Recent financial failures and scandals of Singapore's commodities traders, triggered by the oil price crash this year, highlight a lingering loan-loss risk facing major banks in the city-state.

At least four commodities traders in Singapore — Hin Leong Trading (Pte.) Ltd., Zenrock Commodities Trading Pte. Ltd., Hontop Energy (Singapore) Pte. Ltd. and Agritrade Interntional Pte. Ltd. — were put under receivership or judicial management by their creditors this year, according to company statements and media reports. The sudden and sharp decline in oil prices induced by the pandemic has hit their cashflows or uncovered allegedly fraudulent practices.

DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. Ltd. and United Overseas Bank Ltd. were hurt by a slew of loan losses in 2015 when falling oil prices hit the offshore energy services sector. These banks may now face another round of rising loan losses if oil prices continue to be volatile or the global economy takes much longer to recover from the pandemic, analysts said.

The "banks have provided for a few specific cases and taken general provisions. If there are larger specific losses and a second wave of lockdowns or prolonged recovery, banks may need to provide more," Jefferies equity analyst Krishna Guha said.

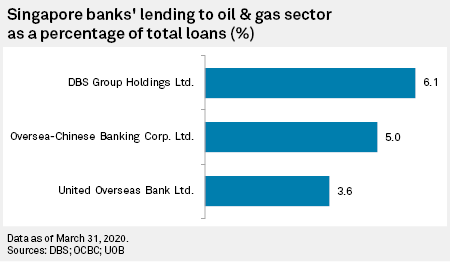

As of March-end, DBS' outstanding loans to the oil and gas industry stood at S$23 billion, or 6.1% of its total loan book, the bank told S&P Global Market Intelligence. Such exposure was higher than its smaller peers, with OCBC at 5%

"We believe that oil as a commodity will continue to be required going forward, but we need to be careful to make sure that during this period of time, we will be following the customers' development and their ability to withstand a low oil price," OCBC's CEO, Samuel Tsien, said at the bank's May 8 post-earnings call. "We do not reduce our exposure per se simply because oil prices are coming down."

Since the oil price crash, Singaporean banks have cut back on lending to the commodities sector, sources told S&P Global Platts in early May. Some brokers in the city-state also imposed risk limitations on accounts that are held by traders, the report said.

Some have trimmed exposures

In fact, both OCBC and UOB have reduced their exposure to the sector in recent years. UOB told S&P Global Market Intelligence that it has trimmed its outstanding oil and gas sector loans by S$1.6 billion, or 1.1 percentage points, since June 2018. OCBC's exposure to the sector was 6% five years ago.

DBS declined to comment on the changes in the percentage of its loans to the sector.

As an oil refining and trading hub, Singapore provides a range of services, including storage, offshore support and bunkering. The Monetary Authority of Singapore said April 21 that it "reminded the banks not to de-risk indiscriminately from the bunkering and oil trading sectors. Banks should, however, continue to apply judicious credit assessment on individual borrowers to manage their risks."

Local banks will continue to have oil and gas exposure, though its nature in terms of specific sub-sectors that they fund may change as activities shift, said Guha.

In the first quarter, DBS set aside S$1.09 billion as allowance to cushion against possible shocks mainly from troubled loans. Of that, S$703 million was for general allowances and the remaining S$383 million mainly for loans recognized as nonperforming during the January-March quarter. The bank's nonperforming assets rose 14% from the previous quarter to S$6.59 billion and the nonperforming loans ratio increased to 1.6% from 1.5%.

DBS said its allowance coverage ratio was at 92% as at March 31. Including collaterals, allowance coverage was 173%, it said.

OCBC's NPL loans ratio rose to 1.52% at the end of the March quarter, from 1.45% three months ago, while its NPA coverage was 90%, or 234% on an unsecured basis, the bank said.

UOB's NPL ratio also increased to 1.6% from 1.5% in the same period.

As of May 22, US$1 was equivalent to S$1.43.

S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.