Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Nov, 2023

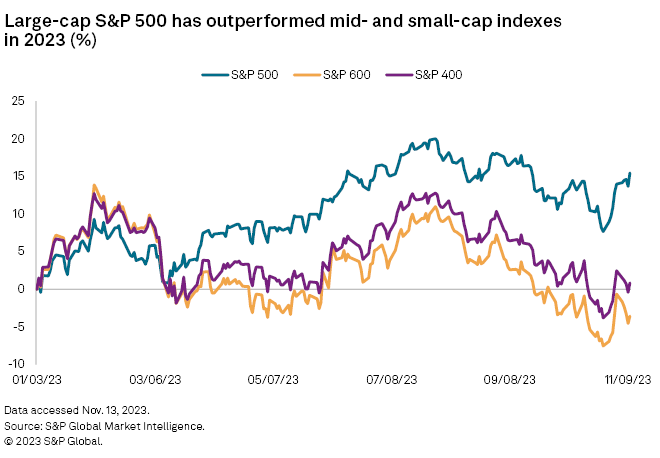

Equities across the board shrugged off high interest rates and recession expectations for much of the summer, but large and small capitalization stocks have gone in opposite directions in recent weeks.

Bolstered by surging mega-cap technology stocks, the large-cap S&P 500 is up roughly 15.5% since the start of 2023, while the S&P 600, an index of smaller-cap stocks, is down nearly 3.6%.

The S&P 500 benefited as its largest stocks — Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., NVIDIA Corp., Tesla Inc. and Meta Platforms Inc. — have rallied, and mega-cap tech stocks have become "somewhat of a safe-haven trade," said Edward Moya, a senior market analyst with Oanda.

Smaller-cap stocks have struggled on concerns that a potential recession could hit small businesses harder as relatively high interest rates from the Federal Reserve's fight against inflation could ratchet up borrowing costs and impede access to credit.

"Surging rates are kryptonite to many small-cap companies that will be relying on refinancing or raising debt next year," Moya said.

The Russell 2000, another small-cap index that includes a broader set of companies, has lost about 2.6% so far in 2023, falling as much as 6.5% near the end of October after rallying for most of the summer.

Within the small-cap S&P 600, the healthcare sector has fared worst, losing more than 20% since the start of the year. The utilities and financials sectors followed, losing nearly 17.9% and 16.2%, respectively, this year.

The large-cap S&P 500 saw significant gains in the information technology sector, which is up 48.5% so far this year, and communication services sector, which is up 43.5%.

Cautiously optimistic

The declines for small caps could be nearing an end, according to Francis Gannon, co-chief investment officer and managing director at Royce & Associates. The Fed is widely expected to be done with its rate hike cycle, and several factors — including the strength of capital expenses, increased federal spending for small businesses and emerging artificial intelligence applications — could all boost small-cap stocks.

"The most significant factor for us is that [the] majority of the management teams we've been speaking to remain cautiously optimistic over the long run," Gannon said. "So while the near-term view is as cloudy as any we've seen, there are enough positives for us to have a very constructive view for long-term small-cap returns going forward."