Short sellers boosted their bets against energy stocks as oil prices soared throughout February, speculating that the days of $100 per barrel oil will be short-lived.

The latest data from S&P Global Market Intelligence shows that short sellers continued to increase their positions against energy stocks even as the sector has exceedingly outperformed every other equity sector this year. As of March 14, the S&P 500 was down 12.4% on the year and every sector dropped except energy, which was up 33.4%.

Climbing shorts

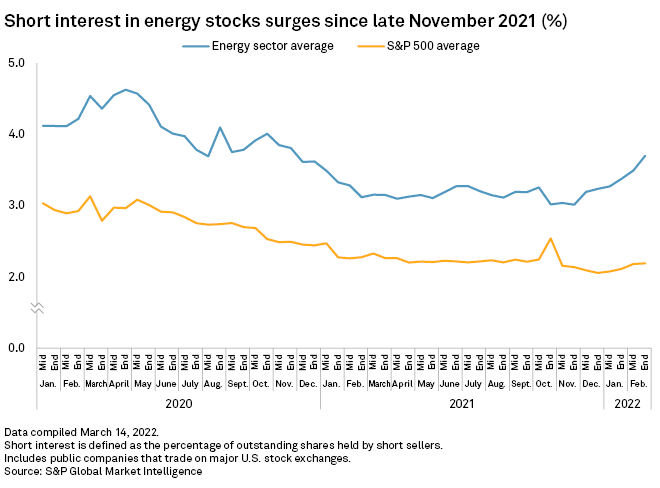

Short interest in energy stocks has climbed nearly 70 basis points since the end of November 2021 to 3.7% at the end of February. Short interest in the energy sector is now at the highest point since November 2020.

Short interest in the overall S&P 500 has stagnated since spiking in early October 2021. Short interest in the large-cap index was at 2.19% at the end of February, up 14 basis points since the end of 2021.

Refiners and marketers

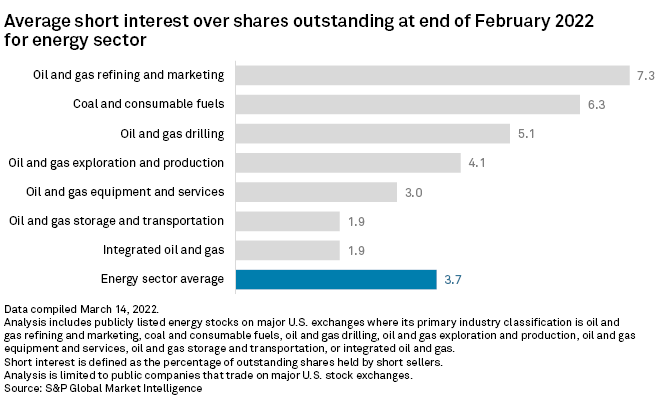

Short sellers, who bet on a stock's decline by selling borrowed shares in hopes of buying them later at a lower price, have focused heavily on oil and gas refining and marketing companies. Short interest in those stocks averaged 7.3% at the end of February, the most of any industry within the energy sector.

Coal and consumable fuels companies, with an average short interest of 6.3%, and oil and gas drilling companies, with 5.1%, were the other energy industries with the most short interest at the end of February.

Arch Resources Inc., a St. Louis-based coal and processing company, was the most-shorted energy company and fourth most-shorted company across sectors as of the end of February. Short interest in the company was at 33.9%, up from 5.3% a year ago.

Stocks and oil

The performance of the S&P 500's energy sector tends to closely follow oil prices. From Dec. 31, 2021, to the end of February, benchmark NYMEX WTI crude oil futures increased by 27.3%, while the S&P 500 energy sector increased 26.5%.

Consumer stocks

Even with the run-up in short interest in energy stocks, the consumer discretionary sector remained the most-shorted sector at the end of February, as short sellers continued to bet that soaring inflation would eat into demand for nonessential goods.

Short interest in the consumer discretionary sector was at 5.14% at the end of February, its highest point since mid-January 2021, according to Market Intelligence data.