Lucrative media rights deals have driven private equity interest in the sports sector, but factors such as a desire to capitalize on both the industry's professionalization and passionate fan base have also stoked appetite for these investments.

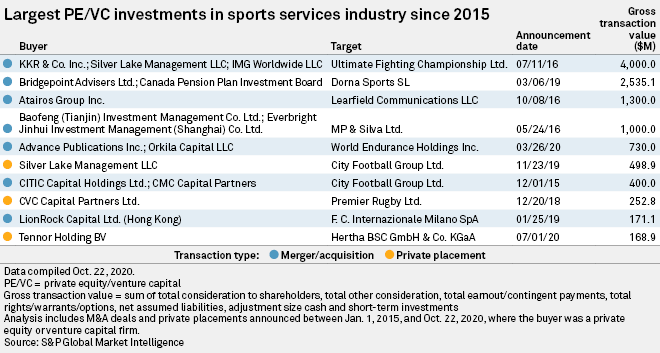

Over the past 12 months, Silver Lake Management LLC acquired a $500 million stake in Manchester City football club's owner City Football Group Ltd. and growth investor Orkila Capital LLC's committed to The IRONMAN Group as part of Advance Publications Inc.'s acquisition of the business. After submitting rival bids, CVC Capital Partners Ltd. and Advent International Corp. teamed up alongside Italian state-backed fund FSI and the group is in exclusive discussions to acquire a 10% stake in Italian football league Serie A's media business. Bain Capital LP also showed interest.

Attractive media rights revenue has been a key driver of appetite for investments in the sports industry, Chris Mort, head of sports at law firm Freshfields Bruckhaus Deringer LLP said in an interview. The most attractive assets are those with wide international appeal. "If a sport has got a very domestic interest, then it's of less interest to the broadcasters, but also it's of less interest to financial investors," Mort added.

For their part, sports organizations may have a heightened interest in outside investment as they face a potential sea change. There's a big question over whether the sports industry will move away from the traditional broadcasting model to Netflix-style over-the-top media services — streaming services offered to viewers directly via the internet — which will require a significant amount of investment, Freshfields partner David Brooks said.

Beyond media rights, other revenue streams like hospitality, gate receipts and sponsorship "can be quite predictable," which is attractive to private equity investors, Tabitha Elwes, head of the media practice at CIL Management Consultants said.

As the industry evolves and professionalizes, so too do the opportunities for additional revenue streams. Data, for example, is becoming a "key part of sports," Elwes added. Data might be used for betting, to inform performance analytics on the whole team or a particular player, or to embed into an over-the-top media consumption. "If you're a Chelsea [Football Club] fan, you can go in and find data and information about Chelsea and what they're doing with a depth and passion that makes [for] increased stickiness, increased revenue opportunities," Elwes said.

What makes sports investments more complex is the industry is as much focused on rules and regulations, team talent, and results for the next week, as it is on the long-term optimal structures and commercial return, Elwes added. Investment and guidance from private equity firms can bring more of a focus on the latter, and the reward of potentially significant returns for the private equity funds themselves.

Growing opportunity

The COVID-19 crisis will further the investment opportunity for private equity firms, Mort said. Organizations that may have held off bringing in outside capital may be more open to buyer proposals as they face financial difficulties. Equally, private equity firms may be more hesitant to transact because there is no visibility on how COVID-19 will play out, he added. "Private equity investors like visibility on cash flow, for example, and it's very hard to give visibility on that."

Viewers will return to watching live sports, Elwes said, but there could be knock on effects on consumer viewing preferences. "Are we going to end up with the same sort of premium packages that we've had before? Are we going to be seeing more pay-per-view and people looking for greater flexibility?"

Large scale investments in clubs and leagues have been limited to a handful of large private equity players, but the industry has more time to evolve, according to Freshfield's Brooks. "I don't see any reason why it wouldn't, and shouldn't, become more mainstream. I think we will find that more private equity outlets have more specialist people looking at this sector," Brooks said.

Elwes also expects to see more private equity firms making investments in the sports industry, but notes investments in teams and leagues have a very particular profile. "I'm not sure that there are lots of organizations that can get comfortable with that."

But the professionalization and growth of the sports industry have created more opportunities, particularly in the mid-market, Elwes added. "Things like sports betting, services to sport, sports technology, talent management and then the various aspects of the esports. I get a sense that those are being looked at quite broadly by a lot of private equity firms."