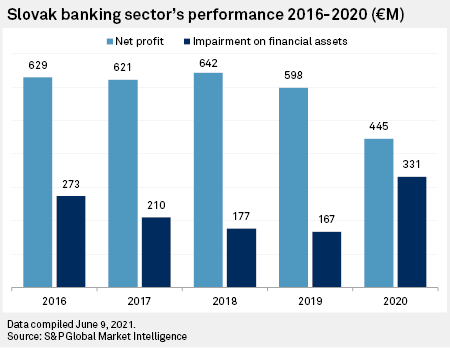

Slovak banks' profits declined by roughly a quarter in 2020, but local lenders will remain resilient even if the economic situation worsens, the country's central bank said in its latest financial stability report.

The 2020 net profit of the Slovak banking sector fell by approximately 25% year over year, according to S&P Global Market Intelligence data, as local banks increased their provisions for potential loan losses, fearing problems with loan repayments amid the COVID-19 pandemic.

Slovakia's biggest banks, Erste Group Bank AG unit Slovenská sporitel'na a.s., Intesa Sanpaolo SpA unit Vseobecna uverova banka a.s. and Raiffeisen Bank International AG unit Tatra banka a.s., reported net profits of €108 million, €83 million and €106 million, respectively, for 2020, down from €180 million, €120 million and €135 million in 2019.

The Slovak banking sector managed 2020 reasonably well, considering the unprecedented situation caused by the pandemic, Vseobecna uverova banka Chief Economist Zdenko Štefanides told S&P Global Market Intelligence.

"Indeed, amidst the economy contracting by 5%, increasing unemployment and many sectors of the economy shut for a substantial part of the year, the banking sector was able to continue to grow volumes of loans and deposits [at] a similar pace as before the pandemic," Štefanides said in written comments.

A prudent approach

The central bank, Narodna banka Slovenska, said in its report that Slovak lenders "fulfilled their role" during the coronavirus crisis, helping local companies cope with the contraction in revenues caused by lockdowns by providing state-guaranteed loans and via regular lending.

Lenders acted responsibly and adhered to prudent lending standards, thanks to which Slovakia does not face a "zombification of the economy," which is a concern for some other European countries, according to central bank board member Vladimír Dvořáček.

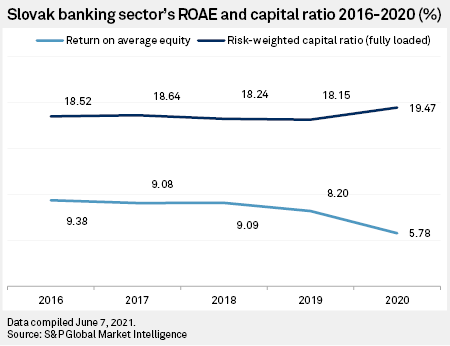

Shareholder prudence has helped, Dvořáček said, presenting the financial stability report at a press conference. Shortly after the pandemic began, the central bank recommended that banks reassess their dividend payment plans, and shareholders pursued a prudent dividend policy, ensuring that a large fraction of profits from the pre-crisis period were retained. This helped them bolster their capital, and the sector's capital adequacy is steadily approaching 20%, Dvořáček said.

Bank profits will gradually return to pre-pandemic levels in the coming years, and 2021 results will benefit from the decision by authorities last year to abolish the country's special bank levy, the central bank said.

Banks are also expected to release some of their loan loss provisions accumulated in 2020, as the majority of clients, whose loan repayments were suspended under loan moratoriums, resumed regular repayments without any problems, Vseobecna uverova banka's Štefanides said.

Nevertheless, the sector's performance will continue to face increased costs associated with credit risk linked to the pandemic, the central bank said.

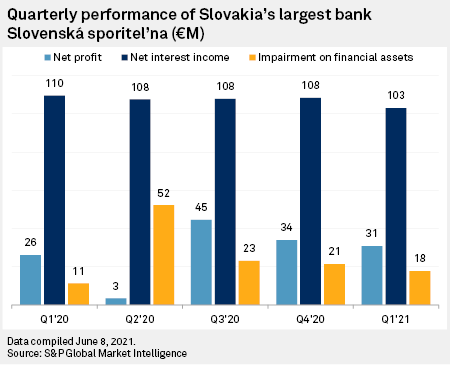

Slovakia's largest bank, Slovenska spořitel'na, said in April it had continued to apply a prudent approach to risk management and created sizable provisions in the first quarter, with net impairment on financial assets amounting to €17.7 million.

Slovenska spořitel'na was the first savings bank opened in Slovakia, established in 1825, and has been part of Austria's Erste Group since 2001. It has the largest retail presence in the country, according to S&P Global Market Intelligence data, as well as the largest share in the deposit market. In the corporate segment, it specializes in servicing small and medium-sized businesses.

Low interest rate environment, housing market

Banks are also under pressure from low rates, the central bank said in its report. Štefanides added that continued margin pressure is a significant problem for local banks and their core profitability; net interest income is the major source of revenues for Slovak banks, accounting for about 75% of overall operating income.

"This is one of the highest shares in the EU, yet interest rates in Slovakia are one of the lowest," Štefanides said. With the ECB's rate on hold for the foreseeable future, "there is really no relief in sight;" Slovak banks will need to look for new sources of income, switch to fee-based business and improve efficiency, and perhaps look for opportunities for mergers and acquisitions, he said.

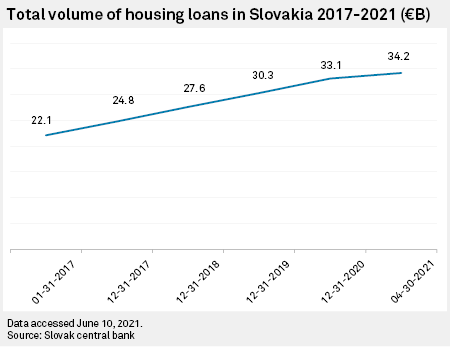

There are also risks in the housing loan segment, which, during the coronavirus crisis, expanded at a pace comparable with previous years, according to the central bank. Competition among banks is helping to drive this. Mortgage lending to households has increased rapidly in recent years, while Slovakia's household debt-to-GDP is nearing 50%, which is one of the highest ratios in central and Eastern Europe, S&P Global Ratings said in a recent report.