Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Sep, 2021

Spain's largest banks remain cautious about future problem loans even though they defied expectations regarding asset quality in the second quarter, according to analysts.

The country's four biggest lenders by assets still had a total of €18.82 billion worth of loans under moratoriums — suspensions of repayments granted to borrowers on request as a result of the coronavirus pandemic — as of June 30, according to calculations by S&P Global Market Intelligence. Banco Santander SA had the largest volume at €8.7 billion, followed by CaixaBank SA on €6.8 billion, Banco Bilbao Vizcaya Argentaria SA on €2.77 billion and Banco de Sabadell SA on €550 million.

Most moratoriums have expired, but those that remain may hold greater risk. Once they come to an end, banks can strike conventional agreements with borrowers to extend them if required, and this would more often apply to those struggling to repay.

"When compared to what we were expecting in Q2 last year after the pandemic hit, asset quality at the major Spanish banks is relatively fine," Chiara Romano, associate director at Scope Ratings, said in an interview. "But I don't think they're out of the woods yet."

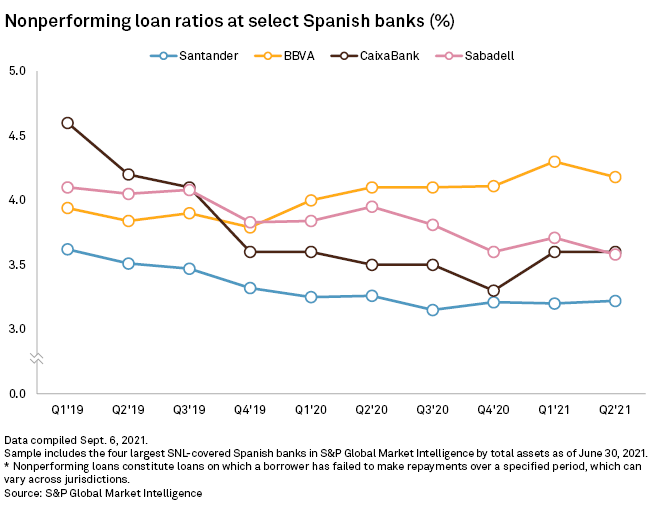

Nonperforming loan ratios at Santander, CaixaBank, BBVA and Sabadell fell by an average of almost 6 basis points quarter over quarter to an average of 3.64%, according to S&P Global Market Intelligence data. The NPL ratio is a measure of loans at risk of default as a proportion of total loans.

Three of the banks beat analyst consensus estimates on nonperforming asset ratios by an average of 18 basis points, with only Sabadell failing at 26 basis points above consensus estimates, the data showed. Nonperforming assets include shorter-term advances as well as loans.

Loan moratoriums

With the bulk of COVID-19-induced loan moratoriums expiring in Spain in April and May, the second quarter was seen by many banks and analysts as the point at which the economic shock delivered by the pandemic would begin to make itself visible on Spanish lenders' balance sheets.

That uptick never materialized, partly because Spain's economy has rebounded more quickly than markets expected at the height of the pandemic. But executives at the banks said during second-quarter earnings calls that it was too early to declare the end of the pandemic's threat to asset quality.

"We're going to be prudent," said CaixaBank CFO Javier Pano Riera. "We clearly need to get well into 2022 to know what the extent of the damage is."

CaixaBank and Santander both have significant exposure to the Portuguese market, where legislative moratoriums — those granted by law as part of governments' response to COVID-19 — are in place until the end of September 2021. The Portuguese market now comprises the largest portion of loan moratoriums for both banks, at 71% for Santander and 57% for CaixaBank.

The bulk of legislative moratoriums granted in Spain have already expired, according to a report by Banco de España. The total outstanding volume of loans subject to legislative moratoriums in Spain stood at €34 billion in December 2020, with 85% due to expire in the first half of 2021 and most expiries concentrated in April and May, the report said.

Nonperforming loan worries

Still, Spain continues to be a significant source of NPLs for the banks. The country has the highest NPL ratio of all of Santander's major markets, at 6.22% at the end of June. Spanish NPLs stood at 4.17% for BBVA, behind Turkey at 7.33%, but ahead of Mexico at 3.05%.

Santander CEO Jose Antonio Alvarez identified small and medium-sized enterprises, particularly those linked to the tourism sector, as the area where most concern remains around the evolution of asset quality.

"It's too early to call the situation; [I] advise you to be cautious," said Alvarez during Santander's earnings call. He said there would be more visibility when the economy fully opens and the tourism industry returns to more normal activity. This would probably be in three of four quarters from now, the CEO said.

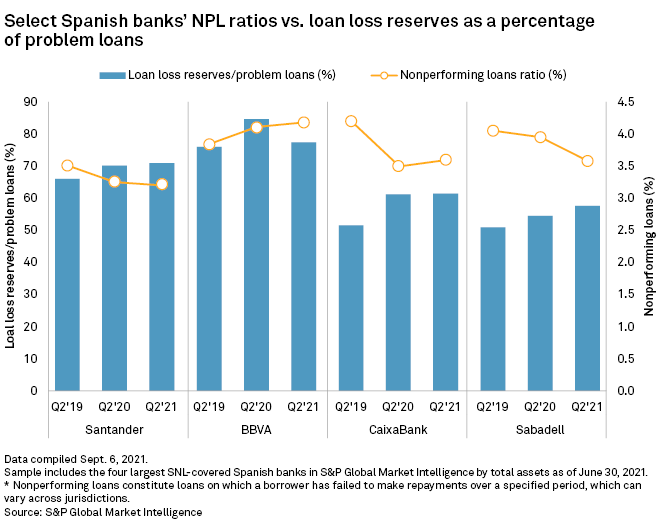

The uncertainty around such borrowers has led to the banks retaining relatively high levels of loan loss reserves — funds put aside to cover potential future losses — compared to pre-pandemic levels, S&P Global Market Intelligence data showed. The four banks' loan loss reserves, as a percentage of problem loans, are up by an average of 554 basis points since the second quarter of 2019

"[Both Santander and BBVA] were actually quite cautious in terms of releasing provisions," said Johann Scholtz, banking equity analyst at Morningstar, referring to the two Spanish banks under his coverage. "There remains concern about the tourism and hospitality sector in Spain, especially, which is quite important on the SME side. That's a bit of a risk to keep an eye on."

Given the lack of significant deterioration in asset quality since the pandemic hit, it is unlikely that any major trouble lies ahead for the banks, according to Sam Theodore, an independent banking analyst and consultant.

Still, the performance of the Spanish economy in the third quarter and the coming quarters will be watched closely for indications of where asset quality might be headed, Theodore added.

"The domestic performance of the Spanish banks will be driven by the economy, to the extent that the economy improves and starts pushing ahead, especially on the business lending side," said Theodore. "If that happens, all these banks will benefit."