Banks in the Gulf must be willing to work with fintechs or else miss out on an opportunity to diversify and boost revenues, experts warn.

Gulf regulators and banks have been slow to adopt Open Banking despite a wealthy, tech-savvy population likely to be receptive to new financial products and greater consumer choice.

Bahrain, the Gulf's financial hub prior to Dubai's rise to pre-eminence this century, hopes to restore some of its previous luster though fintech, launching an Open Banking framework in October and making it mandatory for banks to open up their application programming interfaces, or APIs.

'Underutilized data'

Open APIs enable third parties to access customers' bank account data — with their consent — in order to provide financial services products; customers can more easily switch banks and shop around for everything from money transfers to insurance and mutual funds.

"There's so much valuable data that's underutilized, that's being hoarded. It's going to change the entire financial services industry," said Abdulla Almoayed, CEO and founder of Bahrain's Tarabut Gateway, which provides white label Open Banking software to banks.

His company's clients include National Bank of Bahrain BSC, HSBC Holdings PLC, Standard Chartered PLC and Kuwait Finance House KSCP, Kuwait's largest Islamic bank.

"They're all preparing for the Open Banking movement," said Almoayed.

Tarabut's partnership with NBB led the lender to become, in December 2019, the first bank in the Middle East and North Africa region to provide account aggregation services, which enable customers to see all their Bahrain-domiciled bank accounts on a single app regardless of which banks hold these accounts.

Yet in other countries, regulation has been lacking. In the United Arab Emirates, the central bank has largely left it to Dubai and Abu Dhabi's offshore financial services regulators to craft suitable guidelines, but these are not binding on domestic banks. In September, a fintech, DAPI, wrote an open letter to the UAE banking federation claiming it had been made aware that "certain UAE banks" had asked Abu Dhabi Global Market to rescind its license.

DAPI, which says its technology enables Open Banking, also wrote to the UAE's central bank in August requesting the regulator provide a "roadmap" for Open Banking in the country.

"In the nascent stages, there might be some opposition, especially as data integrity and threat of data theft are huge concerns," said Maria Elena Ponceca, a banking analyst at Al Ramz Capital in Dubai.

"However, in the long run, this is something that banks must look into, as Open Banking offers untapped opportunities for revenue diversification. [It] has gained very little traction so far in the MENA region."

Bank initiatives

Several major Gulf banks have launched digital banks that operate in tandem with their conventional retail divisions. These include Dubai duo Mashreqbank PSC and Emirates NBD Bank PJSC, and Abu Dhabi Islamic Bank PJSC while Saudi Arabia's Alinma Bank has launched what it describes as digital branches.

"Some major banks have launched separate digital banks to test the market," said Chiro Ghosh, vice president for financial institutions at Bahrain's SICO Bank.

"[Open Banking] is a major cross-selling opportunity — right now, customers are typically primarily just parking their deposits in their account for a modest interest income and not doing anything else."

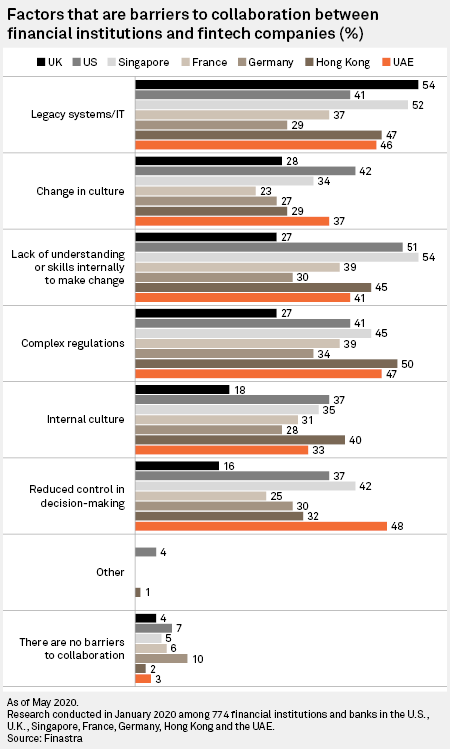

According to a 2020 survey by fintech firm Finastra, 88% of UAE banks said they were looking to open their APIs to enable Open Banking within the next year.

"Initially, [Gulf] banks did not see the ultimate value of Open Banking, but now things have changed," said Wissam Khoury, head of Finastra's Middle East operations. "Banks are embracing it because it gives them advantages in optimizing their cost structure and in increasing their revenue."

Banks' money transfers, foreign exchange and payment services business lines are most at risk of fintech disruption, according to an October 2019 report from S&P Global Ratings. Open Banking will likely have little imminent impact on corporate banking.

"On the corporate side, it depends a lot on the relationship between bank and client," said Ghosh.

Finastra's Khoury predicts bank customer churn will increase as Open Banking becomes more widespread in the Gulf.

"Now we're visiting branches less, interacting with people less, so the entire dynamics go against betting on customer loyalty," said Khoury. To improve customer stickiness, banks need to provide better service, or else fintechs will, he said.

Finastra's survey found that outmoded IT infrastructure and complex regulations were the among the biggest challenges to realizing the open banking in the Gulf. But, although cautious, Gulf banks have long relied on third-party technology companies to build their IT infrastructure rather than developing this in-house, which should make them more amenable to Open Banking, according to Tarabut Gateway's Almoayed.

"The future bank is going to be a faceless bank — you'll be able to subscribe to financial products without even knowing the bank or the financial institution," he said. Banks that are easy to do business with from a technology point of view will become the dominant brands, he said.