Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Sep, 2021

By Lauren Seay and Ali Shayan Sikander

An insurance arm can bring a U.S. bank multiple advantages, but only if the business can gain scale.

Several banks with insurance verticals have used M&A to grow that business line and reap the benefits of revenue diversification and cross-selling opportunities. But others are looking to exit the industry and invest those resources elsewhere after realizing that growth without M&A is harder than it looks.

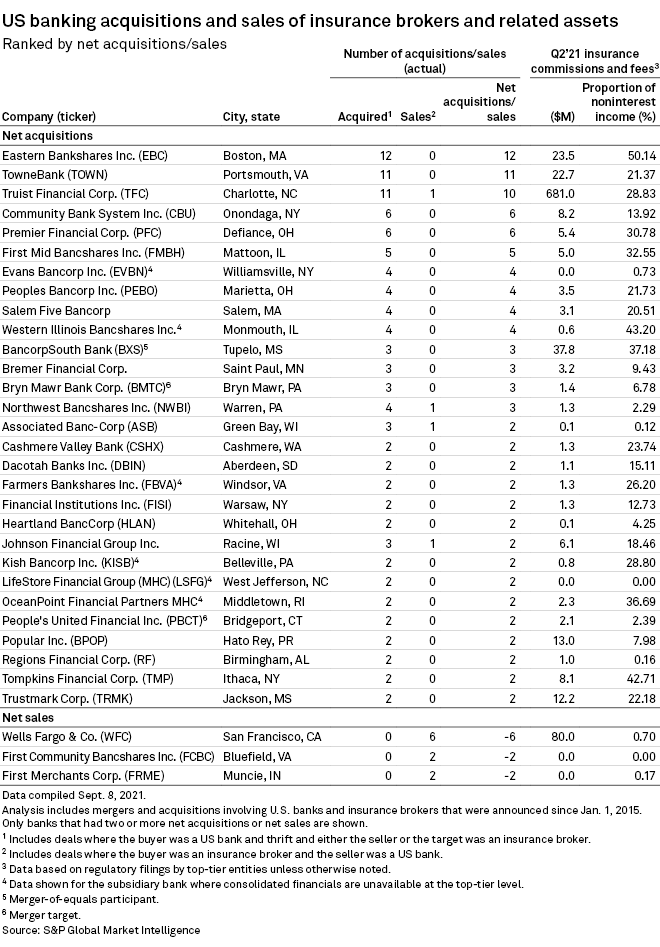

Three banks have sold at least two insurance-related units since 2015, according to S&P Global Market Intelligence data: Wells Fargo & Co., First Community Bankshares Inc. and First Merchants Corp. Christopher McGratty, managing director and head of U.S. bank research for Keefe Bruyette & Woods, said in an interview that banks may opt to exit the business if their operations are subscale or if the company would rather reallocate the capital elsewhere.

Banks operating insurance businesses have to be a niche player or a scale player, Mark Fitzgibbon, head of financial services equity research at Piper Sandler, said in an interview. "The guys in between are the ones that really struggle to make the business successful," he said.

Berkshire Hills Bancorp Inc. is the latest U.S. bank to off-load its insurance operations, a business line equity analysts labeled as subscale. Insurance made up 10.54% of Berkshire Hills' noninterest income in the second quarter. Though the business was a "meaningful contributor" to Berkshire's earnings and income diversification, it offered limited forward growth, Janney Montgomery Scott analyst Jake Civiello wrote in an Aug. 25 note.

"The old Berkshire Hills was trying to be all things to all people, and they bought a lot of businesses in a lot of geographies across the spectrum," Fitzgibbon said. Insurance, he added, "was never going to be a hugely profitable line of business for them."

Eyeing an exit

Berkshire Hills hopes the sale of Berkshire Insurance Group Inc. to Brown & Brown of Massachusetts LLC for $41.5 million will simplify its business model, improve efficiency and support the bank's strategic initiatives as part of its ongoing three-year strategic transformation, Berkshire Bank President and COO Sean Gray said in a statement.

Expenses associated with the insurance business typically ate away at 72% of its revenue, Compass Point analyst Laurie Hunsicker wrote in an Aug. 31 note. According to management, Berkshire Hills plans to let roughly half of the expense savings drop to the bottom line and reinvest the other half back into the business, such as hiring new lending teams, she wrote.

Wells Fargo sold off six insurance brokers between 2015 and 2017, the most of all U.S. banks, and, like Berkshire Hills, is currently working through a strategic transformation. In November 2017, the company announced plans to exit the personal insurance business in order to simplify its product offerings, according to a press release. Insurance contributed $80 million to the company's $11.43 billion in total noninterest income in the second quarter, or only 0.7%.

Scaling with M&A

While some banks look to exit the insurance industry, others are waiting in the wings.

TowneBank has struck 11 deals for insurance brokers since 2015 in order to scale its business, and it is looking for more M&A as it aims to double its operations in the next five years, said Brian Skinner, president and CEO of Towne Financial Services Group, which contains all of TowneBank's nonbank divisions.

|

"The insurance business in general is kind of a slow growth industry, so in order to make meaningful strides in that area, acquisition has to be part of your model, and it definitely is for us," he said in an interview.

For banks, an insurance arm boasts a handful of advantages, such as revenue diversification. That countercyclical fee revenue "became more meaningful" during the COVID-19 pandemic when revenue became tight for the bank, Skinner said.

TowneBank's insurance business brought in $22.7 million in the second quarter, representing 21.4% of the company's total noninterest income.

Offering banking and insurance services can also lead to stickier customer relationships as the company can have a hand in all aspects of a customer's financial life cycle, Skinner said. The complementing business lines also present cross-selling opportunities, both Skinner and Fitzgibbon said.

Insurance is "synergistic" to the banking business, Fitzgibbon said. "You need a mortgage, so you go to the bank and they say, 'When you buy the house, we can get you the homeowners insurance at a good rate. We can package it all together and make it easy for you.' That sounds pretty appealing."

Banks can also scale their insurance business through whole-bank M&A.

After Eastern Bankshares Inc. announced its acquisition of Century Bancorp Inc. in April, Eastern Chairman and CEO Robert Rivers said on a conference call that his insurance and wealth management colleagues were "very, very excited" about the cross-selling opportunities the transaction would create.

Eastern Bankshares acquired the most insurance brokers of any U.S. bank since 2015, with 12 acquisitions during that time period.