Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Apr, 2021

By Allison Good

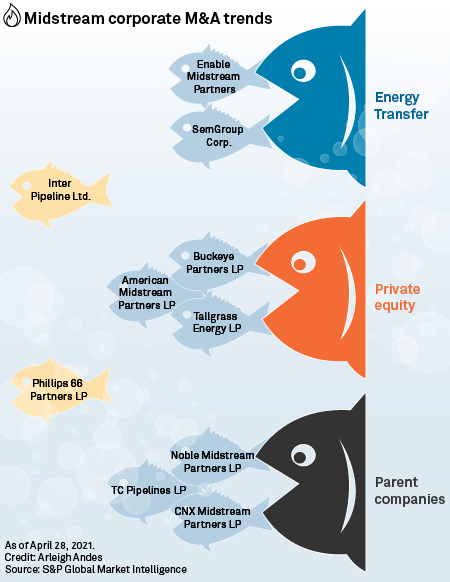

The North American oil and gas midstream sector is seeing renewed momentum in corporate mergers, and at least one industry expert saw the sector completing the consolidation process fairly soon.

"I don't have a magic number for ... U.S. names, but something more than five and less than 10 feels about right," CBRE Clarion Securities portfolio manager Hinds Howard said in an email.

"We are getting closer to that magic number, with the remaining U.S. midstream companies beyond the top four to five mostly being captive subsidiaries of larger energy companies," Howard said. "So I think we're closer than many realize to the end game."

Others said the timeline was less certain. The number of public pipeline firms continues to shrink toward an ideal critical mass, but the process could be difficult and drawn out as smaller companies hesitate to relinquish control.

So far in 2021, Energy Transfer LP announced a $7.3 billion acquisition of Enable Midstream Partners from utility parents OGE Energy Corp. and CenterPoint Energy Inc., while Brookfield Infrastructure Partners LP's pursuit of Canada's Inter Pipeline Ltd. and the potential for Phillips 66 to buy out Phillips 66 Partners LP are other prospective deals on the horizon.

Mizuho Securities USA LLC Managing Director Gabriel Moreen hesitated to say that midstream consolidation would be complete within the next three to five years, even though he expected "a deal or two per year."

"Logic would dictate that there should be two to four midstream providers in each different basin," Moreen explained in an interview. "I think it's going to be difficult to get there, just because you have a lot of midstream companies that are involved in multiple basins. So while one or two basins might be attractive and make sense for a potential acquirer, there are several others where the assets may not be of interest."

This will be a particularly tall order for the Permian Basin, where many midsized operators have considerable footholds alongside heavyweights like Enterprise Products Partners LP, Kinder Morgan Inc., Williams Cos. Inc. and Energy Transfer.

Still, the broader economic landscape has forced some smaller firms to pull back. MPLX LP, for example, had been shifting its focus from gathering and processing gas in the Northeast to building an integrated logistics and storage system in Texas and the Gulf Coast region until oil prices and demand for fuels collapsed in 2020. In response, the Marathon Petroleum Corp.-controlled master limited partnership scrapped a proposed pipeline to deliver NGLs from western Texas to the Gulf Coast and deferred fractionation capacity and an export facility linked to the pipeline project.

Across the various basins, there are lower-capitalized players holding on to their independence that could benefit from consolidation, according to Miller/Howard Investments Inc. portfolio manager John Cusick.

"There are some companies that aren't so great, and you wonder why they exist," Cusick said in an interview. "Maybe they have one or two good assets, but either that company is not willing to sell them because they know they're valuable, or no one wants to buy the whole company because they don't want to be left with the subpar assets."

Those with a gathering and processing focus are more likely to be swallowed up by private equity firms than by the public midstream giants, which will be more interested in individual transmission systems for sale like Consolidated Edison Inc. and Crestwood Equity Partners LP's joint venture Stagecoach Pipeline & Storage Co. LLC, said Henry Hoffman, a partner at energy-focused investment firm SL Advisors LLC.

"A 'strategic' needs two things to make M&A happen: It needs to be neutral to or improve their credit profile, and neutral or accretive to cash flow, and that is harder to do rolling up the small guys," Hoffman noted.

When it comes to what CBRE's Howard called "captive subsidiaries," their sponsors may eventually buy them out. But until then, they remain problematic for existing and potential stockholders.

"Some of the ones that were spun out … the sponsors own 80% to 90% of them and there's no trading volume," Cusick explained, pointing to BP PLCs BP Midstream Partners LP. "How would we get in it without moving the market, or how would we get out of it if something happens?"