Short sellers reduced their bets against financial stocks to the lowest levels since early this year with the Federal Reserve's ongoing push to ease monetary policy through lower interest rates.

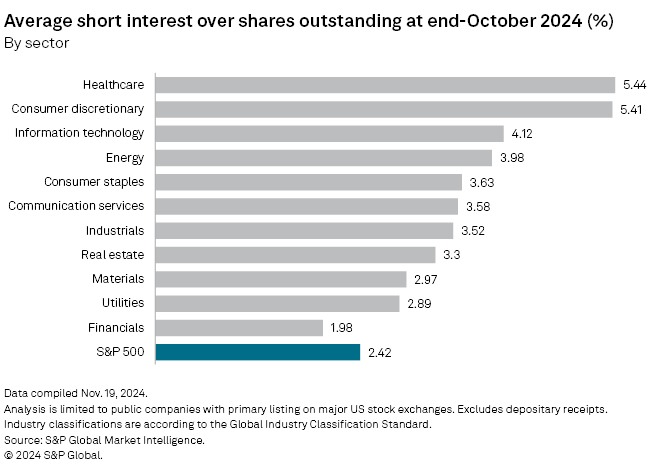

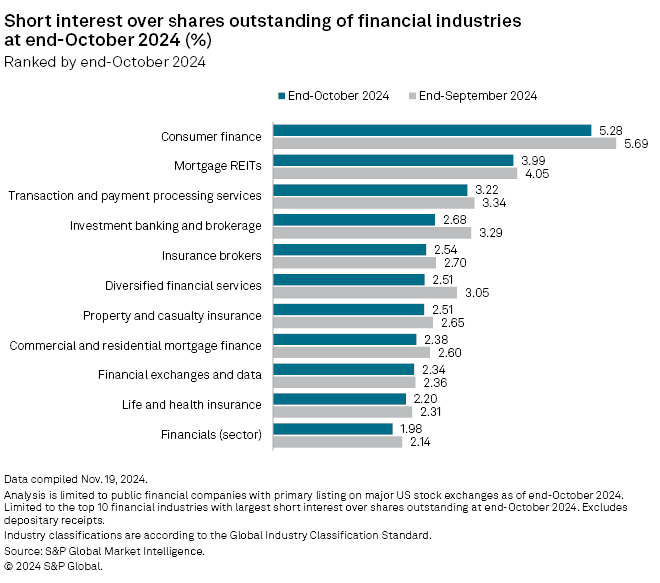

Short interest in the financials sector — which includes banks, insurance companies and brokers — fell to 1.98% at the end of October, down 16 basis points from the end of September and the lowest point since 1.94% at the end of January, according to the latest S&P Global Market Intelligence data.

Financials was again the least-shorted sector at the end of October, ahead of the US presidential election. Healthcare moved above consumer discretionary as the most shorted sector, with 5.44% short interest, up 19 basis points from a month earlier. Short interest in the consumer discretionary sector rose 2 basis points from the end of September to 5.41% at the end of October.

Sector breakdown

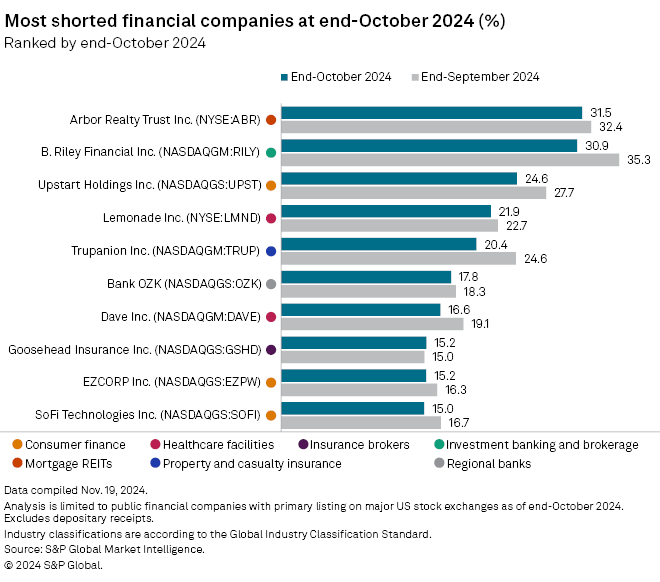

All of the 10 most shorted financial stocks saw their short interest drop from September to October.

B. Riley Financial Inc., the most shorted financial stock in September, saw its short interest fall to 30.94% from 35.31% over the course of the month. Arbor Realty Trust Inc. became the most shorted financials stock at the end of October but also saw its short interest fall to 31.48% at the end of October from 32.40% at the end of September.

Short interest also fell in the most shorted industries within the financials sector. Consumer finance stocks, for example, saw short interest fall to 5.28% at the end of October from 5.69% at the end of September.

Broader market trends

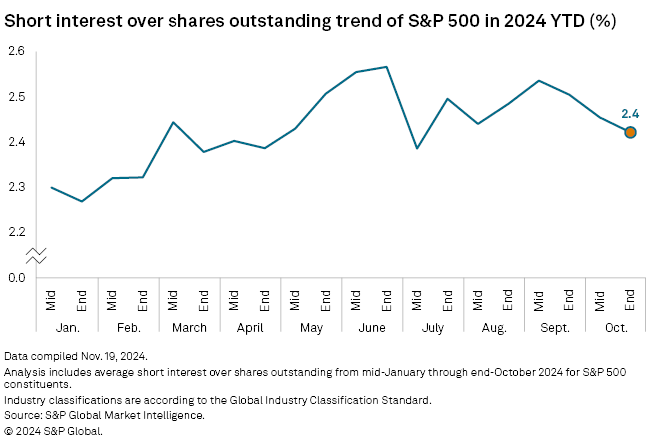

Overall short interest within the S&P 500 was at 2.4% at the end of October.

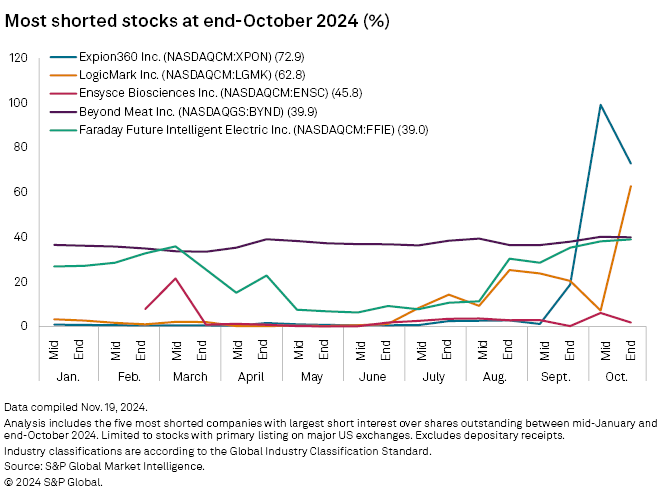

Across major US exchanges, Expion360 Inc. was the most shorted stock at the end of October with 72.9% short interest, up from 18.8% at the end of September.

LogicMark Inc., the second-most shorted stock on major US exchanges at the end of October, saw a similar jump in short interest to 62.8% at the end of October from 20.4% at the end of September.