A moratorium on mortgage payments in Italy amid the coronavirus outbreak will be a useful safety valve for both borrowers and banks, according to industry experts, who warn that small and medium-sized enterprises could be the bigger worry.

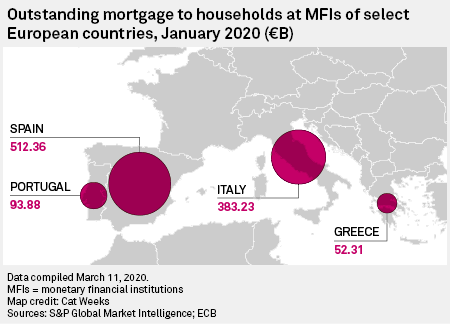

Deputy Economy Minister Laura Castelli told a local radio station earlier in March that the government would suspend mortgage repayments in order to soften the economic impact of COVID-19, the disease caused by the coronavirus. The government has yet to make an official announcement, and the finance ministry had not responded to a request for comment at the time of publication. Italy has some €383.23 billion of outstanding residential mortgages, according to the ECB.

A number of major banks, including Intesa Sanpaolo SpA and UniCredit SpA, have said that they will grant a repayment holiday to struggling mortgage borrowers.

The entire country has been on lockdown for more than two weeks. It has recorded around 31,500 cases of COVID-19 and more than 2,500 deaths as of the morning of March 18.

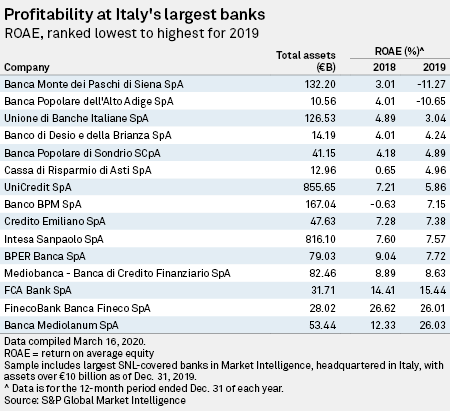

The disruptions are particularly acute for SMEs, which are more likely to default, an analyst said, all of which is expected to put pressure on lenders such as Banca Monte dei Paschi di Siena SpA with low levels of profitability.

|

The state to the rescue?

Marco Troiano, executive director and deputy head of financial institution ratings at Scope Ratings, said that it was important not to read too much into the deputy minister's comments on mortgage relief.

"This was just a comment, not an official statement. But it looks as though some form of forbearance is coming," he said in an interview.

Banks' underlying profitability and capital cushions are a better indicator of who stands to be most affected by a wave of mortgage suspensions, rather than the size of their mortgage books, Troiano said.

He said those banks with low profitability are particularly exposed.

Monte dei Paschi has the weakest profitability of the main Italian banks, according to S&P Global Market Intelligence data, with a return on average equity of negative 11.27% as of the end of the 2019 full year. It is followed by Banca Popolare dell'Alto Adige SpA with a negative 10.65% ROAE, while Unione di Banche Italiane SpA has a ROAE of 3.04%.

|

Troiano said that even in times of crisis, European home owners have typically had a good track record of keeping up their mortgage payments.

"Most people will keep paying the mortgage on their first home," he said.

Angela Gallo, lecturer in finance at Cass Business School, London, said that the immediate financial impact of a mortgage holiday would most likely fall on the government rather than banks.

The government already has a fund designed to help struggling mortgage borrowers as long as they meet certain criteria, Gallo said.

The fund, Fondo di solidarietà per la sospensione delle rate mutui prima casa, allows for mortgage suspension for up to 18 months on the primary residence of borrowers earning less than €30,000 per year, on loans of up to €250,000.

If there were to be a widespread moratorium on mortgages, the main benefit to banks is "allowing them to retain/maintain a healthy relationship with their customers," Gallo said.

Italian banks are better able to support borrowers than they would have been in the 2008 global financial crisis as they are better capitalized now than they were then, Gallo said.

Mortgage breaks should have "a positive impact on the underlying customer," Troiano said.

"However as a bank you have to this with some degree of discrimination as you do not want to encourage strategic defaulters," he said.

In the U.K., Royal Bank of Scotland Group PLC and Lloyds Banking Group PLC have said that they will provide relief for mortgage borrowers struggling due to the pandemic.

|

SMEs on the line

SMEs, however, are more likely to default, and could be a bigger concern for lenders than mortgages, Troiano said.

Banks may also look at providing some relief to SMEs.

"Banks will want to make sure that a liquidity problem does not turn into nonperformance," he said.

Intesa said March 7 that it is making €5 billion available in financing for small businesses and families that are facing a liquidity crunch, in addition to relief for mortgage borrowers.

Outstanding loans to SMEs in Italy stood at €170 billion as of the end of 2017, according to the latest available aggregate figures from the Organisation for Economic Co-operation and Development, or OECD.

SMEs account for 78.5% of all employment in Italy, compared with an EU average of 66.4%, according to the European Commission. Despite the outsize role they play in the economy, they account for 17.7% of Italy's €958 billion total business lending, according to OECD data.