| Wind turbines power an electrolyzer to produce zero-carbon hydrogen. |

Green hydrogen-fueled power plants could become "economic for the first time," thanks to the layering of hydrogen and renewable energy tax credits authorized by the Inflation Reduction Act, according to a Sept. 16 report.

The ICF International Inc. report analyzed five technologies, all forecast to see double-digit percentage declines in their levelized cost of energy, or average electricity generation costs over a facility's lifetime. But the impact of the $369 billion energy spending package was especially dramatic for green hydrogen, which is produced using zero-carbon electricity.

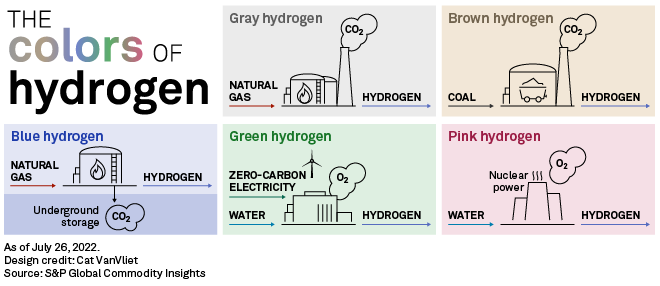

Hydrogen is an energy carrier, allowing it to store energy, generate electricity or provide heat. But production of the gas can be carbon-intensive, with the majority of today's hydrogen derived from fossil fuels. Before the Inflation Reduction Act became law, the process of producing green hydrogen — electrolysis, or the splitting of hydrogen and oxygen in water — was prohibitively expensive for most regions in the U.S.

The Inflation Reduction Act, signed by U.S. President Joe Biden in August, is poised to change that, according to ICF.

"Green hydrogen has the potential to receive the greatest support, as electricity produced using it can receive three incentives simultaneously," the report said, referring to incentives captured during the full life-cycle of production and consumption.

First, clean energy production and investment tax credits, authorized by the Inflation Reduction Act, can be applied to the renewable or nuclear facilities used to power electrolysis. The second incentive is the Section 45V hydrogen production tax credit program, which provides up to $3 per kilogram of low-carbon hydrogen produced.

The third incentive applies to hydrogen later used to generate electricity in a combined-cycle plant. Unlike fossil fuels, hydrogen emits only oxygen and water when combusted, making the zero-carbon electricity produced at these plants eligible for production and investment tax credits.

The combined impact could lower the levelized cost of energy for a green hydrogen-fueled power plant in 2030 by as much as two-thirds, relative to a plant without those incentives, according to ICF. Not all tax credits need to be captured by a single entity, "as the benefits of credits earlier in the supply chain can be passed forward to later stages through reduced prices," the report said. This means that in some regions, green hydrogen-fueled power plants could become cost-competitive with new natural gas-fired facilities.

The incentives follow another show of support for hydrogen from the Biden administration in its $8 billion regional clean hydrogen hub program, funded by the bipartisan infrastructure law of 2021. Since then, about a dozen hydrogen hub projects have popped up in the U.S.

Brian Maxwell, CEO of Green Hydrogen International Corp., said the Inflation Reduction Act will likely bolster that trend. The developer is working on several green hydrogen projects in North America, including a Texas hub powered by wind and solar energy.

"It definitely bends the cost curve down for U.S. projects," Maxwell told S&P Global Commodity Insights.

Jury still out on blue hydrogen

While the U.S. Energy Department has resisted picking a favorite color — relying on emissions profiles instead when applying hydrogen incentives — environmentalists and some investors remain skeptical of blue hydrogen. The fuel is produced from natural gas feedstock, with carbon capture technology to mitigate CO2 emissions. The Section 45Q carbon capture tax credit program, as expanded by the Inflation Reduction Act, provides up to $85 per tonne of CO2 captured from emissions streams.

Not all blue hydrogen facilities currently operating will qualify for the full hydrogen production tax credit. For the full $3, a facility may emit no more than 0.45 kilograms of CO2 equivalent per kilogram of hydrogen produced. Gray hydrogen, produced from natural gas without carbon capture, emits about 10 kilograms of CO2 per kilogram of hydrogen produced. As such, a blue hydrogen facility must capture about 95% of its emissions for the full tax break, a rate few have achieved.

The U.S. still has several blue hydrogen projects underway that plan to use autothermal reforming, a newer technology claiming up to 96% CO2 capture rates.

But unlike green hydrogen incentives, carbon capture tax credits cannot be "stacked" with other incentives, the ICF report said. In other words, a blue hydrogen production facility must choose between earning credits for the hydrogen it produces and earning credits for the CO2 it captures.

"I'm definitely pro-green," Maxwell said. "I don't necessarily say I'm anti-blue."

Whereas the cost of blue hydrogen hinges on that of natural gas, the cost of green hydrogen is taken up by capital expenditure, the developer said. However, once a green hydrogen electrolyzer is built, operating costs remain low as renewable energy provides cheap power.

"Our problem is scaling green to a suitable size," Maxwell said. "But we think, long-term, green will be more economic and definitely less volatile."

S&P Global Commodity Insights and S&P Global Market Intelligence are owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.