Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Nov, 2022

By Brian Scheid and Annie Sabater

Short sellers are paring back their bets against consumer discretionary stocks as signs emerge that inflation may have peaked.

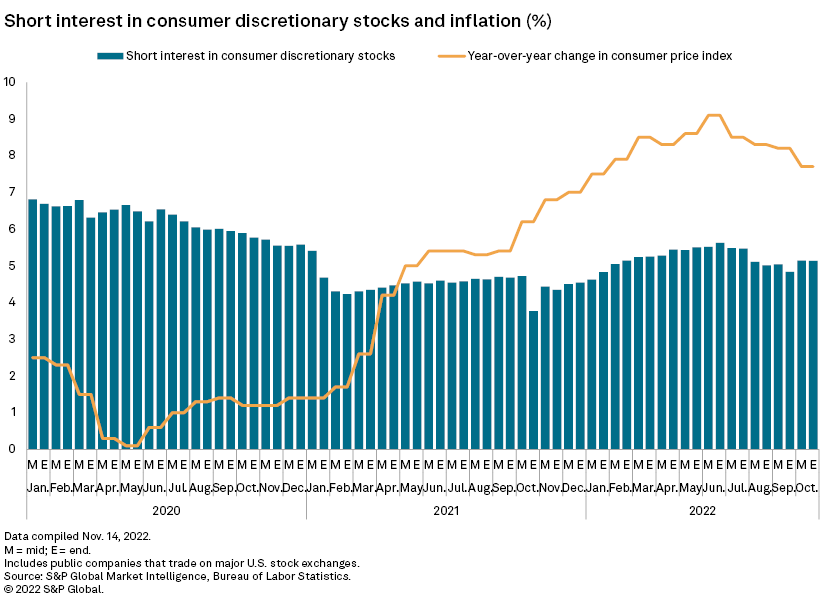

Short interest, which measures the percentage of outstanding shares held by short sellers, in U.S. consumer discretionary stocks stood at 5.13% at the end of October, according to the latest S&P Global Market Intelligence data. While that is up from August and September, it was down from earlier in the month and nearly 50 basis points below a peak in June of 5.62%.

The decline in short interest in consumer discretionary stocks has coincided with slowing inflation. According to the consumer price index, the market's preferred inflation gauge, the pace of consumer price increases may have peaked in June at 9.1% year over year. The latest CPI reading showed consumer prices were up 7.7% year over year in October.

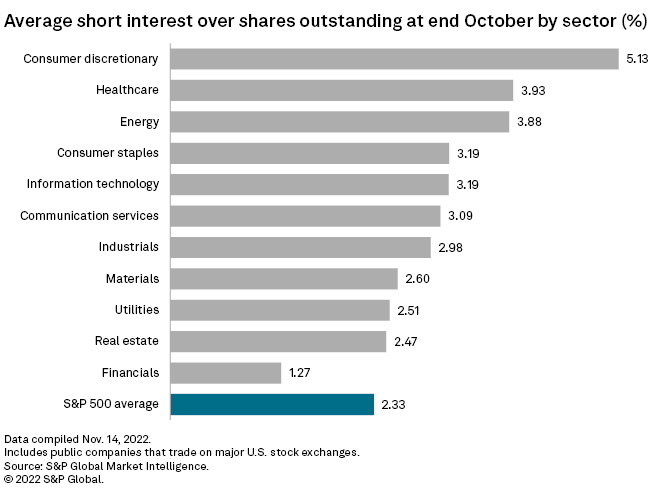

Short interest in the consumer discretionary space remains well above other sectors. Healthcare and energy stocks had the second- and third-most short interest at 3.93% and 3.88%, respectively, at the end of October.

Financials remains the least-shorted sector, with short interest of 1.27% at the end of October.

Consumer shorts rise, fall with inflation

Short interest in consumer discretionary stocks, which climbed during the worst of the COVID-19 pandemic, fell to 3.77% in October 2021. It climbed steadily with inflation throughout much of 2022, as investors believed the largest increase in prices since the early 1980s would significantly reduce consumer demand.

Most shorted stocks

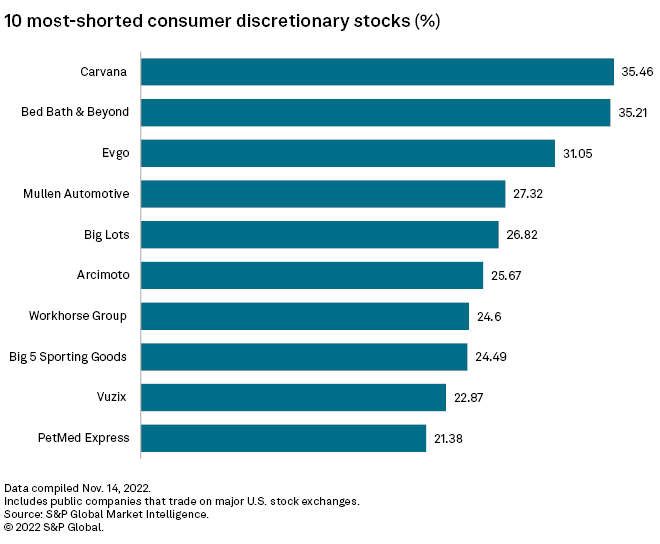

Eight of the 20 most-shorted U.S. stocks at the end of October were consumer discretionary stocks, including Carvana Co., Bed Bath & Beyond Inc., EVgo Inc. and Mullen Automotive Inc.

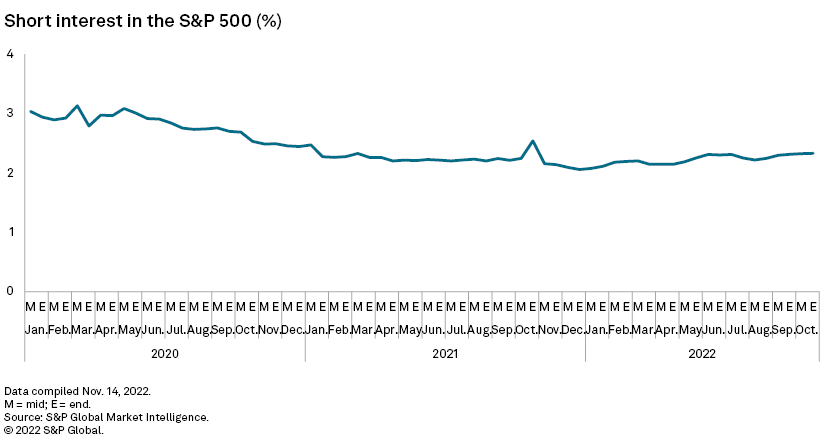

S&P 500 shorts

Average short interest in the S&P 500 remains relatively steady and was at 2.33% at the end of October, down from 2.54% in October 2021.