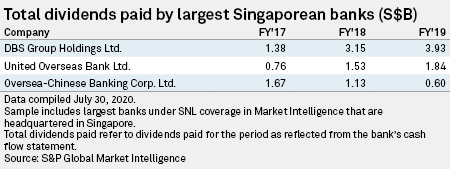

Dividend payouts of Singaporean banks are set to fall by at least S$2.55 billion this year, after the central bank asked lenders to conserve capital and free up cash to boost lending to aid a recovery from recession.

The Monetary Authority of Singapore on July 29 directed banks to limit their dividend per share for this year at 60% of the amount paid last year. The new cap means DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. Ltd. and United Overseas Bank Ltd. will be paying per-share dividend of no more than S$0.74, S$0.32 and S$0.66, respectively, for 2020.

The central bank also ordered the banks to offer their shareholders the option of receiving the dividend in scrip instead of cash.

The dividend limit is a "step change" as the Singapore central bank had earlier "refrained from being prescriptive and tried to balance the interests of borrowers, lenders and capital providers," Jefferies said in a research note on July 29. Jefferies expects dividend cap to result a potential S$30 billion of additional lending power, assuming a 10-times leverage.

Several global central banks, including the U.S. Federal Reserve and the European Central Bank have asked banks to limit or stop dividend payouts to conserve capital as the global economy slows due to the coronavirus pandemic. While investors in most parts of the world are bracing for a dip in their dividend incomes from banks, China has been an exception, where many local banks announced higher dividends on their 2019 earnings during the local outbreak of COVID-19 in parts of the country.

"While the local banks' capital positions are strong, the dividend restrictions are a pre-emptive measure to bolster their resilience and capacity to support lending to businesses and individuals through an uncertain period ahead for our economy," the Singapore central bank said. In April, it had advised banks to ensure that sustained lending took priority over discretionary distributions.

Local banks supported the central bank's precautionary move as consistent with its prudence. "At the same time, the 60% cap recognizes the interests of shareholders as it is not as severe as the restrictions in some other jurisdictions, which include an outright halt to distributions," DBS said in a statement.

UOB said it remains well-capitalized and is confident about its ability to ride through the pandemic. "We will continue to maintain a strong balance sheet in support of our customers and to sustain our investments in our franchise and capabilities," Lee Wai Fai, chief financial officer, said in emailed comments.

Singapore's gross domestic product shrank 41.2% in the April-to-June quarter, measured on a seasonally adjusted and annualized basis over the previous three months, plunging the economy into recession, generally defined as two consecutive quarters of economic contraction. The second-quarter GDP contraction was the biggest on record, though many analysts believe an improvement in the coming quarters. The nation's consumer price index fell for the third consecutive month in June.

The central bank's stress tests show that the local banks will stay resilient even under the adverse conditions of a serious and prolonged health crisis. Still, given the substantial uncertainties and few signs of a recovery in the global economy, the restriction will be "prudent" for local banks and bolster their ability to support the credit needs of businesses and consumers as well as absorb any economic further shocks, the central bank said.

Jefferies expects the direction to cap the dividend yield on bank stocks at 4% from an earlier estimate of 6%, with the associated dilution due to the scrip scheme. However, "investors need to keep in mind the strong capital positions, the customary prudence of the central bank and the fact that the 60% cap is not as severe as restrictions in some other jurisdictions," the U.S. investment bank said.

As of July 31, US$1 was equivalent to S$1.37