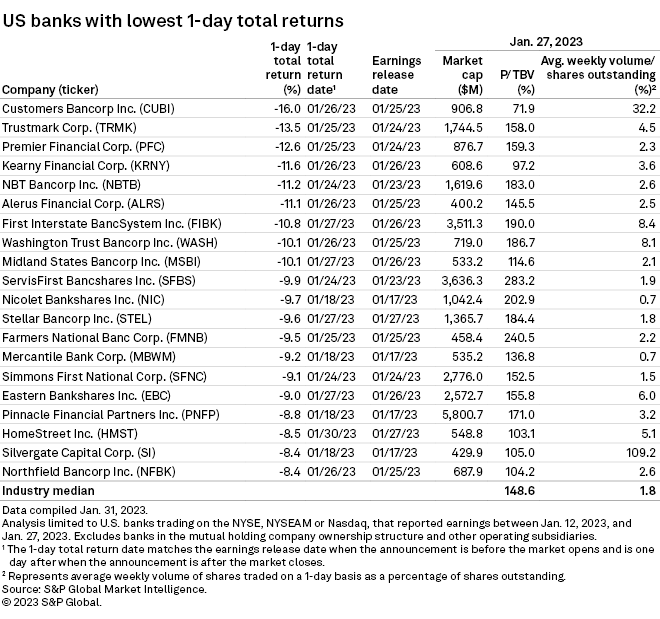

Numerous banks' stock prices took a blow this earnings season as funding pressure reared its ugly head in the form of deposit outflows, higher cost of funds and net interest margin pressure.

Of the nine U.S. banks that posted negative double-digit stock returns either the day they reported earnings or the day after, the majority reported a higher cost of funds and a lower net interest margin quarter over quarter. Investors were not keen on high levels of deposit outflows, rising deposit costs and net interest margin pressure in the quarter.

Largest one-day drops

Customers Bancorp Inc. posted the largest single-day stock price drop among banks in the analysis when its stock slipped 16.0% in Jan. 26 trading. Customers Bancorp's fourth-quarter 2022 earnings included a higher cost of funds and a declining net interest margin as a result of intensifying funding pressures, the sale of available-for-sale securities at a loss and earnings pressure related to Paycheck Protection Program loans.

After First Interstate BancSystem Inc. reported higher-than-expected levels of deposit outflows that led to 10 basis points of net interest margin compression, the company's stock price dropped 10.8% on Jan. 27. In a conference call, one analyst asked why investors should remain confident in the company's management.

"The performance of the company really hasn't changed much," President and CEO Kevin Riley said. "We had some deposit outflows in the fourth quarter that we didn't anticipate, but the fundamentals of the operation of this company have not changed at all."

* Download a template to compare a bank's financials to industry aggregate totals.

* Download a template for a comprehensive profile on a selected bank or thrift.

* View U.S. industry data for commercial banks, savings banks and savings and loan associations.

Stephens analyst Andrew Terrell said in a note that the sell-off is "overdone" because the company should have a more defensible path than its peers to NIM stability or improvement in the second half of 2023, "given less variable asset exposure and the greatest exposure in our coverage list to assets repricing 3-36 months (nearly 2x that of the group)."

Trustmark Corp.'s stock declined by 13.5% in Jan. 25 trading after the company reported quarter-over-quarter net interest margin expansion but predicted the metric would remain flat in 2023.

"We believe the market will focus on forward guidance — especially with regard to the NIM," because the flat NIM guidance implies a "significant retraction from current levels (and lower EPS)," Hovde analyst David Bishop wrote in a note.

The company's fourth-quarter 2022 results were affected by a $100.75 million litigation settlement expense related to a 2009 lawsuit involving Stanford Financial Group, which led Trustmark to report a loss of $34.1 million for the quarter, or 56 cents per diluted share.

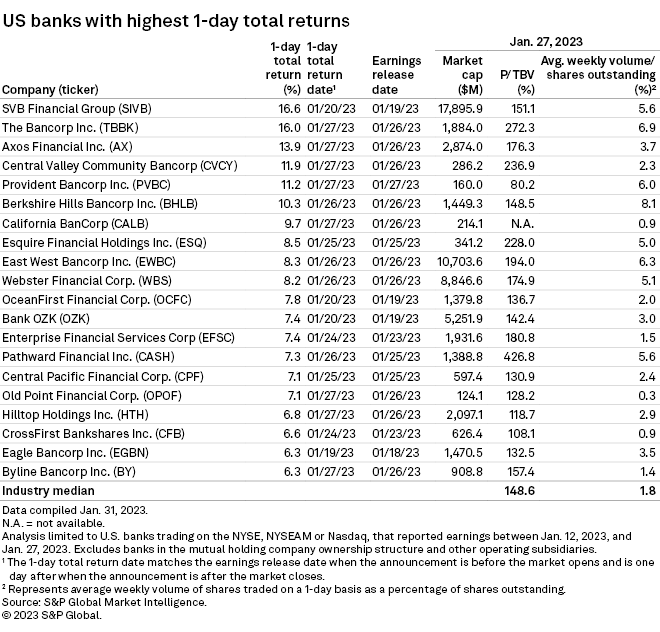

Largest one-day gains

SVB Financial Group posted the largest one-day stock gain tied to earnings, picking up 16.6% in Jan. 20 trading. Wells Fargo analyst Jared Shaw believes investors felt they found the bottom after a bad 2022 when the company's business model reacted to rising interest rates.

SVB Financial banks venture capital-backed companies, and has experienced deposit outflows as its clients burn through cash and hold back on raising new money after a crash in valuations. However, venture capital is expected to rebound in 2023 and the cash burns should slow, Shaw said.

While the company will likely experience earnings and margin pressure this year, "the bigger picture is, Silicon Valley is still the bank that is in the best position to bank the tech and innovation economy," Shaw said. "They're in the best position once that really recovers."

The Bancorp Inc. posted a 16.0% one-day stock price gain after reporting earnings on Jan. 26. In a note, Piper Sandler analyst Frank Schiraldi attributed the positive reaction to the company's conference call discussion, during which it reiterated its 2023 guidance — which implies 40% earnings per share growth year over year — and provided reasons why that estimate is conservative and the company may outperform it.

Investors reacted positively to deposit growth in the quarter, particularly among noninterest bearing deposits. For example, Central Valley Community Bancorp reported an uptick in noninterest-bearing deposits in the fourth quarter of 2022, and only a 4-basis-point rise in its cost of deposits year over year. The company's stock popped 11.9% in Jan. 27 trading.

D.A. Davidson analyst Gary Tenner wrote in a note that the results "further highlight the strength of [Central Valley's] underlying deposit franchise."