Singapore's three largest banks expect wealth management and growing loan portfolios to drive earnings in 2025 after they posted strong earnings growth in the third quarter.

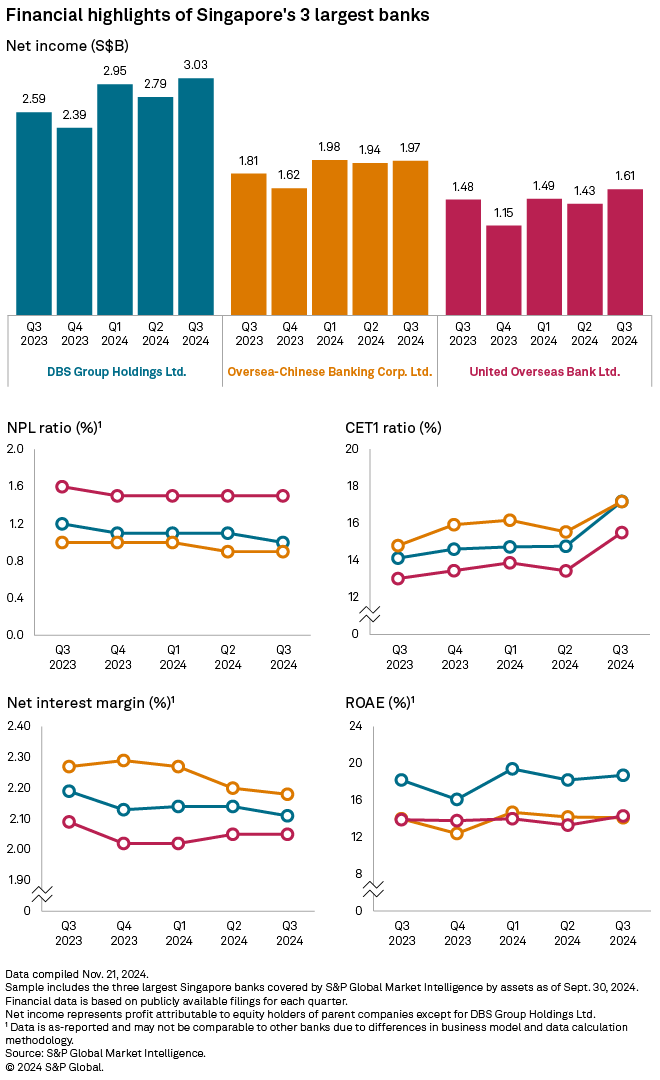

DBS Group Holdings Ltd. reported net income of S$3.03 billion in the quarter ended Sept. 30, up 17% year over year from S$2.59 billion. The biggest lender by assets in Southeast Asia notched quarterly earnings above S$3 billion for the first time.

Oversea-Chinese Banking Corp. Ltd. (OCBC) reported net profit of S$1.97 billion for the third quarter, 9% higher than the S$1.81 billion recorded a year ago, while United Overseas Bank Ltd. (UOB) posted S$1.61 billion in net profit, up 9% year over year from S$1.48 billion.

The banks' results for the quarter "continue to surprise in a positive way, with earnings delivering its usual beat of consensus forecasts," Yeap Jun Rong, market strategist for online broker IG, wrote in a Nov. 8 report. "The momentum in wealth management activities continues to support overall performance, as the banks continue to enjoy strong inflows from the region."

Wealth management fees

Singapore's growth as a global asset management hub with over S$5.4 trillion in assets under management, according to the Monetary Authority of Singapore's 2023 survey, has given banks new avenues of growth.

Wealth management fees drove the banks' record profits in the third quarter, and the trend is expected to continue into 2025.

DBS' profit was supported by record fee income led by wealth management, higher treasury customer sales and strong markets trading income. The bank's net fee and commission income in the third quarter was S$1.11 billion, up from S$843 million in the same period in 2023. Wealth management fees rose 18% year over year to $609 million from broad-based growth in investment products and bancassurance.

DBS CEO Piyush Gupta expects fee income to rise further. "The percentage of investments of total [assets under management] rose to 56%. Clients were also doing activities that give us better yield," Gupta said during a Nov. 7 media briefing.

"Wealth management is another high growth and ROE business where there is more to be done — new customers onboarded, new product relationships with existing customers," Tan Su Shan, DBS' deputy CEO and group head of institutional banking, said on a Nov. 7 conference call in response to an analyst's question about competition.

OCBC said increased wealth management activities lifted fee and trading income in the third quarter. Net fee income rose 10% to S$508 million from S$461 million, as wealth management fees climbed 25% from the prior-year period.

CEO Helen Wong expects wealth fees to do better in 2025 as assets under management have increased and OCBC unit Bank of Singapore Ltd. is expected to add 500 relationship managers to its team.

"If the interest environment is coming down, our customer will be a lot more active. As you can see, actually, the last quarter, wealth fees [have] been growing really well," Wong said during the bank's Nov. 8 earnings call.

Loan growth

Singapore's largest banks also expect loan growth to accelerate in 2025 as interest rates come down.

"I do see that next year, loan growth [has] a bigger potential compared to this year," OCBC's Wong said.

UOB expects high single-digit loan growth in 2025. On the bank's third-quarter earnings call, CEO Ee Cheong Wee said healthy demand across sectors and geographies boosted its loan books, driven by ASEAN's role as a trade hub, the rise of the digital economy and the growth of the green economy.