starling Chief Strategy Officer Declan Ferguson said, in a webcast conversation with analysts at Goodbody, that the bank had about 1.6 million personal account customers as well as about 225,000 small and medium-sized enterprise customers.

Ferguson said that the numbers of SMEs opening accounts had increased in 2020, driven in part by Starling's provision of state-backed coronavirus loans.

"We really needed to be part of those schemes in order to be seen as a credible alternative to the incumbent banks," he said.

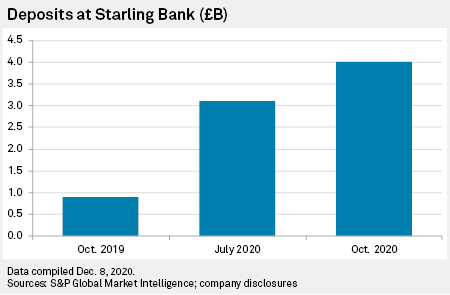

The bank has increased its deposits to £3.96 billion in October 2020 from £897 million the year before.

However, Shore Capital analyst Gary Greenwood warned that there were question marks over SME lending during the pandemic.

"There is a question over how much lending to SMEs is profitable lending because a lot of it will be the government-backed loans and banks can make a decent economic return on the bigger, Coronavirus Business Interruption Loans but the smaller Bounce Back Loans are another matter," said Greenwood.

Rival digital bank Monzo Bank Ltd. has more customers than Starling but has struggled during the pandemic, cutting jobs and warning earlier this year there was "significant doubt" over its ability to continue as a going concern.

Starling and other digital banks would be more likely to concentrate on building a big customer base over a five year period and then sell to an incumbent, said the analyst who wished to remain anonymous.

Ferguson, however, was optimistic about continued growth at the bank and predicted it would have £8 billion to £10 billion deposits in a year's time.

Starling has raised just over £260 million of equity funding and it has had £100 million from the Banking Competition Remedies group to aid SME banking.