Société Générale SA's new plan that entails both a merger of Crédit du Nord SA into its Société Générale's French retail network and investments to drive profitability at its online bank Boursorama SA by 2024 signals a concerted shift from the lender's traditional brick-and-mortar banking that may require some short-term pain for long-term gain.

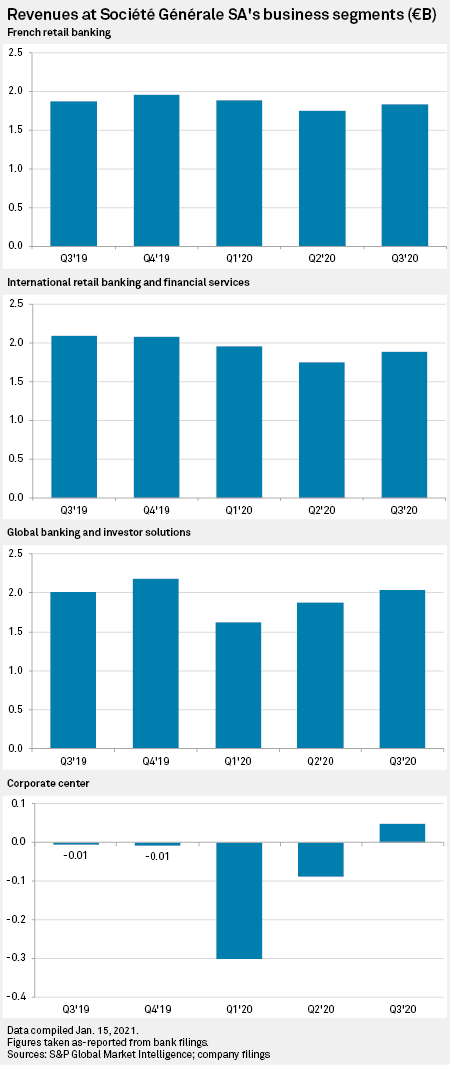

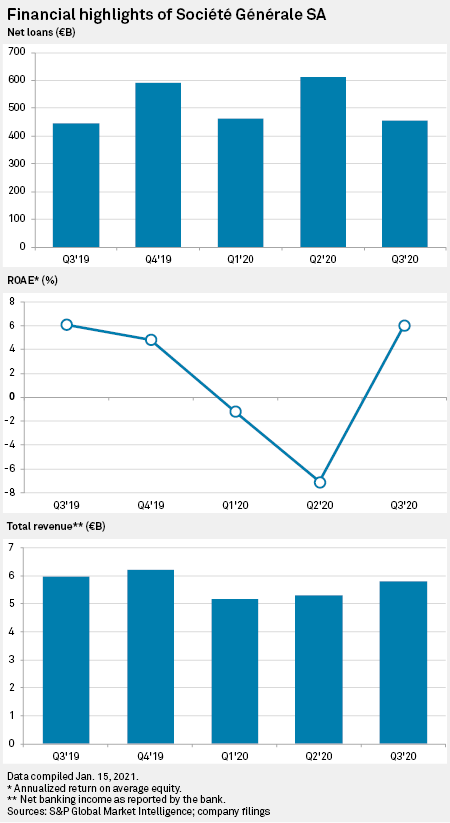

The strategy, unveiled late last year, comes against a backdrop of dismal profitability across Europe's banking industry due to a range of pressures, from negative or ultra-low interest rates to fierce competition, tough regulation, and more recently, to coronavirus-induced economic jolts. SocGen already bears the battle scars. S&P Global Market Intelligence data shows the bank's return on average equity, a key measure of profitability, was negative 1.16% and negative 7.09% in the first and second quarters of 2020 before rebounding in the third quarter to positive 6.04%, a promising result that was nonetheless lower than the 6.12% recorded in the third quarter of 2019.

Under the plan, SocGen aims to cut costs by €350 million in 2024 and €450 million the following year from 2019 levels. The first savings should begin to appear in 2023, when the lender merges IT systems, SocGen said.

Savings will also come from branch closures. SocGen and local peers BNP Paribas SA and Crédit Agricole SA have been relatively slow to adapt their branch and digital strategies as customer preferences shift online from bricks and mortar. More than 60% of Crédit du Nord and SocGen branches are less than 1 kilometer from each other, the bank said. By 2025 it will have 1,500 branches compared to 2,100 in 2020, although it has yet to determine the mix of Crédit du Nord and SocGen branches the network will ultimately have.

Weak retail

Prior to the pandemic, the lender had been cutting branches to tackle a weak retail market. SocGen's

"Retail banking is, I wouldn't say something of the past, but it is evolving, and will continue to evolve," Arnaud Journois, vice president of global financial institutions at DBRS Morningstar, said in an interview, while also pointing to pandemic-related restrictions making online banking increasingly attractive.

"In the end mobile banking will gain weight and traditional retail banking will decrease. Merging two banks with a reduction of branches, merging IT systems, rationalizing the whole retail banking makes a lot of sense now," Journois said.

At a presentation about the new strategy, Sébastien Proto, SocGen deputy general manager and head of the SocGen and Crédit du Nord networks, said digital was at the "cornerstone" of the bank's business model, and there would be a growing share of digital sales. While French clients were "a bit less keen" to use digital banking than in other countries, the crisis may accelerate a change, Proto said. According to Eurostat, the EU's statistical office, 66% of individuals used internet banking in France in 2019, compared to 91% in the Netherlands, 84% in Sweden and 78% in the U.K. In Germany and Spain, the figure stood at 61% and 55%, respectively.

By 2025, SocGen will have 30% of digital-only sales and more than 80% of both online and physical sales, he said. More than 80% of corporate business will be available by electronic signature, Proto added.

High profile, low impact

SocGen is aiming for Boursorama to hit a profit of €100 million and €200 million in 2024 and 2025, respectively, compared to a loss of nearly €50 million in 2019. The online bank is expected to have cumulative losses of €230 million between 2021 and 2023. It also wants to nearly double total clients to 4.5 million in 2025 from 2.5 million in 2020. Boursorama already leads the French market in terms of clients, according to PriceBank, an online banking comparator.

"It's really critical to have a banking arm of that sort," Nicolas Hardy, executive director in the financial institutions team of Scope Ratings, said of Boursorama. "It is very important in terms of positioning in the market."

However, there is only so much Boursorama can deliver. While the SocGen group is able to benefit from cross-selling products via Boursorama and from the strong brand name, its impact on the bottom line would be minimal, Hardy said.

"Even the figures they are communicating on contribution to net results going forward, it is not really material and is not going to be a game changer on its own for the coming years.

Stunted retail growth

While SocGen sees retail as an expanding business, it is "more an area of transformation and transition than an area of growth," Hardy said.

Upsides to retail revenues are limited due to the low interest rate environment and the bank's heavy dependency on mortgage lending, as is the norm across France's banking sector, he said. Higher margin consumer finance lending is growing, but it is "marginal" compared to mortgages. One potential area of growth is cross-selling "balance sheet-light products" such as insurance. French banks have been shifting to higher-fee products like asset management and insurance to ease margin pressure at their retail operations.

The impact of the strategy will not happen overnight, given the short-term implementation costs being factored into the equation. For example, the Crédit du Nord project will cost between €700 million and €800 million, with 70% to be taken in 2021. Boursorama will lose money for the next three years as SocGen invests in expanding its expansion.

"It's one thing to announce cost savings and do them but it is another thing to get the synergies from it and increase or improve revenues," Journois said.