South Korean banks have six more months to improve their short-term resilience to liquidity shocks, as the nation's financial regulators focus on injecting more money into the market to alleviate a credit crunch.

Three of the seven largest banks in South Korea could possibly have failed to meet the new minimum liquidity coverage ratio of 95%, up from 92.5% previously, if the Financial Services Commission, or FSC, had not delayed the deadline to meet the higher requirement by six months to mid-2023, based on S&P Global Market Intelligence data. The regulator said Oct. 20 it would delay the rollback of the lower requirements announced during the COVID-19 pandemic to give banks greater room to manage enhanced volatility and uncertainties in the money market.

"Liquidity is tight in [South] Korea as the central bank increases its policy rate," said Michael Makdad, a senior analyst at Morningstar. "I think the worry in Korea is real estate properties. Some of these illiquid assets were funded by short-term debt."

The country faces a delicate balancing act as authorities try to curb inflation by raising interest rates and containing a credit squeeze triggered by the debt default of a Legoland theme park developer. Gangwon Jungdo Development Corp. missed 205 billion won of bond payments due Sept. 29, rattling the money markets and requiring the Gangwon state government to promise it would cover the default, according to local media reports.

Following the incident, more companies have struggled to refinance their maturing debts, especially construction and power companies hit by rising global rates and raw material costs, amid sharply rising yields on corporate bonds and costs of insuring debts against default.

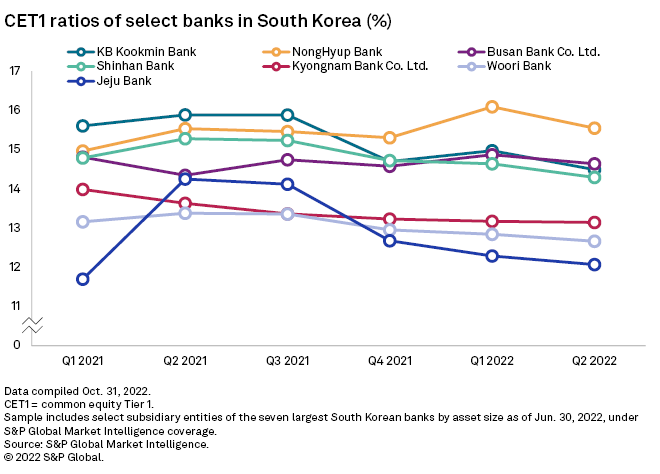

Among the seven biggest local banks, KB Kookmin Bank did not even meet the requirement of holding high-quality liquid assets equivalent to 92.5% of its expected total net cash outflows over the next 30 days, according to Market Intelligence data. Woori Bank was on the borderline as of June 30, the data showed.

Postponing the deadline for banks to increase their liquidity coverage ratios to near pre-pandemic levels is part of South Korea's efforts to shore up the credit market. Other measures include raising the cap on the loan-to-deposit ratio and providing 50 trillion won of assistance to small businesses. A higher liquidity coverage ratio reduces the money available in the secondary market, an impact that could amplify during a credit squeeze.

There is also a concern that banks would rush to sell bonds that are considered risky to shore up their liquidity position, which could further exacerbate credit market woes, two analysts told Market Intelligence.

Legoland Korea Resort's default "has further weakened investor sentiment in the domestic debt capital market at a time when domestic interest rates have rapidly increased and the property market is weak," said Daehyun Kim, a director at S&P Global Ratings.

Market relief

The yields on AA-rated three-year corporate bonds came down to 5.37% on Dec. 5 after hitting a one-year high of 5.736% on Oct. 21, according to the Korea Financial Investment Association. Credit spreads between the three-year corporate bonds and the South Korean treasury bonds with the same maturity stood at 176 basis points, narrowing from 124 bps on Oct. 21.

"We have asked major institutional investors to refrain from excessive selling of bonds or reduction of any planned [bond] purchases given the financial market situation," the FSC said in a statement Oct. 28.

KB Kookmin Bank, Woori Bank, Shinhan Bank Co. Ltd., NongHyup Bank, Busan Bank Co. Ltd. and Kyongnam Bank Co. Ltd. did not respond to a request from Market Intelligence. Jeju Bank could not be reached.

As of Dec. 6, US$1 was equivalent to 1,319.48 South Korean won.